BP 2005 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

150 Making energy more

Notes on financial statements continued

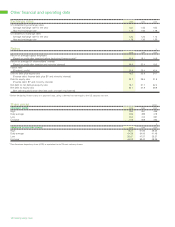

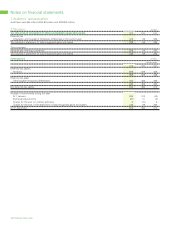

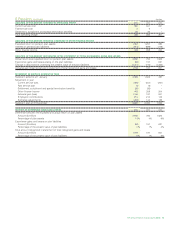

5 Creditors $ million

2005 2004 2003

Within After Within After Within After

1 year 1 year 1 year 1 year 1 year 1 year

Group undertakings 6,513 – 7,449 – 5,061 –

Social security 15 – 57 – 46 –

Accruals and deferred income 8 27 7 60 22 50

Dividends 1 – 1 – 1 –

Other 182 – 172 – 178 –

6,719 27 7,686 60 5,308 50

The profile of the maturity of the financial liabilities included in the balance sheet at 31 December is shown in the table below. These amounts are

included within Creditors – amounts falling due after more than one year, and are denominated in US dollars.

$ million

2005 2004 2003

Due within

1 to 2 years 5 5 5

2 to 5 years 22 55 45

27 60 50

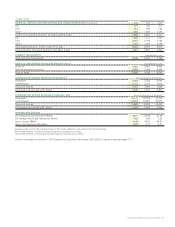

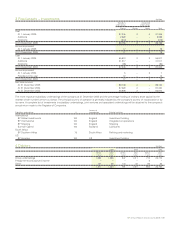

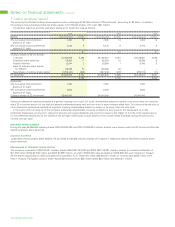

6 Pensions

The material financial assumptions used for estimating the benefit obligations of the plans are set out below. The assumptions used to evaluate

accrued pension benefits at 31 December in any year are used to determine pension expense for the following year, that is, the assumptions at

31 December 2005 are used to determine the pension liabilities at that date and the pension cost for 2006.

%

2005 2004 2003

Expected long-term rate of return 7.0 7.0 7.0

Discount rate for plan liabilities 4.75 5.25 5.5

Rate of increase in salaries 4.25 4.0 4.0

Rate of increase for pensions in payment 2.5 2.5 2.5

Rate of increase in deferred pensions 2.5 2.5 2.5

Inflation 2.5 2.5 2.5

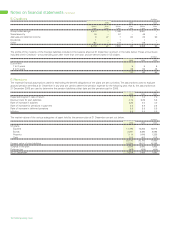

The market values of the various categories of asset held by the pension plan at 31 December are set out below.

$ million

2005 2004 2003

UK plans

Equities 17,796 16,263 13,815

Bonds 2,291 2,396 2,092

Property 1,114 1,645 1,325

Cash 919 402 618

22,120 20,706 17,850

Present value of plan liabilities 18,894 18,613 16,288

Surplus in the plan 3,226 2,093 1,562

Deferred tax (968) (628) (469)

At 31 December 2,258 1,465 1,093