Blackberry 2016 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

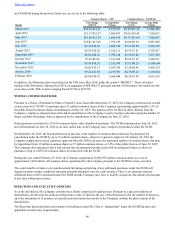

36

Class A Common Shares

The holders of class A common shares are not entitled to receive notice of, or attend or vote at, any meeting of the Company’s

shareholders, except as provided by applicable law. Each such holder is entitled to receive notice of, and to attend, any

meetings of shareholders called for the purpose of authorizing the dissolution or the sale, lease or exchange of all or

substantially all of the Company’s property other than in the ordinary course of business and, at any such meeting, shall be

entitled to one vote in respect of each class A common share on any resolution to approve such dissolution, sale, lease or

exchange. Dividends are to be declared and paid in equal amounts per share on all the common shares and the class A common

shares without preference or distinction. Subject to the rights of holders of any class of share ranking prior to the common

shares and class A common shares, in the event that the Company is liquidated, dissolved or wound-up, holders of common

shares and class A common shares are entitled to receive the remaining assets ratably on a per share basis without preference or

distinction.

The Company authorized for issuance the class A common shares when the Company was a private company to permit

employees to participate in equity ownership. Class A common shares previously issued by the Company to such employees

were converted on a one-for-one basis into common shares in December 1996. At this time, the Company has no plans to issue

further class A common shares.

Preferred Shares

The holders of preferred shares are not entitled to receive notice of, or to attend or vote at, any meeting of the Company’s

shareholders, except as provided by applicable law. Preferred shares may be issued in one or more series and, with respect to

the payment of dividends and the distribution of assets in the event that the Company is liquidated, dissolved or wound-up,

rank prior to the common shares and the class A common shares. The Board has the authority to issue series of preferred shares

and determine the price, number, designation, rights, privileges, restrictions and conditions, including dividend rights, of each

series without any further vote or action by shareholders. The holders of preferred shares do not have pre-emptive rights to

subscribe to any issue of the Company’s securities. At this time there are no preferred shares outstanding and the Company has

no plans to issue any preferred shares.

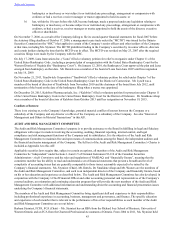

Convertible Debentures

The following is a summary of the material attributes and characteristics of the Debentures. This summary does not purport to

be complete and is subject to, and qualified in its entirety by, the terms of the Indenture (as defined below). Reference is made

to the Indenture, which has been filed on SEDAR at www.sedar.com and with the SEC at www.sec.gov, for complete

descriptions of the Debentures.

General

The Debentures are direct, unsecured debt obligations of the Company and are issued under an indenture (the “Trust

Indenture”) dated as of November 13, 2013 between the Company, as issuer, BlackBerry Corporation, BlackBerry UK Limited,

BlackBerry Finance, LLC and BlackBerry Singapore Pte. Limited, as guarantors (collectively, the “Guarantors”) and

Computershare Trust Company of Canada, as trustee (the “Trustee”), as supplemented by a supplemental indenture dated as of

December 12, 2013 between the same parties (the “First Supplemental Indenture”) and a second supplemental indenture dated

as of April 30, 2014 between the same parties (the “Second Supplemental Indenture”, and together with the First Supplemental

Indenture and the Trust Indenture, the “Indenture”). The Debentures are limited in the aggregate principal amount of

$1,250,000,000.

The Debentures have a maturity date of November 13, 2020 (the “Maturity Date”), subject to the prior conversion, redemption

or payment thereof as provided by the Indenture.

Each of the Guarantors has separately guaranteed the payment of principal, premium (if any) and interest and other amounts

due under the Debentures, and the performance of all other obligations of the Company under the Indenture (the “Guarantees”).

Other significant subsidiaries of the Company may be required to provide such Guarantees where they satisfy certain financial

tests.

Interest

The Debentures bear interest at a rate of 6% per annum, payable in equal quarterly instalments in arrears on the last day of

February, May, August and November of each year. If an Event of Default (as defined below) has occurred and is continuing,

the Debentures will bear interest at a rate of 10% per annum during the period of the default.

Subordination

The Debentures rank pari passu with one another, in accordance with their tenor without discrimination, preference or priority

and, subject to statutory preferred exceptions, shall rank equally with all other present and future unsubordinated unsecured