BP 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 Making energy more

Notes on financial statements continued

35 Derivative financial instruments

An outline of the group’s financial risks and the policies and objectives pursued in relation to those risks is set out in the financial risk management

section on pages 24-26.

This note contains the disclosures required by IAS 32 for derivative financial instruments. IAS 39 prescribes strict criteria for hedge accounting,

whether as a cash flow or fair value hedge, and requires that any derivative that does not meet these criteria should be classified as trading and

marked-to-market. BP adopted IAS 32 and IAS 39 with effect from 1 January 2005 without restating prior periods. Consequently, the group’s

accounting policy under UK GAAP has been used for 2004 and 2003. The policy under UK GAAP and the disclosures required by UK GAAP for

derivative financial instruments are shown in Note 37.

In the normal course of business the group is a party to derivative financial instruments (derivatives) with off-balance sheet risk, primarily to

manage its exposure to fluctuations in foreign currency exchange rates and interest rates, including management of the balance between floating

rate and fixed rate debt. The group also manages certain of its exposures to movements in oil, natural gas and power prices. In addition, the group

trades derivatives in conjunction with these risk management activities.

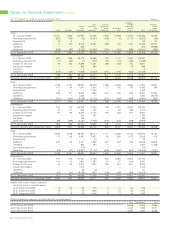

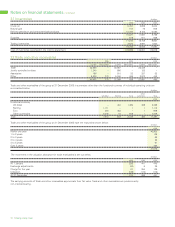

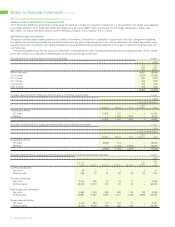

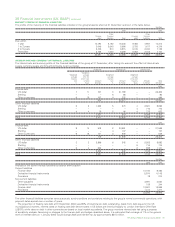

The fair value of derivative financial instruments at 31 December 2005 are set out below.

$ million

2005

Fair Contractual Fair Contractual

value or notional value or notional

asset amounts liability amounts

Cash flow hedges

Currency forwards, futures and swaps 34 666 (94) 3,100

Currency options – 693 (35) 1,470

Commodity futures 57 274 – –

91 1,633 (129) 4,570

Fair value hedges

Currency forwards, futures and swaps 222 2,566 (124) 1,967

Interest rate swaps 19 324 (217) 7,521

241 2,890 (341) 9,488

Hedges of net investments in foreign entities 63 346 – –

Derivatives held for trading

Currency derivatives 41 634 (18) 1,687

Oil derivatives 2,765 56,394 (2,826) 52,524

Natural gas derivatives 6,836 148,794 (6,307) 128,330

Power derivatives 3,341 25,793 (3,158) 26,618

12,983 231,615 (12,309) 209,159

13,378 236,484 (12,779) 223,217

Of which – current 3,652 (9,083)

– non-current 9,726 (3,696)

Embedded derivatives held for trading

Natural gas contracts 587 4,620 (3,098) 8,563

Interest rate contracts – – (30) 150

587 4,620 (3,128) 8,713

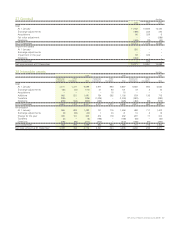

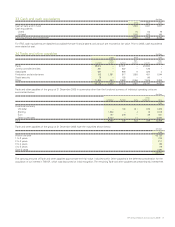

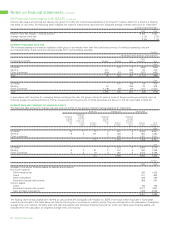

CASH FLOW HEDGES

At 31 December 2005, the group held forward currency contracts, cylinders and options that were being used to hedge the foreign currency risk of

highly probable transactions. Changes in the fair value of instruments used as hedges are not recognized in the accounts until the position matures.

The hedges were assessed to be highly effective.

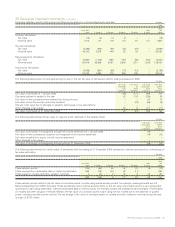

An analysis of these changes in fair value is as follows:

$ million

Net fair value

Fair value of cash flow hedges at 1 January 2005 198

Change in fair value during the year (191)

Fair value recognized in income statement during the year (8)

Fair value on capital expenditure hedging recycled into carrying value of assets during the year (37)

Fair value of cash flow hedges at 31 December 2005 (38)

Cash flow hedges have the following maturities: $ million

2005

Fair value Fair value

asset liability

Within one year 54 (108)

1 to 2 years 19 (17)

2 to 3 years 3 (3)

3 to 4 years 6 (1)

4 to 5 years 2 –

Over 5 years 7 –

91 (129)