Blackberry 2016 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

13

2016. Early adoption is permitted. The Company has adopted this guidance early and applied it prospectively in the fourth

quarter of fiscal 2016.

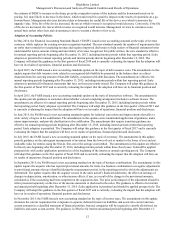

In January 2016, the FASB issued a new accounting standard on the topic of financial instruments. The amendments in this

update address certain aspects of recognition, measurement, presentation, and disclosure of financial instruments. The standard

primarily affects the accounting for equity investments, financial liabilities under the fair value option, and the presentation and

disclosure requirements for financial instruments. In addition, the guidance clarifies that an entity should evaluate the need for

a valuation allowance on a deferred tax asset related to available-for-sale securities. The guidance is effective for interim and

annual periods beginning after December 15, 2017, with early adoption permitted for certain requirements. The Company will

adopt this guidance in the first quarter of fiscal 2019 and is currently evaluating the impact that the adoption will have on its

results of operations, financial position and disclosures.

In February 2016, the FASB issued a new accounting standard on the topic of leases. The new standards would require

companies and other organizations to include lease obligations in their balance sheets, including a dual approach for lessee

accounting under which a lessee would account for leases as finance leases or operating leases. Both finance leases and

operating leases will result in the lessee recognizing a right-of-use (“ROU”) asset and a corresponding lease liability. For

finance leases the lessee would recognize interest expense and amortization of the ROU asset, and for operating leases, the

lessee would recognize a straight-line total lease expense. The guidance is effective for interim and annual periods beginning

after December 15, 2018. Early adoption is permitted. The Company will adopt this guidance in the first quarter of fiscal 2020

and is currently evaluating the impact that the adoption will have on its results of operations, financial position and disclosures.

In March 2016, the FASB issued a new accounting standard on the topic of revenue from contracts with customers. The

amendments in this update clarify the implementation guidance on principal versus agent considerations. When another party,

along with the reporting entity, is involved in providing goods or services to a customer, an entity is required to determine

whether the nature of its promise is to provide that good or service to the customer (as a principal) or to arrange for the good or

service to be provided to the customer by the other party (as an agent). The guidance is effective for interim and annual periods

beginning after December 15, 2017. The Company will adopt this guidance in the first quarter of fiscal 2019 and is currently

evaluating the impact that the adoption will have on its results of operations, financial position and disclosures.

In March 2016, the FASB issued a new accounting standard on the topic of stock compensation. The amendments in this update

simplify several aspects of the accounting for share-based payment award transactions, including the income tax consequences,

classification of awards as either equity or liabilities, and classification on the statements of cash flows. The guidance is

effective for interim and annual periods beginning after December 15, 2016. Early adoption is permitted. The Company will

adopt this guidance in the first quarter of fiscal 2018 and is currently evaluating the impact that the adoption will have on its

results of operations, financial position and disclosures.