Blackberry 2016 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

23

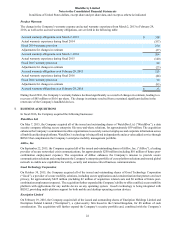

existing security solutions, help customers identify the latest cybersecurity threats, develop risk appropriate mitigation

strategies, implement and maintain IT security standards and techniques, and defend against the risk of future attacks.

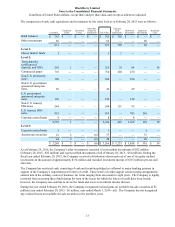

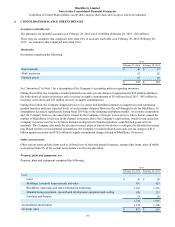

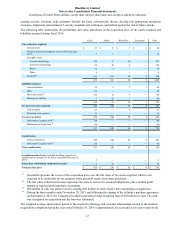

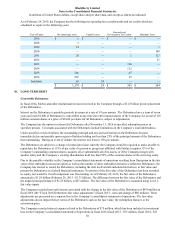

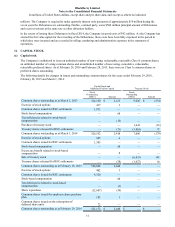

The following table summarizes the preliminary fair value allocations of the acquisition price of the assets acquired and

liabilities assumed during fiscal 2016:

Good AtHoc WatchDox Encription Total

Non-cash assets acquired

Current assets $ 33 $ 11 $ 3 $ 1 $ 48

Property, plant and equipment, net and other long term

assets 9 3 — — 12

Intangible assets

Acquired technology 148 55 30 — 233

Customer relationships 88 40 4 — 132

Brand 31 3 — — 34

Other 9 — — — 9

Goodwill(1) 313 191 28 8 540

631 303 65 9 1,008

Liabilities assumed

Current liabilities 54 6 3 1 64

Debt 88 — — — 88

Deferred revenue(2) 156 15 7 — 178

Deferred tax liability 7 42 — — 49

305 63 10 1 379

Net non-cash assets acquired 326 240 55 8 629

Cash acquired 23 — 4 — 27

Restricted cash acquired 10 — — — 10

Net assets acquired 359 240 59 8 666

Settlement of acquiree debt(3) 88 — — — 88

Elimination of bridge loan(4) (30) — — — (30)

417 240 59 8 724

Consideration

Cash consideration 329 240 59 8 636

Settlement of acquiree debt(3) 88 — — — 88

Total consideration 417 240 59 8 724

Acquisition-related costs (included in selling, general and

administration expenses for the fiscal year ended February 29,

2016) 2 — — — 2

Future post-combination employment expense 6 10 — — 16

Total purchase price $ 425 $ 250 $ 59 $ 8 $ 742

______________________________

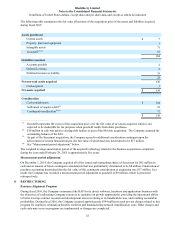

(1) Goodwill represents the excess of the acquisition price over the fair value of net assets acquired, which is not

expected to be deductible for tax purposes when goodwill results from share purchases.

(2) The fair value of deferred revenue represents the costs to service the assumed obligations, plus a normal profit

margin as required under purchase accounting.

(3) $88 million in cash was paid to Good’s existing debt holders to settle Good’s debt outstanding at acquisition.

(4) During the three months ended November 28, 2015 and following the signing of the definitive purchase agreement

on September 4, 2015, the Company provided Good with a bridge financing loan of $30 million in cash. The cash

was reacquired on acquisition and the loan was eliminated.

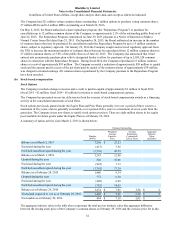

The weighted average amortization period of the acquired technology and customer relationships related to the business

acquisitions completed during the year ended February 29, 2016 is approximately six years and seven years respectively.