Blackberry 2016 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

25

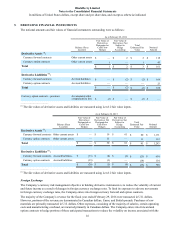

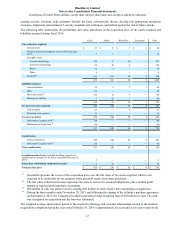

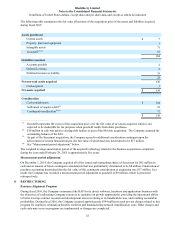

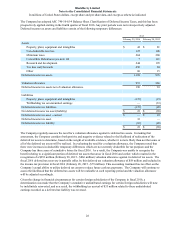

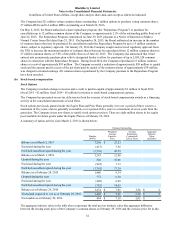

The following table summarizes the fair value allocations of the acquisition price of the assets and liabilities acquired

during fiscal 2015:

Assets purchased

Current assets $ 7

Property, plant and equipment 1

Intangible assets 71

Goodwill(1)(4) 85

164

Liabilities assumed

Accounts payable 2

Deferred revenue 8

Deferred income tax liability 18

28

Net non-cash assets acquired 136

Cash acquired 3

Net assets acquired $ 139

Consideration

Cash consideration $ 104

Settlement of acquiree debt(2) 18

Contingent consideration(3)(4) 17

$ 139

______________________________

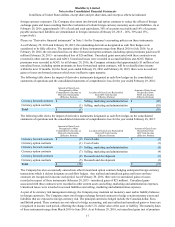

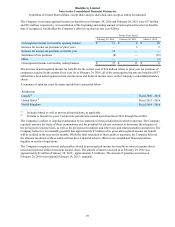

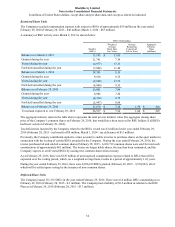

(1) Goodwill represents the excess of the acquisition price over the fair value of net assets acquired, which is not

expected to be deductible for tax purposes when goodwill results from share purchases.

(2) $18 million in cash was paid to existing debt holders as part of the Movirtu acquisition. The Company assumed the

outstanding balance of the debt.

(3) As part of the Secusmart acquisition, the Company agreed to additional consideration contingent upon the

achievement of certain financial targets, the fair value of which has been determined to be $17 million.

(4) See “Measurement period adjustment” below.

The weighted average amortization period of the acquired technology related to the business acquisitions completed

during the year ended February 28, 2015 is approximately five years.

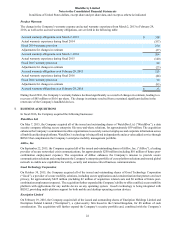

Measurement period adjustment

On December 1, 2014, the Company acquired all of the issued and outstanding shares of Secusmart for $82 million in

cash and an amount of future contingent consideration that was preliminarily determined to be $8 million. Finalization of

purchase accounting determined that the fair value of this contingent consideration at acquisition was $17 million. As a

result, the Company has recorded a measurement period adjustment to goodwill of $9 million, which is presented

retrospectively.

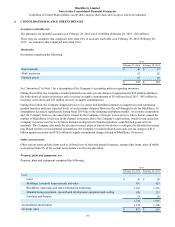

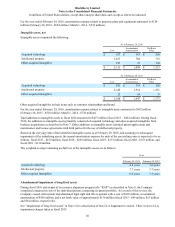

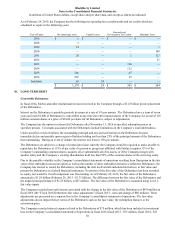

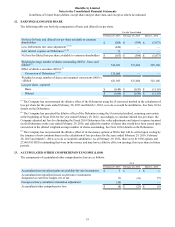

8. RESTRUCTURING

Resource Alignment Program

During fiscal 2016, the Company commenced the RAP for its device software, hardware and applications business with

the objectives of reallocating Company resources to capitalize on growth opportunities, providing the operational ability

to better leverage contract research and development services relating to its handheld devices, and reaching sustainable

profitability. During fiscal 2016, the Company incurred approximately $344 million in total pre-tax charges related to this

program for employee termination benefits, facilities and manufacturing network simplification costs. Other charges and

cash costs may occur as programs are implemented or changes are completed.