BP 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 Making energy more

its start-up, expected in 2008. Tangguh will also supply

gas into new terminals in Fujian, China, and Baja, Mexico.

In 2005, we made good progress in the construction of

China’s first LNG import facility in Guangdong, where

BP is a joint-venture partner. When the facility becomes

operational in 2006, gas will be supplied from the NWS

partnership (BP 16.7%) in Australia.

We continue to be the largest NGLs marketer in the

US. Our capacity utilization was well above plan, despite

disruptions to supply following the summer’s Gulf of Mexico

hurricanes. Full operations at our joint venture NGLs plant

in Egypt started in the first quarter of 2005 and the plant

reached full gas processing capacity of close to 1.1bcf/d

in the second half of the year.

BP Alternative Energy In 2005, we announced the launch

of BP Alternative Energy, a business dedicated to the

development and wholesale marketing and trading of

low-carbon power. We believe we have sufficient new

technologies and sound commercial opportunities within

our reach to build a significant and sustainable business in

alternative and renewable energy. BP Alternative Energy will

manage a first phase of investment of around $1.8 billion

during the next three years, the first part of our aim to

invest $8 billion over 10 years. This first-phase investment

will be spread in broadly equal proportions between solar,

wind, hydrogen and high-efficiency gas-fired power

generation. The business will initially employ around 2,500

people. It will bring together the group’s existing activities

in these technologies with our power marketing and trading

capabilities to form a single business. In solar, our sales

grew by 6% in 2005, and continued to generate profits. We

are committed to doubling our manufacturing capacity of

solar cells between 2004 and the end of 2006. In 2005, we

successfully completed the Frederick solar plant expansion

in Maryland, US. We also signed a joint venture agreement

with Xinjiang SunOasis Company, a leading photovoltaic

module manufacturer and system supplier in China.

We completed the construction and commissioning of

our 9MW Amsterdam wind farm, and applied for planning

permission for 10 turbines at the BP fuel terminal on the

Isle of Grain, UK, to generate 18MW of power.

We finalized all the commercial agreements and

commissioned the first unit of K-Power’s 1,100MW gas-fired

power plant in South Korea, where we have a 35% interest.

We successfully started commercial operations at our

wholly owned 50MW combined heat and power plant in

Hythe, UK, which supplies steam and electricity to local

industrial customers. We sold our 100% interest in the

Great Yarmouth 400MW gas-fired power station to RWE

in November 2005 for $282 million. At the end of 2005,

two new co-generation projects in North America, with

capacity totalling over 700MW, were in the early stages

of development.

In June 2005, together with our partners, we

announced plans for the development of the world’s

first large project to generate electricity from hydrogen,

while reducing CO2emissions and enhancing oil recovery

in the North Sea. The hydrogen will be used at a power

station in Peterhead, UK, to generate 350MW of ‘clean’

electricity and the CO2reinjected into the offshore Miller

field. Work has begun on the front-end engineering design

stage, addressing significant technical challenges that we

believe we and our partners are well placed to manage. At

the same time, we are keeping under constant review the

schedule of the project and its commercial viability, which is

itself dependent on clarification of the regulatory regime.

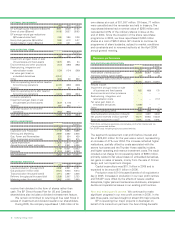

OTHER BUSINESSES AND CORPORATE

$ million

2005 2004 2003

Profit (loss) before interest and taxa(1,191) 164 (253)

Inventory holding (gains) losses 5 (8) 1

Replacement cost profit (loss) before

interest and tax (1,186) 156 (252)

Results include:

Impairment and gain (loss) on sale

of business and fixed assets 38 1,164 139

Environmental and other provisions (278) (283) (213)

Restructuring, integration and

rationalization costs (134) (102) 5

Fair value gain (loss) on

embedded derivatives (13) – –

Other 3 66 549

Total non-operating items (384) 845 480

aProfit from continuing operations and includes profit after interest and tax

of equity-accounted entities.

Other businesses and corporate comprises Finance, the

group’s aluminium asset, interest income and costs relating

to corporate activities, and also the portion of O&D not

included in the sale of Innovene to INEOS. This includes

the equity-accounted investments in China (the SECCO

petrochemicals complex) and Malaysia (Polyethylene

Malaysia Sdn Bhd and Ethylene Malaysia Sdn Bhd). The

result includes a net charge for non-operating items of

$384 million, of which $278 million is in respect of new, and

revisions to existing, environmental and other provisions.

TECHNOLOGY

Technological innovation and know-how are central

to our strategy and performance. Technology is vital in

converting resources to reserves and meeting the needs

of our customers.

We aim to align our technological activities with our

business strategy, focusing on areas where BP can create a

distinctive advantage. When we adopt new technologies we

spread them as rapidly as possible through the group and

apply them on a large scale. We aim to use the best talent

inside and outside BP to develop and apply technologies.

Our five-year technology plan is intended to maximize

our ability to access increasingly complex oil and gas fields,

to develop better products for our customers – often by

using alternative low-carbon technologies – and to improve

our day-to-day operations continuously.

We are a world leader in advanced seismic imaging,

from discovery through to field development and

management, and a world-class formulator for creating fuels

and lubricants that better meet customer needs. We have