BP 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Making energy more

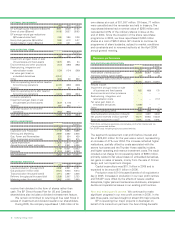

The group follows the successful efforts method

of accounting for its oil and natural gas exploration and

production activities.

The acquisition of geological and geophysical seismic

information, prior to the discovery of proved reserves, is

expensed as incurred, similar to accounting for research

and development costs.

Licence and property acquisition costs are initially

capitalized within intangible assets. These costs are

amortized on a straight-line basis until such time as either

exploration drilling is determined to be successful or it is

unsuccessful and all costs are written off. Each property is

reviewed on an annual basis to confirm that drilling activity

is planned and that it is not impaired. If no future activity is

planned, the remaining balance of the licence and property

acquisition costs is written off.

For exploration wells and exploratory-type stratigraphic

test wells, costs directly associated with the drilling of wells

are temporarily capitalized within intangible fixed assets,

pending determination of whether potentially economic oil

and gas reserves have been discovered by the drilling effort.

These costs include employee remuneration, materials and

fuel used, rig costs, delay rentals and payments made to

contractors. The determination is usually made within one

year after well completion, but can take longer, depending

on the complexity of the geological structure. If the well did

not encounter potentially economic oil and gas quantities,

the well costs are expensed as a dry hole and are reported

in exploration expense. Exploration wells that discover

potentially economic quantities of oil and gas and are

in areas where major capital expenditure (e.g. offshore

platform or a pipeline) would be required before production

could begin, and where the economic viability of that

major capital expenditure depends on the successful

completion of further exploration work in the area, remain

capitalized on the balance sheet as long as additional

exploration appraisal work is under way or firmly planned.

For complicated offshore exploration discoveries, it is

not unusual to have exploration wells and exploratory-type

stratigraphic test wells remaining suspended on the balance

sheet for several years while additional appraisal drilling and

seismic work on the potential oil and gas field is performed

or while the optimum development plans and timing are

established. All such carried costs are subject to regular

technical, commercial and management review, on at least

an annual basis, to confirm the continued intent to develop,

or otherwise extract value from, the discovery. If this is

no longer the case, the costs are immediately expensed.

Once a project is sanctioned for development, the

carrying values of licence and property acquisition costs and

exploration and appraisal costs are transferred to production

assets within tangible assets.

Field development costs subject to depreciation are

expenditures incurred to date, together with sanctioned

future development expenditure approved by the group.

The capitalized exploration and development costs

for proved oil and gas properties (which include the costs

of drilling unsuccessful wells) are amortized on the basis

of oil-equivalent barrels that are produced in a period

as a percentage of the estimated proved reserves.

The estimated proved reserves used in these unit-of-

production calculations vary with the nature of the

capitalized expenditure. The reserves used in the calculation

of the unit-of-production amortization are as follows:

••• Proved developed reserves for producing wells.

••• Total proved reserves for development costs.

••• Total proved reserves for licence and property

acquisition costs.

••• Total proved reserves for future decommissioning costs.

The impact of changes in estimated proved reserves is

dealt with prospectively by amortizing the remaining book

value of the asset over the expected future production.

If proved reserve estimates are revised downwards,

earnings could be affected by higher depreciation expense

or an immediate write-down of the property’s book value

(see discussion of impairment of fixed assets and

goodwill below).

Given the large number of producing fields in the

group’s portfolio, it is unlikely that any changes in reserve

estimates, year on year, will have a significant effect on

prospective charges for depreciation.

Oil and natural gas reserves The group manages its

hydrocarbon resources in three major categories: prospect

inventory, non-proved resources and proved reserves. When

a discovery is made, volumes transfer from the prospect

inventory to the non-proved resource category. The reserves

move through various non-proved resources sub-categories as

their technical and commercial maturity increases through

appraisal activity. Reserves in a field will only be categorized

as proved when all the criteria for attribution of proved

status have been met, including an internally imposed

requirement for project sanction, or for sanction expected

within six months. Internal approval and final investment

decision are what we refer to as project sanction.

At the point of sanction, all booked reserves will be

categorized as proved undeveloped (PUD). Volumes will

subsequently be recategorized from PUD to proved

developed (PD) as a consequence of development activity.

The first PD bookings will occur at the point of first oil or

gas production. Major development projects typically take

one to four years from the time of initial booking to the

start of production. Adjustments may be made to booked

reserves due to production, reservoir performance,

commercial factors, acquisition and divestment activity

and additional reservoir development activity.

The group reassesses its estimate of proved reserves

on an annual basis. The estimated proved reserves of oil

and natural gas are subject to future revision. As discussed

below, oil and natural gas reserves have a direct impact on

certain amounts reported in the financial statements.

Proved reserves do not include reserves that are

dependent on the renewal of exploration and production

licences, unless there is strong evidence to support the

assumption of such renewal.

The group estimates its reserves of oil and natural gas

according to UK SORP. This differs from the basis of

determining reserves required by the Securities and