BP 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 Making energy more

Notes on financial statements continued

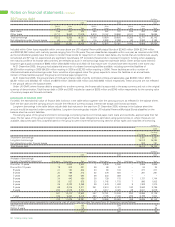

44 Capital and reserves

Share Capital

Share premium redemption Merger

capital account reserve reserve

At 31 December 2004 5,403 5,636 730 27,162

Adoption of IAS 39 ––––

At 1 January 2005 5,403 5,636 730 27,162

Currency translation differences (net of tax) ––––

Exchange gain on translation of foreign operations transferred

to (profit) or loss on sale (net of tax) ––––

Actuarial gain (loss) (net of tax) ––––

Employee share schemes 17 436 – –

Atlantic Richfield 3 76 – 28

Issue of ordinary share capital for TNK-BP 27 1,223 – –

Purchase of shares by ESOP trusts ––––

Available-for-sale investments marked to market (net of tax) ––––

Available-for-sale investments recycling (net of tax) ––––

Repurchase of ordinary share capital (265) – 19 –

Share-based payments (net of tax) ––––

Cash flow hedges marked to market (net of tax) ––––

Cash flow hedges recycling (net of tax) ––––

Profit for the year ––––

Dividends ––––

At 31 December 2005 5,185 7,371 749 27,190

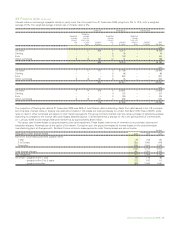

Share Capital

Share premium redemption Merger

capital account reserve reserve

At 1 January 2004 5,552 3,957 523 27,077

Currency translation differences (net of tax) ––––

Exchange gain on translation of foreign operations transferred

to (profit) or loss on sale (net of tax) ––––

Actuarial gain (loss) (net of tax) ––––

Unrealized gain on acquisition of further investment in

equity-accounted investments ––––

Employee share schemes 16 311 – –

Atlantic Richfield 7 153 – 85

Issue of ordinary share capital for TNK-BP 35 1,215 – –

Purchase of shares by ESOP trusts ––––

Repurchase of ordinary share capital (207) – 207 –

Share-based payments (net of tax) ––––

Profit for the year ––––

Dividends ––––

At 31 December 2004 5,403 5,636 730 27,162

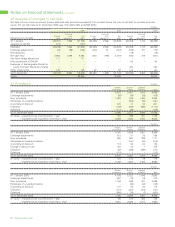

Share Capital

Share premium redemption Merger

capital account reserve reserve

At 1 January 2003 5,616 3,794 449 27,033

Currency translation differences (net of tax) ––––

Actuarial gain (loss) (net of tax) ––––

Employee share schemes 8 127 – –

Atlantic Richfield 2 36 – 44

Purchase of shares by ESOP trusts ––––

Repurchase of ordinary share capital (74) – 74 –

Share-based payments (net of tax) ––––

Increased minority participation ––––

Profit for the year ––––

Dividends ––––

At 31 December 2003 5,552 3,957 523 27,077