BP 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

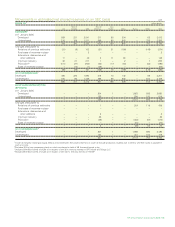

50 First-time adoption of International Financial Reporting Standards continued

Other non-financial contracts at fair value Certain net-settled non-financial contracts are deemed to meet the definition of financial instruments

under IAS 39 and, as such, need to be recorded on the balance sheet at fair value.

Increase (decrease) in caption heading $ million

At 1 January

2005

Non-current assets – derivative financial instruments 110

Current assets – derivative financial instruments 34

Current liabilities – derivative financial instruments 14

Non-current liabilities – derivative financial instruments 12

Deferred tax liabilities 44

Total equity 74

Other non-financial contracts no longer at fair value Certain non-financial contracts held for trading purposes were marked to market under UK

GAAP. However, under IFRS they could no longer be recorded at fair value as they did not meet the definition of financial assets or financial

liabilities. These contracts are accounted for on an accruals basis.

Increase (decrease) in caption heading $ million

At 1 January

2005

Non-current assets – derivative financial instruments (34)

Current assets – derivative financial instruments 47

Deferred tax liabilities 5

Total equity 8

Available-for-sale financial assets Under UK GAAP, the group’s investments other than subsidiaries, jointly controlled entities and associates were

stated at cost less accumulated impairment losses.

For IFRS, these investments are classified as available-for-sale financial assets, and as such need to be recorded at fair value with the gain or

loss arising as a result of the change in fair value being recorded directly in equity.

The transition adjustment relates to the fair value of listed investments held by the group. In accordance with IAS 39, all future fair value

adjustments will be booked directly in equity until disposal of the investment, when the cumulative associated gains/losses are recycled through

the income statement. At this point, the gain or loss on disposal under IFRS will be identical to that which would result using historical cost

accounting.

Increase (decrease) in caption heading $ million

At 1 January

2005

Other investments 344

Deferred tax liabilities 114

Total equity 230

Embedded derivatives Embedded derivatives are required to be separated from their host contracts and separately recorded at fair value, with any

resulting change in gain or loss in the period being recognized in the income statement.

Certain contracts have been determined to contain embedded derivatives. These embedded derivatives will be fair valued at each period end

with the resulting gains or losses taken to the income statement.

Increase (decrease) in caption heading $ million

At 1 January

2005

Non-current assets – prepayments and accrued income 599

Current assets – prepayments and accrued income 278

Current liabilities – accruals and deferred income 402

Non-current liabilities – accruals and deferred income 1,151

Deferred tax liabilities (267)

Total equity (409)

BP Annual Report and Accounts 2005 125