Blackberry 2016 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

15

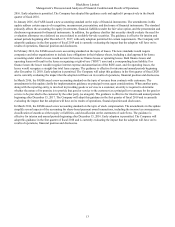

On September 22, 2015, the Company acquired all of the issued and outstanding shares of AtHoc, a leading provider of secure

networked crisis communications, for approximately $250 million (including $10 million of future post-combination

employment expense). The acquisition of AtHoc enhances the Company’s mission to provide secure communication solutions

and complements the Company’s enterprise portfolio of cross-platform solutions and trusted global network to enable new

capabilities for safety, security and mission-critical business communications.

On May 7, 2015, the Company acquired all of the issued and outstanding shares of WatchDox, a data security company

offering secure enterprise file-sync-and-share solutions, for approximately $59 million. The acquisition enhances the

Company’s commitment to allow organizations to securely connect employees and corporate information across all mobile and

desktop platforms. WatchDox’s technology is being offered independently and as a value added service through BES12 that

complements the Company’s enterprise mobility management portfolio.

On February 19, 2016, the Company acquired all of the issued and outstanding shares of Encription, a cybersecurity firm based

in the United Kingdom, for $8 million of cash consideration. The acquisition will further expand the Company’s security

portfolio and, combined with the Company’s existing security solutions, help customers identify the latest cybersecurity threats,

develop risk appropriate mitigation strategies, implement and maintain IT security standards and techniques, and defend against

the risk of future attacks.

The Company’s expectations as to revenue and other financial metrics for fiscal 2017 set forth in this MD&A reflect the

completion of the acquisition of WatchDox on May 7, 2015, AtHoc on September 22, 2015, Good on October 30, 2015 and

Encription on February 19, 2016.

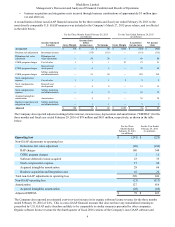

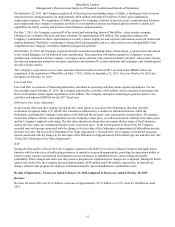

Free Cash Flow

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. For the

three months ended February 29, 2016, the Company reported free cash flow of $6 million, which consisted of operating cash

flows of $9 million, minus capital expenditures of $3 million. The Company anticipates continuing to generate positive free

cash flow and adjusted EBITDA for the 2017 fiscal year.

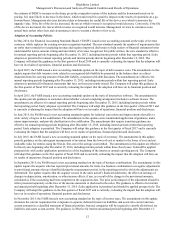

Debentures Fair Value Adjustment

As previously disclosed, the Company elected the fair value option to account for the Debentures; therefore, periodic

revaluation is required under U.S. GAAP. The valuation is influenced by a number of embedded features within the

Debentures, including the Company’s put option on the debt and the investors’ conversion option, among others. The primary

factors that influence the fair value adjustment are the Company’s share price, as well as associated volatility in the share price,

and the Company’s implied credit rating. The fair value adjustment charge does not impact the key terms of the Debentures

such as the face value, the redemption features or the conversion price. In the fourth quarter of fiscal 2016, the Company

recorded non-cash income associated with the change in the fair value of the Debentures of approximately $40 million (pre-tax

and after tax) (the “Q4 Fiscal 2016 Debentures Fair Value Adjustment”). In fiscal 2016, the Company recorded net non-cash

income associated with the change in the fair value of the Debentures of approximately $430 million (pre-tax and after tax) (the

“Fiscal 2016 Debentures Fair Value Adjustment”).

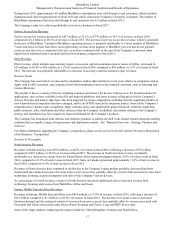

RAP

During the first quarter of fiscal 2016, the Company commenced the RAP for its device software, hardware and applications

business with the objectives of reallocating resources to capitalize on growth opportunities, providing the operational ability to

better leverage contract research and development services relating to its handheld devices, and reaching sustainable

profitability. Other charges and cash costs may occur as programs are implemented or changes are completed. During the fourth

quarter and fiscal 2016, the Company incurred approximately $180 million and $344 million, respectively, in total pre-tax

charges related to this program for employee termination benefits, patent abandonment, and facilities costs.

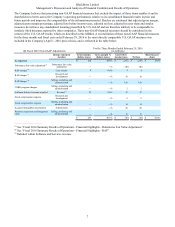

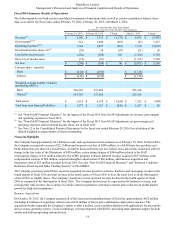

Results of Operations - Fiscal year ended February 29, 2016 compared to fiscal year ended February 28, 2015

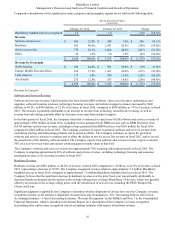

Revenue

Revenue for fiscal 2016 was $2.16 billion, a decrease of approximately $1.18 billion, or 35.2%, from $3.34 billion in fiscal

2015.