BP 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Making energy more

Notes on financial statements continued

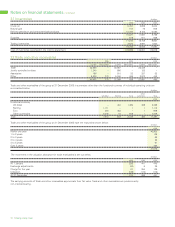

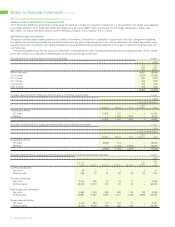

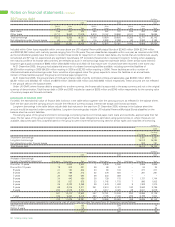

36 Financial instruments (UK GAAP) continued

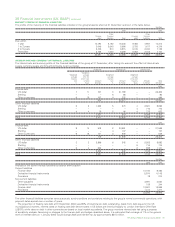

Interest rate swaps and futures are used by the group to modify the interest characteristics of its long-term finance debt from a fixed to a floating

rate basis or vice versa. The following table indicates the types of instruments used and their weighted average interest rates as at 31 December.

$ million except percentages

2004 2003

Receive fixed rate swaps – notional amount 8,182 7,432

Average receive fixed rate 3.1% 3.1%

Average pay floating rate 2.3% 1.1%

CURRENCY EXCHANGE RATE RISK

The monetary assets and monetary liabilities of the group in currencies other than the functional currency of individual operating units are

summarized below. These currency exposures arise from normal trading activities.

$ million

Net foreign currency monetary assets (liabilities)

Other

Functional currency US dollar Sterling Euro currencies Total

2004

US dollar – 374 2 (942) (566)

Sterling 314 – 380 66 760

Other currencies (269) (51) (25) (237) (582)

To t al 45 323 357 (1,113) (388)

2003

US dollar – 191 (24) 39 206

Sterling 67 – 308 34 409

Other currencies (1,148) (25) (27) (131) (1,331)

To t al (1,081) 166 257 (58) (716)

In accordance with its policy for managing foreign exchange rate risk, the group enters into various types of foreign exchange contracts, such as

currency swaps, forwards and options. The fair values and carrying amounts of these derivatives are shown in the fair value table in Note 38.

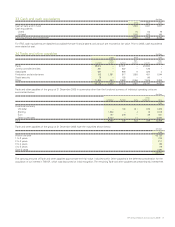

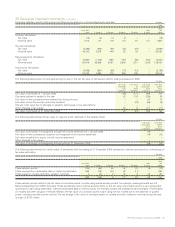

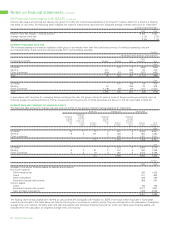

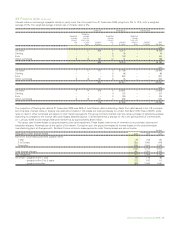

INTEREST RATE AND CURRENCY OF FINANCIAL ASSETS

The following table shows the interest rate and currency profile of the group’s material financial assets at 31 December.

Fixed rate Floating rate Interest free

Weighted

Weighted average Weighted Weighted

average time for average average

interest which rate interest time until

rate is fixed Amount rate Amount maturity Amount Total

% Years $ million % $ million Years $ million $ million

2004

US dollar 10 11 72 4 661 5 5,224 5,957

Sterling 8 2 101 3 428 5 864 1,393

Other currencies – – – 3 830 5 1,221 2,051

173 1,919 7,309 9,401

2003

US dollar – – – 3 1,015 4 2,060 3,075

Sterling 8 2 91 3 947 5 560 1,598

Other currencies 3 2 19 4 697 5 2,073 2,789

110 2,659 4,693 7,462

$ million

2004 2003

Analysis of the above financial assets by balance sheet caption

Non-current assets

Other investments 394 1,452

Loans 811 852

Other receivables 429 495

Derivative financial instruments 898 534

Current assets

Loans 193 182

Derivative financial instruments 5,317 1,891

Cash and cash equivalents 1,359 2,056

9,401 7,462

The floating rate financial assets earn interest at various rates set principally with respect to LIBOR or the local market equivalent. Fixed asset

investments included in the table above are held for the long term and have no maturity period. They are excluded from the calculation of weighted

average time until maturity. Similarly, cash and cash equivalents and derivative financial instruments, which are highly liquid financial assets, are

excluded from the calculation of weighted average time until maturity.