BP 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Progress also continued in our other existing profit

centres. The North Sea completed its biggest maintenance

campaign in several years in a demanding operational

environment. Three new projects – Clair, Rhum and Farragon

– started production in 2005. All three came on line

successfully, underpinning our long-term commitment to

this mature basin. In North America, a major project was

sanctioned for the further development of the Wamsutter

gas field in Wyoming for $2.2 billion. In Alaska, we continue

to improve our knowledge of the extraction of viscous oil

resources, while striving for greater operational efficiencies

on our existing facilities.

We continually seek to enhance our portfolio through

planned divestments. In 2005, these yielded proceeds of

$1,416 million, mainly from the sale of our interests in the

Ormen Lange field in Norway and also the Teak, Samaan

and Poui fields in Trinidad & Tobago.

A total of 12 new oil and gas discoveries were made

from a focused exploration programme. Major successes

included a number of discoveries in the deepwater Gulf

of Mexico and Angola, and a second discovery in offshore

Sakhalin Island in Russia.

BUILDING PRODUCTION AND RETURNS

THROUGH FOCUS AND CHOICE

BP exploration and production locations

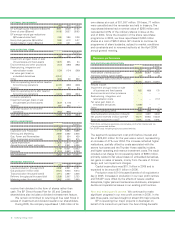

Reserves On the basis of UK generally accepted accounting

practice (SORP), our proved reserves replacement ratio (RRR)

was 100% (including equity-accounted entities), compared

with 110% in 2004. On the same basis, excluding equity-

accounted entities, the RRR was 71%. This was the 13th

consecutive year in which our RRR was 100% or greater. We

also prepare estimates of our proved reserves on the basis of

the rules and interpretation required by the US Securities and

Exchange Commission (SEC). On this basis, the reserves

replacement ratio, excluding equity-accounted entities, was

68% (compared with 78% in 2004); including equity-

accounted entities, the ratio was 95% (compared with 89%

in 2004). The differences from our SORP-based estimates

arise mainly from the SEC’s requirement that year-end prices

should be used. All our proved reserves replacement ratios

are based on discoveries, extensions, revisions and improved

recovery and exclude the effects of acquisitions and

disposals. BP has a robust internal process to control the

quality of its reserve bookings, which forms part of an

BP Annual Report and Accounts 2005 13

oil fields, the Baku-Tbilisi-Ceyhan (BTC) pipeline, the Shah

Deniz gas field and the South Caucasus pipeline. The Central

Azeri project achieved its first production in February 2005

and the West Azeri project achieved its first production in

December 2005, four months ahead of schedule.

Construction of the BTC pipeline progressed and line-fill of

the pipeline started in 2005, with the official inauguration

ceremony held on 25 May at the Sangachal terminal near

Baku. The Georgian section was inaugurated in early October

and the first tanker lifting from Ceyhan is expected in the

second quarter of 2006. In-country assembly of the drilling rig

and platform for the Shah Deniz field is on schedule for

start-up in 2006 and the associated South Caucasus pipeline

is also on course to be completed during 2006.

The Kizomba B development offshore Angola achieved

its first oil production four months ahead of schedule in

July 2005 and the Greater Plutonio project remains on track

to deliver first oil in 2007.

In Trinidad & Tobago, the Atlantic LNG Train 4 commenced

liquefaction at the end of the year. The Cannonball gas

development, Trinidad & Tobago’s first major offshore

construction project executed locally, is due to start

production in the first quarter of 2006.

In Algeria, the carbon dioxide (CO2) capture system in

our In Salah gas project started operations. This is one of

the world’s largest CO2capture projects, providing emissions

savings estimated to be equivalent to taking a quarter of a

million cars off the road. The In Amenas project is expected

to start production in the first half of 2006. BP was awarded

three blocks in Algeria’s sixth international licensing round.

In Indonesia, we received the final governmental approvals

for the Tangguh LNG project, which is proceeding on schedule.

In the Gulf of Mexico, the Mad Dog project achieved

first production in January 2005. Following stability problems

in July 2005, repairs to the Thunder Horse platform are

proceeding offshore. Production, originally scheduled for

the end of 2005, is now expected to start in the second

half of 2006. This is due to be followed by Atlantis, with

first production expected around the end of 2006.

In Russia, oil production from TNK-BP grew by just

under 10% compared with 2004. Total production, including

gas, exceeded 2 million boe/d for the first time in the third

quarter of 2005. Total dividends received by BP amounted to

$1.95 billion. Towards the end of the year, TNK-BP disposed

of non-core producing assets in the Saratov region, along

with the Orsk refinery. Future investment in TNK-BP’s

upstream business includes further extension drilling in the

Ust Vakh area of the Samotlor field and in the Kammenoye

field, as well as the greenfield Demiansky project in the

Uvat area. BP’s exploration successes in Sakhalin through

Elvaryneftegas, a joint venture with Rosneft, continued in

2005 with a second discovery. The region is now beginning

to show significant future potential.

In Egypt, we sanctioned investment in the Saqqara

field. We also extended two concessions in the Gulf of

Suez, the Merged Concession Agreement and South Garib,

which will extend the life of the existing oil fields, increase

the recovery of remaining reserves and provide a foundation

for future growth through exploration.