BP 2005 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

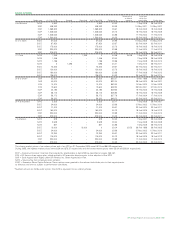

DIRECTORS’ INTERESTS

in BP ordinary shares or calculated equivalents

Change from

31 Dec 2005-

At 31 Dec 2005 At 1 Jan 2005 7 Feb 2006

Current directors

Dr D C Allen 443,742a408,342 –

Lord Browne 2,242,954b2,031,279 –

J H Bryan 158,760c158,760 –

A Burgmans 10,000 10,000 –

I C Conn 156,349d121,187 54

E B Davis, Jr 67,610c66,349 –

D J Flint 15,000 – –

Dr B E Grote 988,812c888,213 –

Dr A B Hayward 305,543 206,084 54

Dr D S Julius 15,000 15,000 –

Sir Tom McKillop 20,000 20,000 –

J A Manzoni 275,743 196,336 51

Dr W E Massey 49,722c49,722 –

H M P Miles 22,145 22,145 –

Sir Ian Prosser 16,301 16,301 –

P D Sutherland 30,079 30,079 –

M H Wilson 60,000c60,000 –

At retirement At 1 Jan 2005

Directors leaving the board in 2005

C F Knight 98,782c98,578

Sir Robin Nicholson 4,052 4,020

aIncludes 25,368 shares held as ADSs.

bIncludes 58,713 shares held as ADSs.

cHeld as ADSs.

dIncludes 38,836 shares held as ADSs.

The above figures indicate and include all the beneficial and non-beneficial

interests of each director of the company in shares of the company (or calculated

equivalents) that have been disclosed to the company under the Companies

Act 1985 as at the applicable dates. In making these disclosures, the directors

did not distinguish between beneficial and non-beneficial interests.

Executive directors are also deemed to have an interest in such shares of the

company held from time to time by The BP Employee Share Ownership Plan

(No. 2) to facilitate the operation of the company’s option schemes.

No director has any interest in the preference shares or debentures of

the company, or in the shares or loan stock of any subsidiary company.

BP Annual Report and Accounts 2005 163

segments, at their regular meetings. That enabled them to assess

the effectiveness of the system of internal control in operation

for managing significant risks, including social, environmental

and ethical risks, throughout the year. This process did not extend

to joint ventures or associates.

The BP general auditor presented reports to the January 2006

meetings of both the audit and ethics and environment assurance

committees to support the board in its annual assessment of

internal control. The reports described how significant risks were

identified and embedded within business segment and function

plans across the group; the effectiveness of executive management’s

controls; and the continuing development of the systems in place

to identify, address and manage risks. The reports also highlighted

future potentially significant risks that had been reviewed by the

board as part of the company’s planning process. The two committees

engage with executive management regularly to monitor the

management of risks. Significant incidents that occurred and

management’s response to them were considered by the

committees during the year.

In the board’s view, the information it received was sufficient to

enable it to review the effectiveness of the company’s system of

internal control in accordance with the Internal Control Revised

Guidance for Directors on the Combined Code (Turnbull).

considered a number of other broad matters of governance, including

issues that spanned the remit of the other principal committees.

Additionally, the committee addressed non-executive succession

planning issues in co-ordination with the nomination committee.

NOMINATION COMMITTEE REPORT

Schedule and composition The committee met twice during 2005

and comprised the following directors: P D Sutherland (chairman),

Dr D S Julius (from the AGM), Dr W E Massey, Sir Robin Nicholson

(retired at the AGM), Sir Ian Prosser.

All members of the nomination committee are considered by the

board to be independent.

Role and authority The task of the nomination committee is to

identify and evaluate candidates for appointment and reappointment

as director or company secretary of BP.

Process During the year, the nomination committee carried out

a detailed review of the skills and expertise of the non-executive

directors as part of the board succession planning described

earlier. The committee receives external assistance as required.

The committee consults with the group chief executive concerning

the identification and appointment of new executive directors.

External search consultants are retained in the UK/Europe and

in the US to assist the committee to identify potential candidates

as non-executive directors.

Activities in 2005 The committee considered the composition of

the board and board committees in the context of forthcoming work

programmes, BP’s strategy and business activities and retirements

from the board. In its succession planning for both executive and non-

executive directors, the committee is mindful of the requirements of

the group’s strategy and five-year plan. Board and committee evaluation

processes informed its work in identifying the skills and experiences

sought from potential candidates. Evaluations of the balance of skills

and experience on the board are carried out in conjunction with

the chairman’s committee. The committee keeps under review

contingency planning for key executive and non-executive director

roles. The nomination committee recommended to the board that

17 incumbent directors be proposed for re-election at the AGM.

COMBINED CODE COMPLIANCE

BP complied throughout 2005 with the provisions of the Combined

Code Principles of Good Governance and Code of Best Practice,

except in the following aspects:

A.4.4 Letters of appointment do not set out fixed time commitments

since the schedule of board and committee meetings is subject to

change according to the exigencies of the business. All directors are

expected to demonstrate their commitment to the work of the board

on an ongoing basis. This is reviewed by the nomination committee in

recommending candidates for annual re-election.

B.1.4 The amount of fees received by executive directors in

respect of their service on outside boards is not disclosed since

this information is not considered relevant to BP.

B.2.2 The remuneration of the chairman is fixed by the board as

a whole (rather than the remuneration committee) within the limits

set by shareholders, since the chairman’s performance is a matter

for the whole board.

INTERNAL CONTROL REVIEW

The board governance policies include a process for the board to

review regularly the effectiveness of the system of internal control

as required by Code provision C.2.1. As part of this process, the board

and the audit and ethics and environment assurance committees

requested, received and reviewed reports from executive

management, including management of the principal business