Blackberry 2016 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

30

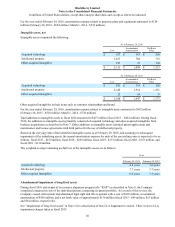

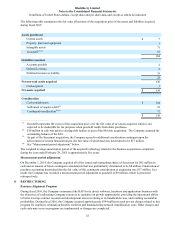

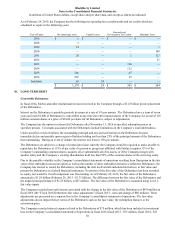

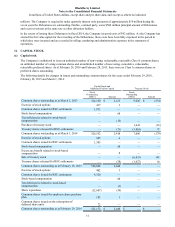

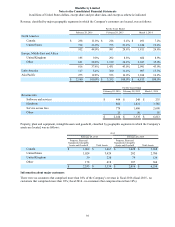

As at February 29, 2016, the Company has the following net operating loss carryforwards and tax credits which are

scheduled to expire in the following years:

Year of Expiry Net Operating Losses Capital Losses Research and

Development Tax Credits Minimum Taxes

2026 $ 1 $ — $ — $ —

2028 2 — — —

2029 14 — — 1

2030 — — — 109

2031 28 — 1 127

2032 — — — 27

2033 — — 120 —

2034 — — 112 —

2035 646 — 47 —

2036 867 — 25 —

Indefinite 16 24 — —

$ 1,574 $ 24 $ 305 $ 264

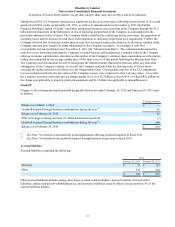

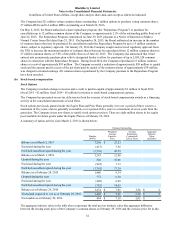

10. LONG-TERM DEBT

Convertible Debentures

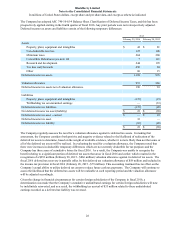

In fiscal 2014, Fairfax and other institutional investors invested in the Company through a $1.25 billion private placement

of the Debentures.

Interest on the Debentures is payable quarterly in arrears at a rate of 6% per annum. The Debentures have a term of seven

years and each $1,000 of Debentures is convertible at any time into 100 common shares of the Company, for a total of 125

million common shares at a price of $10.00 per share for all Debentures, subject to adjustments.

The Company has the option to redeem the Debentures after November 13, 2016 at specified redemption prices in

specified periods. Covenants associated with the Debentures include limitations on the Company’s total indebtedness.

Under specified events of default, the outstanding principal and any accrued interest on the Debentures become

immediately due and payable upon request of holders holding not less than 25% of the principal amount of the Debentures

then outstanding. During an event of default, the interest rate rises to 10% per annum.

The Debentures are subject to a change of control provision whereby the Company would be required to make an offer to

repurchase the Debentures at 115% of par value if a person or group (not affiliated with Fairfax) acquires 35% of the

Company’s outstanding common shares, acquires all or substantially all of its assets, or if the Company merges with

another entity and the Company’s existing shareholders hold less than 50% of the common shares of the surviving entity.

Due to the possible volatility in the Company’s consolidated statements of operations resulting from fluctuation in the fair

value of the embedded conversion option as well as the number of other embedded derivatives within the Debentures, the

Company has elected to record the Debentures, including the debt itself and all embedded derivatives, at fair value and

present the Debentures as a hybrid financial instrument. No portion of the fair value of the Debentures has been recorded

as equity, nor would be if each component was freestanding. As of February 29, 2016, the fair value of the Debentures

amounted to $1.28 billion (February 28, 2015 - $1.71 billion). The difference between the fair value of the Debentures and

the unpaid principal balance of $1.25 billion, is $27 million. The fair value of the Debentures is measured using Level 2

fair value inputs.

The Company recorded non-cash income associated with the change in the fair value of the Debentures of $430 million in

fiscal 2016 (the “Fiscal 2016 Debentures fair value adjustments”) (fiscal 2015 - non-cash charge of $80 million). These

adjustments are presented on a separate line in the Company’s consolidated statements of operations. The fair value

adjustments do not impact the key terms of the Debentures such as the face value, the redemption features or the

conversion price.

The Company recorded interest expense related to the Debentures of $75 million, which has been included in investment

loss on the Company’s consolidated statements of operations in fiscal 2016 (fiscal 2015 - $75 million; fiscal 2014 - $21