BP 2005 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 Making energy more

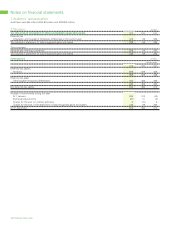

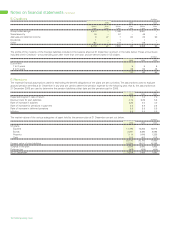

Parent company financial statements of BP p.l.c. continued

Accounting policies

ACCOUNTING STANDARDS

These accounts are prepared in accordance with applicable UK

accounting standards. In preparing the financial statements for the

current year, the company has adopted Financial Reporting Standards

No. 20 ‘Share-based Payment’ (FRS 20), No. 21 ‘Events after the

Balance Sheet Date’ (FRS 21), No. 22 ‘Earnings per share’, No. 23

‘The Effects of Changes in Foreign Exchange Rates’, No. 24 ‘Financial

Reporting in Hyperinflationary Economies’, No. 25 ‘Financial

Instruments: Disclosure and Presentation’, No. 26 ‘Financial

Instruments: Measurement’, No. 27 ‘Life Assurance’ and No. 28

‘Corresponding Amounts’.

The adoption of FRS 20 has resulted in changes in accounting

policy for share-based payment transactions and the adoption of

FRS 21 has resulted in changes in accounting policy for dividends.

FRS 20 requires that the fair value of options and shares awarded to

employees is charged to the income statement over the vesting

period. Under UK GAAP, no charge was made in respect of share

options. Dividends proposed or declared on equity instruments after

the balance sheet date are no longer recognized as a liability at the

balance sheet date. These changes in accounting policy have resulted

in a prior year adjustment. Shareholders’ interest at 1 January 2004

has been increased by $1,750 million and profit for the years ended

31 December 2004 and 2003 reduced by $64 million and $47 million

respectively. The statement of total recognized gains and losses

includes a prior year adjustment representing deferred taxation on

share-based payments. Profit for the current year has been reduced

by approximately $86 million as a result of the changes in

accounting policy.

ACCOUNTING CONVENTION

The accounts are prepared under the historical cost convention.

FOREIGN CURRENCY TRANSACTIONS

Foreign currency transactions are booked in the functional currency at

the exchange rate ruling on the date of transaction. Foreign currency

monetary assets and liabilities are translated into the functional

currency at rates of exchange ruling at the balance sheet date.

Exchange differences are included in profit for the year.

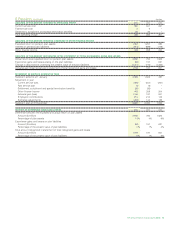

INVESTMENTS

Investments in subsidiary and associated undertakings are held at

cost. The company assesses investments for impairment whenever

events or changes in circumstances indicate that the carrying value of

an investment may not be recoverable. If any such indication of

impairment exists, the company makes an estimate of its recoverable

amount. Where the carrying amount of an investment exceeds its

recoverable amount, the investment is considered impaired and is

written down to its recoverable amount.

SHARE-BASED PAYMENTS

Equity-settled transactions The cost of equity-settled transactions

with employees is measured by reference to the fair value at the date

at which they are granted and is recognized as an expense over the

vesting period, which ends on the date on which the relevant

employees become fully entitled to the award. Fair value is

determined by using an appropriate valuation model. In valuing equity-

settled transactions, no account is taken of any vesting conditions

other than conditions linked to the price of the shares of the company

(market conditions).

No expense is recognized for awards that do not ultimately vest,

except for awards where vesting is conditional upon a market

condition, which are treated as vesting irrespective of whether or not

the market condition is satisfied, provided that all other performance

conditions are satisfied.

At each balance sheet date before vesting, the cumulative expense

is calculated, representing the extent to which the vesting period has

expired and management’s best estimate of the achievement or

otherwise of non-market conditions and number of equity instruments

that will ultimately vest or in the case of an instrument subject to a

market condition, be treated as vesting as described above. The

movement in cumulative expense since the previous balance sheet

date is recognized in the income statement, with a corresponding

entry in equity.

Where the terms of an equity-settled award are modified or a new

award is designated as replacing a cancelled or settled award, the

cost based on the original award terms continues to be recognized

over the original vesting period. In addition, an expense is recognized

over the remainder of the new vesting period for the incremental fair

value of any modification, based on the difference between the fair

value of the original award and the fair value of the modified award,

both as measured on the date of the modification. No reduction is

recognized if this difference is negative.

Where an equity-settled award is cancelled, it is treated as if it had

vested on the date of cancellation, and any cost not yet recognized in

the income statement for the award is expensed immediately. Any

compensation paid up to the fair value of the award at the cancellation

or settlement date is deducted from equity, with any excess over fair

value being treated as an expense in the income statement.

Cash-settled transactions The cost of cash-settled transactions is

measured at fair value using an appropriate option valuation model.

Fair value is established initially at the grant date and at each

balance sheet date thereafter until the awards are settled. During the

vesting period, a liability is recognized representing the product of the

fair value of the award and the portion of the vesting period expired as

at the balance sheet date. From the end of the vesting period until

settlement, the liability represents the full fair value of the award as at

the balance sheet date. Changes in the carrying amount for the

liability are recognized in profit or loss for the period.

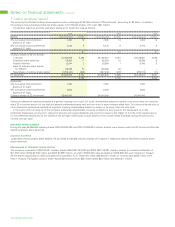

PENSIONS AND OTHER POST-RETIREMENT BENEFITS

For defined benefit pension and other post-retirement benefit

schemes, scheme assets are measured at fair value and scheme

liabilities are measured on an actuarial basis using the projected unit

method and discounted at an interest rate equivalent to the current

rate of return on a high-quality corporate bond of equivalent currency

and term to the scheme liabilities. Full actuarial valuations are obtained

at least every three years and are updated at each balance sheet date.

The resulting surplus or deficit, net of taxation thereon, is presented

separately above the total for net assets on the face of the balance

sheet.

The service cost of providing pension and other post-retirement

benefits to employees for the year is charged to the income

statement. The cost of making improvements to pension and other

post-retirement benefits is recognized in the income statement on a

straight-line basis over the period during which the increase in

benefits vests. To the extent that the improvements in benefits vest

immediately, the cost is recognized immediately.

A charge representing the unwinding of the discount on the

scheme liabilities during the year is included within other finance

expense.