BP 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

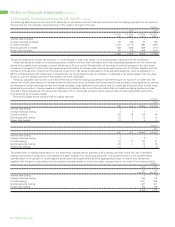

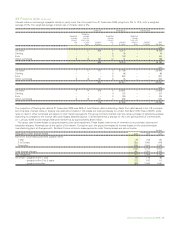

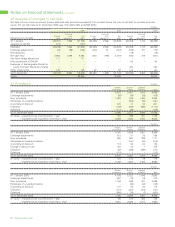

42 Pensions and other post-retirement benefits continued $ million

2003

US post-

UK US retirement

pension pension benefit Other

ANALYSIS OF THE AMOUNT CHARGED TO PROFIT BEFORE INTEREST AND TAXATION plans plans plans plans Total

Current service cost 290 177 54 116 637

Past service cost – 14 14 – 28

Settlement, curtailment and special termination benefits – (11) (669) 87 (593)

Payments to defined contribution plans – 134 – 36 170

Total operating charge (income) 290 314 (601) 239 242

Innovene operations (29) (23) (3) (19) (74)

Continuing operationsa261 291 (604) 220 168

ANALYSIS OF THE AMOUNT CREDITED (CHARGED) TO OTHER FINANCE EXPENSE

Expected return on plan assets 1,053 351 2 94 1,500

Interest on plan liabilities (848) (432) (259) (301) (1,840)

Other finance income (expense) 205 (81) (257) (207) (340)

Innovene operations (7) (2) 14 10 15

Continuing operations 198 (83) (243) (197) (325)

ANALYSIS OF THE AMOUNT RECOGNIZED IN THE STATEMENT OF RECOGNIZED

INCOME AND EXPENSE

Actual return less expected return on pension plan assets 1,639 749 2 2 2,392

Experience gains and losses arising on the plan liabilities 641 30 67 135 873

Change in assumptions underlying the present value of the plan liabilities (1,437) (1,030) (443) (279) (3,189)

Actuarial gain (loss) recognized in statement of recognized income and expense 843 (251) (374) (142) 76

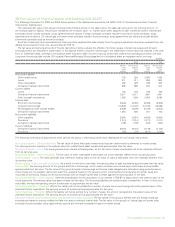

MOVEMENT IN SURPLUS (DEFICIT) DURING THE YEAR

Benefit obligation at 1 January 14,822 6,765 4,326 5,141 31,054

Exchange adjustment 1,738 – – 910 2,648

Current service cost 290 177 54 116 637

Plan amendments – 14 14 – 28

Interest cost 848 432 259 301 1,840

Special termination benefits – (11) (669) 87 (593)

Contributions by plan participants 33 – – 2 35

Benefit payments (761) (668) (217) (325) (1,971)

Acquisitions – – – 1 1

Disposals – – – – –

Actuarial (gain) loss on obligation 796 1,000 376 144 2,316

Benefit obligation at 31 December 17,766 7,709 4,143 6,377 35,995

Fair value of plan assets at 1 January 15,138 4,206 33 1,447 20,824

Exchange adjustment 1,864 – – 222 2,086

Expected return on plan assets 1,053 351 2 94 1,500

Contributions by plan participants 33 – – 2 35

Contributions by employers (funded plans) 258 2,189 – 86 2,533

Contributions by employers (unfunded plans) – 30 213 209 452

Benefit payments (761) (668) (217) (325) (1,971)

Acquisitions – – – 2 2

Disposals – – – – –

Actuarial gain (loss) on plan assets 1,639 749 2 2 2,392

Fair value of plan assets at 31 December 19,224 6,857 33 1,739 27,853

Surplus (deficit) 1,458 (852) (4,110) (4,638) (8,142)

Represented by

Asset recognized 1,562 – – 118 1,680

Liability recognized (104) (852) (4,110) (4,756) (9,822)

1,458 (852) (4,110) (4,638) (8,142)

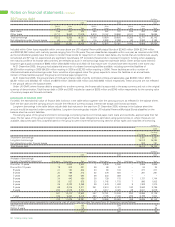

The surplus (deficit) may be analysed between wholly or partly funded and wholly

unfunded plans as follows

Funded 1,458 (494) (72) (308) 584

Unfunded – (358) (4.038) (4,330) (8,726)

1,458 (852) (4,110) (4,638) (8,142)

The defined benefit obligation may be analysed between wholly or partly funded and

wholly unfunded plans as follows

Funded (17,766) (7,351) (105) (2,047) (27,269)

Unfunded – (358) (4,038) (4,330) (8,726)

(17,766) (7,709) (4,143) (6,377) (35,995)

aIncluded within production and manufacturing expenses and distribution and administration expenses.

Pension and other post-retirement benefit surpluses and deficits are disclosed on a pre-tax basis. On a post-tax basis the pension and other post-retirement

benefit surplus (deficit) at 31 December 2005 would be $(4,770) million (2004 $(6,514) million and 2003 $(6,489) million).

BP Annual Report and Accounts 2005 91