Blackberry 2016 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

14

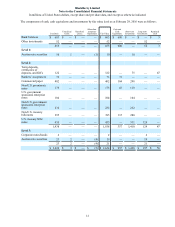

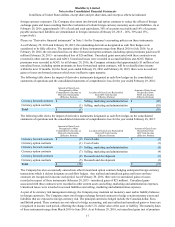

The contractual maturities of available-for-sale investments as at February 29, 2016 were as follows:

Cost Basis Fair Value

Due in one year or less $ 1,822 $ 1,823

Due in one to five years 127 127

Due after five years 17 19

$ 1,966 $ 1,969

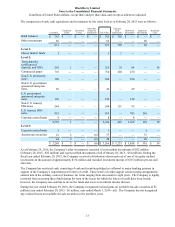

As at February 29, 2016 and February 28, 2015, the Company had no investments with continuous unrealized losses.

The Company engages in limited securities lending to generate fee income. Collateral, which exceeds the market value of

the loaned securities, is retained by the Company until the underlying security has been returned to the Company. As at

February 29, 2016, the Company had no loaned securities (February 28, 2015 - loaned securities with a market value of

$85 million).

Auction rate securities which have been publicly called at par were valued at par and considered short term investments

on the consolidated balance sheets as at February 29, 2016. For the other auction rate securities, the Company used a

multi-year investment horizon and considered the underlying risk of the securities and the current market interest rate

environment. The Company has the ability and intent to hold these securities until such time that market liquidity returns

to normal levels, and does not consider the principal or interest amounts on these securities to be materially at risk. As

there is uncertainty as to when market liquidity for auction rate securities will return to normal, the Company has

classified the auction rate securities as long-term investments on the consolidated balance sheets as at February 29, 2016

and February 28, 2015.

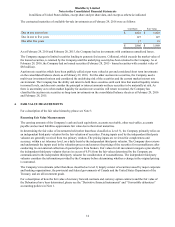

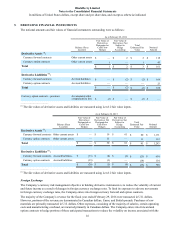

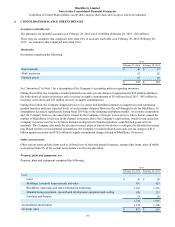

4. FAIR VALUE MEASUREMENTS

For a description of the fair value hierarchy, please see Note 3.

Recurring Fair Value Measurements

The carrying amounts of the Company’s cash and cash equivalents, accounts receivable, other receivables, accounts

payable and accrued liabilities approximate fair value due to their short maturities.

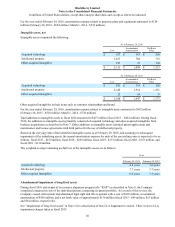

In determining the fair value of investments held (other than those classified as Level 3), the Company primarily relies on

an independent third party valuator for the fair valuation of securities. Pricing inputs used by the independent third party

valuator are generally received from two primary vendors. The pricing inputs are reviewed for completeness and

accuracy, within a set tolerance level, on a daily basis by the independent third party valuator. The Company also reviews

and understands the inputs used in the valuation process and assesses the pricing of the securities for reasonableness after

conducting its own internal collection of quoted prices from brokers. Fair values for all investment categories provided by

the independent third party valuator that are in excess of 0.5% from the fair values determined by the Company are

communicated to the independent third party valuator for consideration of reasonableness. The independent third party

valuator considers the information provided by the Company before determining whether a change in the original pricing

is warranted.

The Company’s investments (other than those classified as Level 3) largely consist of securities issued by major corporate

and banking organizations, the provincial and federal governments of Canada and the United States Department of the

Treasury, and are all investment grade.

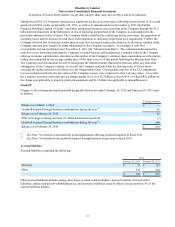

For a description of how the fair value of currency forward contracts and currency option contracts and the fair value of

the Debentures have been determined, please see the “Derivative financial instruments” and “Convertible debentures”

accounting policies in Note 1.