Blackberry 2016 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

27

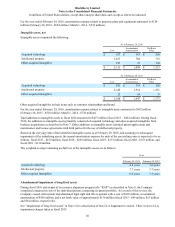

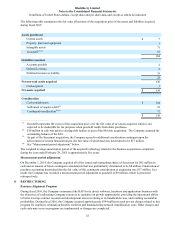

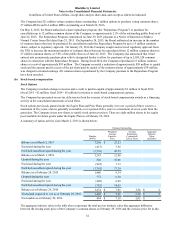

fiscal 2015) related to the write-down to fair value less costs to sell of the assets held for sale. All losses on disposal or on

write-down to fair value less costs to sell have been included in the selling, marketing and administration expenses on the

Company’s consolidated statements of operations and included in the total CORE program charges in fiscal 2015 and

prior periods.

In fiscal 2015, the Company completed the Real Estate Sale, offering properties comprising over three million square feet

of space through a combination of sale-leaseback and vacant asset sales. The Company recorded proceeds of

approximately $278 million and incurred a net loss on disposal of approximately $66 million on these properties for a

total net loss on disposal of $137 million for the Real Estate Sale, the remainder of which was recorded in prior periods

when certain of the properties were classified as held for sale and were written down to fair value less costs to sell. As part

of the Real Estate Sale, the Company is leasing back office space with remaining lease terms of one month to seven years.

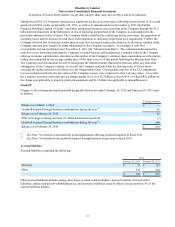

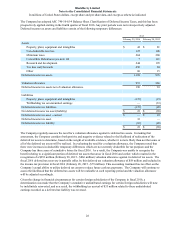

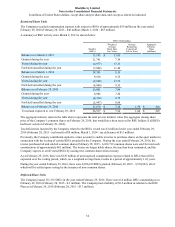

9. INCOME TAXES

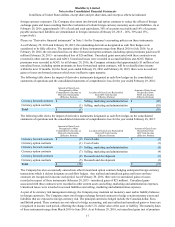

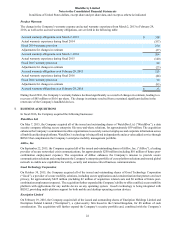

The difference between the amount of the provision for income taxes and the amount computed by multiplying net

income before income taxes by the statutory Canadian tax rate is reconciled as follows:

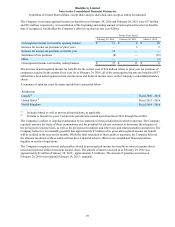

For the Years Ended

February 29, 2016 February 28, 2015 March 1, 2014

Statutory Canadian tax rate 26.6% 26.6% 26.6%

Expected recovery of income taxes $(75) $ (102) $ (1,908)

Differences in income taxes resulting from:

Valuation allowance 58 79 781

Investment tax credits (29)(51)(77)

Canadian tax rate differences 2(27)(82)

Change in unrecognized income tax benefits (9) — —

Foreign tax rate differences 6 11 (10)

Other differences 6 8 (47)

Withholding tax on unremitted earnings (33) 1 32

$(74) $ (81) $ (1,311)

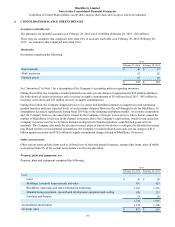

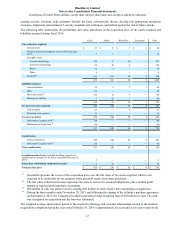

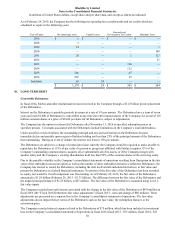

For the Years Ended

February 29, 2016 February 28, 2015 March 1, 2014

Loss before income taxes:

Canadian $(278) $ (600) $ (7,212)

Foreign (4) 215 28

$(282) $ (385) $ (7,184)

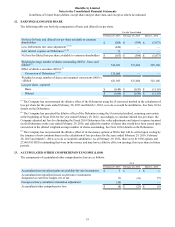

The recovery of income taxes consists of the following:

For the Years Ended

February 29, 2016 February 28, 2015 March 1, 2014

Current

Canadian $(10) $ (153) $ (1,203)

Foreign 38 21 77

Deferred

Canadian (35) 39 (184)

Foreign (67) 12 (1)

$(74) $ (81) $ (1,311)