Blackberry 2016 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

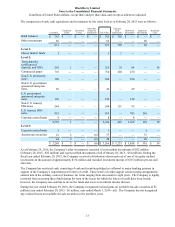

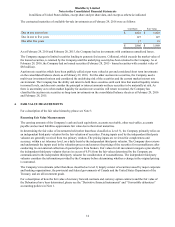

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

5

of future operating or cash flow losses, significant disposal activity, a significant decline in the Company’s share price, a

significant decline in revenue or adverse changes in the economic environment.

When indicators of impairment exist, LLA impairment is tested using a two-step process. The Company performs a cash

flow recoverability test as the first step, which involves comparing the asset group’s estimated undiscounted future cash

flows to the carrying amount of its net assets. If the net cash flows of the asset group exceeds the carrying amount of its

net assets, LLA are not considered to be impaired. If the carrying amount exceeds the net cash flows, there is an indication

of potential impairment and the second step of the LLA impairment test is performed to measure the impairment amount.

The second step involves determining the fair value of the asset group. Fair values are determined using valuation

techniques that are in accordance with U.S. GAAP, including the market approach, income approach and cost approach. If

the carrying amount of the asset group’s net assets exceeds the fair value of the Company, then the excess represents the

maximum amount of potential impairment that will be allocated to the asset group, with the limitation that the carrying

value of each asset cannot be reduced to a value lower than its fair value. The total impairment amount allocated is

recognized as a non-cash impairment loss.

Business acquisitions

The Company accounts for its acquisitions using the acquisition method whereby identifiable assets acquired and

liabilities assumed are measured at their fair values as of the date of acquisition. The excess of the acquisition price over

such fair value, if any, is recorded as goodwill, which is not expected to be deductible for tax purposes. The Company

includes the operating results of each acquired business in the consolidated financial statements from the date of

acquisition.

Royalties

The Company recognizes its liability for royalties in accordance with the terms of existing license agreements. Where

license agreements are not yet finalized, the Company recognizes its current estimates of the obligation in accrued

liabilities in the consolidated financial statements. When the license agreements are subsequently finalized, the estimate is

revised accordingly. Management’s estimates of royalty rates are based on the Company’s historical licensing activities,

royalty payment experience, and forward-looking expectations.

Warranty

The Company records the estimated costs of product warranties at the time revenue is recognized. BlackBerry devices are

generally covered by a time-limited warranty for varying periods of time. The Company’s warranty obligation is affected

by product failure rates, differences in warranty periods, regulatory developments with respect to warranty obligations in

the countries in which the Company carries on business, freight expense, and material usage and other related repair costs.

The Company’s estimates of costs are based upon historical experience and expectations of future return rates and unit

warranty repair costs. If the Company experiences increased or decreased warranty activity, or increased or decreased

costs associated with servicing those obligations, revisions to the estimated warranty liability would be recognized in the

reporting period when such revisions are made.

Convertible Debentures

The Company elected to measure the Debentures at fair value in accordance with the fair value option. Each period, the

fair value of the Debentures is recalculated and resulting gains and losses from the change in fair value of the Debentures

are recognized in income. The fair value of the Debentures has been determined using the significant inputs of principal

value, interest rate spreads and curves, embedded call and put option dates and prices, the stock price and volatility of the

Company’s listed common shares, and the Company’s implicit credit spread.

Revenue recognition

The Company recognizes revenue as earned when the following four criteria have been met: (i) when persuasive evidence

of an arrangement exists, (ii) the product has been delivered to a customer and title has been transferred or the services

have been rendered, (iii) the sales price is fixed or determinable, and (iv) collection is reasonably assured. In addition to

this general policy, the following paragraphs describe the specific revenue recognition policies for each of the Company’s

major categories of revenue.

Hardware

Revenue for hardware products is recognized when the four criteria noted above are met. The determination of when the

price is fixed or determinable can affect the timing of revenue recognition, as discussed further below.