BP 2005 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

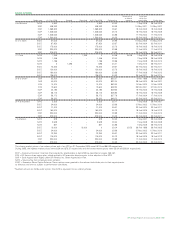

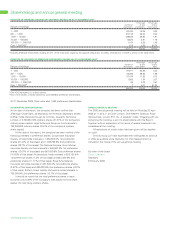

Summary of 2005 remuneration of executive directors

Annual remuneration Long-term remuneration

Share element of EDIP/LTPPs

2002-2004 plan 2003-2005 plan 2005-2007 plan

(vested in (to vest in (awarded in

Feb 2005) Feb 2006) Apr 2005)

Annual Non-cash benefits Potential

Salary performance bonus and other emoluments Total Actual Expected maximum

(thousand) (thousand) (thousand) (thousand) shares Valueashares Valuecperformance

2004 2005 2004 2005 2004 2005 2004 2005 vested (thousand) to vestb(thousand) sharesd

Lord Browne £1,382 £1,451 £2,280 £1,750 £82 £90 £3,744 £3,291 356,667 £1,958 474,384 £3,202 2,006,767

Dr D C Allen £410 £431 £615 £480 £11 £12 £1,036 £923 60,000 £329 147,783 £998 436,623

I C Conne£200 £421 £300 £450 £42 £43 £542 £914 51,750 £284 68,250 £461 415,832

Dr B E Grote $841 $923 $1,262 $1,100 $0 $0 $2,103 $2,023 136,960 $1,419 175,229 $2,077 501,782

Dr A B Hayward £410 £431 £615 £460 £36 £14 £1,061 £905 55,125 £303 147,783 £998 436,623

J A Manzoni £410 £431 £615 £440 £46 £47 £1,071 £918 60,000 £329 147,783 £998 436,623

Amounts shown are in the currency received by executive directors. Annual bonus is shown in the year it was earned.

aBased on market price on date of award (£5.49 per share/$62.15 per ADS).

bGross award of shares based on a performance assessment by the remuneration committee and on the other terms of the plan. Sufficient shares

are sold to pay for tax applicable. Remaining shares are held in trust for current directors until 2009, when they are released to the individual.

cBased on closing price of BP shares on 1 February 2006 (£6.75 per share/$71.12 per ADS).

dMaximum potential shares that could vest at the end of the three-year period depending on performance.

e2004 remuneration reflects that received by Mr Conn from his appointment as executive director on 1 July 2004.

new service contracts to allow for severance payments to be phased,

where appropriate to do so. It will also consider mitigation to reduce

compensation to a departing director, where appropriate to do so.

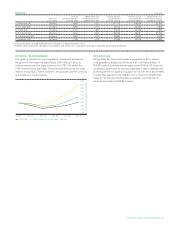

The chart above reflects the average mix of total remuneration received

by executive directors in 2005 and includes actual salary, bonus and

share element award.

Salary Base salaries for all executive directors were reviewed relative

to top Europe-based global companies and the US oil and gas sector.

Having taken account of market movements and performance, the

committee awarded a 5% increase in base salaries with effect from

1 July 2005 for all exective directors except Mr Conn, whose increase

was slightly higher to bring him to the same level as his peers.

Annual bonus The measures and weightings described earlier form

the framework within which the remuneration committee determined

the annual bonuses for the executive directors.

The committee made evaluations against each of the measures:

financial, metrics and milestones, and individual. The financial

Base salary

Performance-related annual bonus

Performance-related long-term incentives

2005 ACTUAL REMUNERATION ELEMENTS

measures were taken from the annual plan principally on cash flow.

Cash flow was strong. Amounts received from the divestment of

non-strategic assets significantly exceeded internal targets (principally

due to the Innovene disposal) and these, along with other actions

and successes, more than offset reductions in cash flow caused

by adverse events. Production rates, allowing for the impact of oil

prices on production-sharing contracts and weather-related downtime,

were within internal expectations.

Annual strategic metrics and milestones were taken from the

five-year group business plan. There is a wide range of measures,

including those relating to people, safety, environment, technology

and organization as well as operations and business development.

The group continued to perform well, developing business in Russia,

India and elsewhere. New fields came on stream in the US, Angola,

Azerbaijan and Trinidad & Tobago. A new code of conduct was

launched and employees were trained in its application. Safety

performance was impaired by the incident at Texas City.

Individual performance against leadership objectives was

reviewed by the committee, as was the underlying performance

of the group in the context of the five-year plan, together with

competitor results and positioning. Results are in line with or

exceed expectations.

The committee also considered this performance in the light of

the significant events during the year, both positive and negative.

These included the high prices of oil and gas; the overall financial

performance of the group; the disposal of non-strategic assets,

principally Innovene; the financial and other consequences of the

serious incident at the Texas City refinery and the repairs to the

Thunder Horse platform; and the effects of the hurricanes in the

Gulf of Mexico. The scale and the impact of all of these events were

taken into account in determining the annual bonuses, which are set

out in the table above.

168 Making energy more

Information subject to audit