BP 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 Making energy more

Notes on financial statements continued

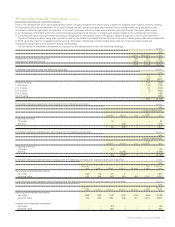

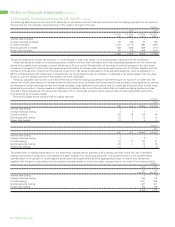

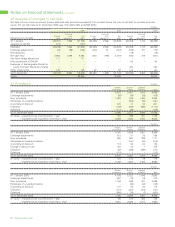

40 Analysis of changes in net debt

Net debt is current and non-current finance debt less cash and cash equivalents. The net debt ratio is the ratio of net debt to net debt plus total

equity. The net debt ratio at 31 December 2005 was 17% (2004 22% and 2003 22%).

$ million

2005 2004 2003

Cash and Cash and Cash and

Finance cash Net Finance cash Net Finance cash Net

Movement in net debt debt equivalents debt debt equivalents debt debt equivalents debt

At 1 January (23,091) 1,359 (21,732) (22,325) 2,056 (20,269) (22,008) 1,716 (20,292)

Adoption of IAS 39 (147) – (147) – – – – – –

Restated (23,238) 1,359 (21,879) (22,325) 2,056 (20,269) (22,008) 1,716 (20,292)

Exchange adjustments (44) (88) (132) (403) 91 (312) (199) 121 (78)

Debt acquired – – – – – – (15) – (15)

Net cash flow 3,803 1,689 5,492 (431) (788) (1,219) (760) 219 (541)

Fair value hedge adjustment 171 – 171 – – – – – –

Debt transferred to TNK-BP – – – – – – 93 – 93

Exchange of Exchangeable Bonds for –

Lukoil American Depositary Shares – – – – – – 420 – 420

Other movements 146 – 146 68 – 68 144 – 144

At 31 December (19,162) 2,960 (16,202) (23,091) 1,359 (21,732) (22,325) 2,056 (20,269)

Equity 80,765 78,235 70,264

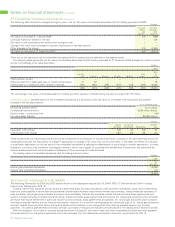

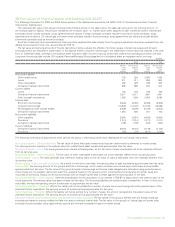

41 Provisions $ million

Decom- Environ- Litigation

missioning mental and other Total

At 1 January 2005 5,572 2,457 1,570 9,599

Exchange adjustments (38) (32) (35) (105)

New provisions 1,023 565 1,464 3,052

Write-back of unused provisions – (335) (86) (421)

Unwinding of discount 122 47 32 201

Utilization (128) (366) (650) (1,144)

Deletions (101) (25) – (126)

At 31 December 2005 6,450 2,311 2,295 11,056

Of which – expected to be incurred within 1 year 162 489 451 1,102

– expected to be incurred in more than 1 year 6,288 1,822 1,844 9,954

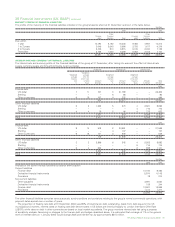

$ million

Decom- Environ- Litigation

missioning mental and other Total

At 1 January 2004 4,720 2,298 1,581 8,599

Exchange adjustments 213 21 25 259

New provisions 286 587 298 1,171

Write-back of unused provisions – (151) (64) (215)

Unwinding of discount 118 55 23 196

Change in discount rate 434 40 1 475

Utilization (87) (393) (294) (774)

Deletions (112) – – (112)

At 31 December 2004 5,572 2,457 1,570 9,599

Of which – expected to be incurred within 1 year 124 513 78 715

– expected to be incurred in more than 1 year 5,448 1,944 1,492 8,884

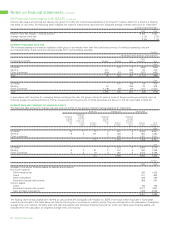

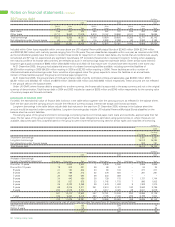

$ million

Decom- Environ- Litigation

missioning mental and other Total

At 1 January 2003 4,168 2,122 1,546 7,836

Exchange adjustments 257 28 28 313

New provisions 1,159 599 331 2,089

Write-back of unused provisions – (84) (64) (148)

Unwinding of discount 107 46 20 173

Utilization (121) (337) (273) (731)

Deletions (850) (76) (7) (933)

At 31 December 2003 4,720 2,298 1,581 8,599

Of which – expected to be incurred within 1 year 99 272 364 735

– expected to be incurred in more than 1 year 4,621 2,026 1,217 7,864