BP 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

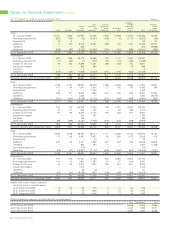

13 Impairment of goodwill continued $ million

2005

Refining Retail Lubricants Other Total

Goodwill 1,388 832 3,612 123 5,955

Excess of recoverable amount over carrying amount 13,593 1,511 3,953 n/a –

$ million

2004

Refining Retail Lubricants Other Total

Goodwill 1,404 878 4,008 128 6,418

Excess of recoverable amount over carrying amount 13,250 4,111 4,082 n/a –

$ million

2003

Refining Retail Lubricants Other Total

Goodwill 1,398 907 3,703 143 6,151

Excess of recoverable amount over carrying amount 12,728 3,083 3,685 n/a –

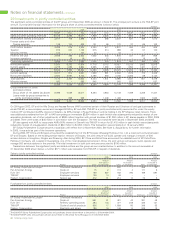

OTHER BUSINESSES AND CORPORATE

In November 2004, Solvay exercised its option to sell its interests in BP Solvay Polyethylene Europe and BP Solvay Polyethylene North America

to BP. Solvay held 50% of BP Solvay Polyethylene Europe and 51% of BP Solvay Polyethylene North America. The total consideration for the

acquisition was $1,391 million. See Note 3, Acquisitions, for more information.

The methodology to determine the option exercise price was laid out in the original agreement creating the polyethylene joint venture.

Management believed that this price was high compared with the likely recoverable amount for the businesses and conducted an impairment test.

The cash flows for the next five years were derived from the five-year group plan. Cost inflation rate was assumed to be 2% throughout the

period. For determining the value in use for each of the businesses, a period of 20 years was used, with a terminal value based on the value of

working capital releases. Cash flows beyond the five-year period were extrapolated based on the final year of the five-year group plan using

unchanged margin and volume assumptions for the subsequent years.

The key assumptions to which the calculations of value in use were most sensitive were variable contribution margin, production volumes and

discount rate. The values assigned to the variable contribution margin were rising across the plan period from $175 to $179 per tonne for Europe and

$153 to $194 per tonne for US and annual sales volumes were also rising in the plan period from 1,065,000 tonnes to 1,273,000 tonnes in Europe

and from 882,000 tonnes to 907,000 tonnes in the US. These key assumptions reflected past experience and were consistent with external sources.

The recoverable amount of the European business was $631 million lower than the acquisition fair values. This impairment was first applied to

the goodwill amount of $325 million and the balance recognized against the carrying value of property, plant and equipment. The recoverable

amount of the US business exceeded its carrying amount by $289 million. There were additional selling costs and closing adjustments of

$59 million in 2005, which created additional goodwill of $59 million. This was impaired in 2005.

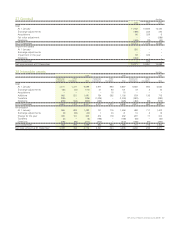

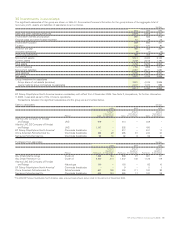

14 Distribution and administration expenses $ million

2005 2004 2003

Distribution 13,187 12,325 11,570

Administration 1,325 1,284 1,384

14,512 13,609 12,954

Innovene operations (806) (841) (684)

Continuing operations 13,706 12,768 12,270

15 Currency exchange gains and losses $ million

2005 2004 2003

Currency exchange (gains) and losses charged (credited) to income 94 55 (129)

Innovene operations (80) (13) (3)

Continuing operations 14 42 (132)

16 Research $ million

2005 2004 2003

Expenditure on research 502 439 349

Innovene operations (128) (139) (115)

Continuing operations 374 300 234

17 Operating leases $ million

2005 2004 2003

Minimum lease payments 1,841 1,840 1,447

Sub-lease rentals (110) (109) (128)

1,731 1,731 1,319

Innovene operations (49) (89) (68)

Continuing operations 1,682 1,642 1,251

BP Annual Report and Accounts 2005 59