Blackberry 2016 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

40

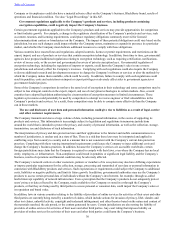

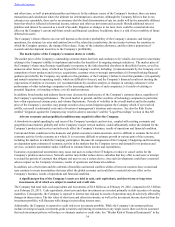

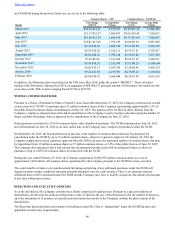

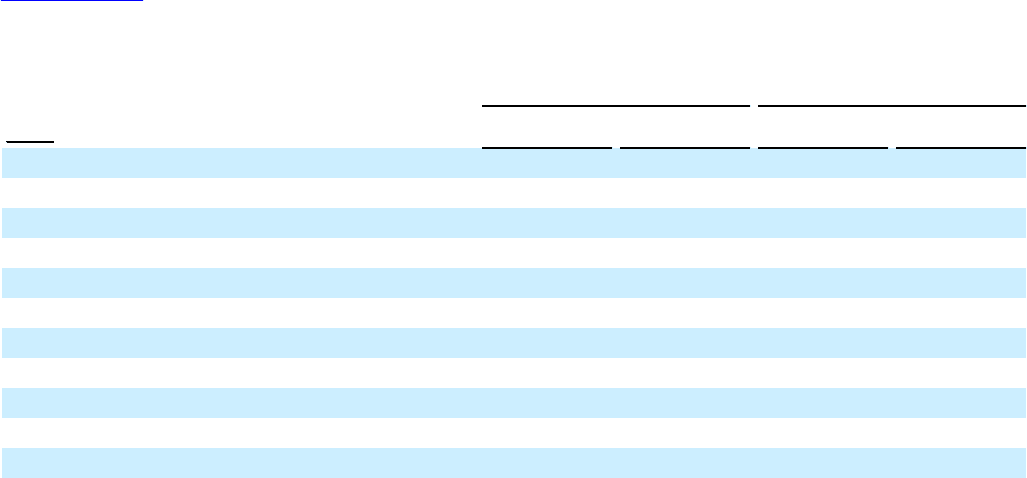

and NASDAQ during the previous fiscal year are set out in the following table:

Common Shares – TSX Common Shares – NASDAQ

Month Price Range

(CDN $) Average Daily

Volume Price Range

(US $) Average Daily

Volume

March 2015 $10.93-$14.23 2,517,597 $8.59-$11.45 12,206,405

April 2015 $11.17-$12.67 1,464,493 $8.85-$10.46 7,126,611

May 2015 $11.68-$13.28 1,668,164 $9.71-$11.09 7,962,857

June 2015 $10.01-$12.40 1,796,345 $8.04-$9.94 9,887,489

July 2015 $9.30-$10.56 1,402,794 $7.15-$8.28 8,208,593

August 2015 $8.56-$10.28 1,256,211 $6.41-$7.81 6,103,417

September 2015 $8.02-$10.35 1,789,418 $5.96-$7.82 7,677,283

October 2015 $7.99-$9.94 1,321,034 $6.03-$7.56 5,389,311

November 2015 $9.50-$10.95 1,353,999 $7.15-$8.25 6,500,604

December 2015 $9.86-$13.12 2,393,709 $7.28-$9.46 9,490,353

January 2016 $9.21-$12.86 2,473,962 $6.33-$9.22 9,150,024

February 2016 $8.94-$10.67 1,660,080 $6.39-$7.89 4,816,563

In addition, the Debentures have been listed on the TSX since May 2014, under the symbol “BB.DB.U”. There is limited

trading in the Debentures. During fiscal 2016, an aggregate of $68,866,135 principal amount of Debentures was traded on only

seven days on the TSX, at prices ranging from $115.00 to $125.50.

NORMAL COURSE ISSUER BID

Pursuant to a Notice of Intention to Make a Normal Course Issuer Bid dated June 25, 2015, the Company commenced a normal

course issuer bid (“NCIB”) to purchase up to 12 million common shares of the Company, representing approximately 2.5% of

the public float of common shares outstanding as of June 22, 2015. The purpose of the NCIB is to offset dilution from the

Company’s employee share purchase plan and an amendment to the Company’s equity incentive plan increasing the number of

shares available thereunder, both as approved by the shareholders of the Company on June 23, 2015.

Daily purchases are limited to 578,619 common shares, other than block purchases. The NCIB commenced on June 29, 2015

and will terminate on June 28, 2016 or on such earlier date as the Company may complete its purchases under the NCIB.

On September 24, 2015, the Board authorized an increase in the number of common shares that may be purchased for

cancellation under the NCIB by up to 15 million common shares, subject to regulatory approval. On January 29, 2016 the

Company sought and received regulatory approval from the TSX to increase the maximum number of common shares that may

be repurchased from 12 million common shares to 27 million common shares, or 5.8% of the public float as of June 22, 2015.

The Company also announced that it had entered into an automatic purchase plan with its designated broker to allow for

purchases of up to 2,685,524 common shares in connection with the NCIB.

During the year ended February 29, 2016, the Company repurchased 12,606,978 million common shares at a cost of

approximately $93 million. All common shares repurchased by the Company pursuant to the NCIB have been canceled.

The actual number of shares to be purchased and the timing and pricing of any additional purchases under the NCIB will

depend on future market conditions and upon potential alternative uses for cash resources. There is no assurance that any

additional shares will be purchased under the NCIB and the Company may elect to modify, suspend or discontinue the program

at any time without prior notice.

DIRECTORS AND EXECUTIVE OFFICERS

As at the date hereof, the Company currently has a Board comprised of eight persons. Pursuant to a special resolution of

shareholders, the directors are authorized from time to time to increase the size of the Board and to fix the number of directors,

up to the maximum of 15 persons, as currently provided under the articles of the Company, without the prior consent of the

shareholders.

The Board has determined that each member of the Board except Mr. Chen is “independent” under the NASDAQ rules and

applicable securities law requirements.