BP 2005 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176 Making energy more

ANNUAL GENERAL MEETING

The 2006 annual general meeting will be held on Thursday 20 April

2006 at 11.30 a.m. at ExCel London, One Western Gateway, Royal

Victoria Dock, London E16 1XL. A separate notice, ‘Engaging with us’,

convening the meeting, is sent to shareholders with this Report,

together with an explanation of the items of special business to be

considered at the meeting.

All resolutions of which notice has been given will be decided

on a poll.

Ernst & Young LLP have expressed their willingness to continue

in office as auditors and a resolution for their reappointment is

included in the notice of the annual general meeting.

By order of the board

David J Jackson

Secretary

6 February 2006

SUBSTANTIAL SHAREHOLDINGS

At the date of this report, the company had been notified that

JPMorgan Chase Bank, as depositary for American depositary shares

(ADSs), holds interests through its nominee, Guaranty Nominees

Limited, in 6,723,651,976 ordinary shares (31.07% of the company’s

ordinary share capital). Legal & General Group plc hold interests in

758,262,602 ordinary shares (3.61% of the company’s ordinary

share capital).

At the date of this report, the company has been notified of the

following interests in preference shares: Co-operative Insurance

Society Limited holds interests in 1,550,538 8% 1st preference

shares (21.44% of that class) and 1,789,796 9% 2nd preference

shares (32.7% of that class); The National Farmers Union Mutual

Insurance Society Ltd hold interests in 945,000 8% 1st preference

shares (13.07% of that class) and 987,000 9% 2nd preference shares

(18.03% of that class); Prudential plc holds interests in 528,150 8%

1st preference shares (7.3% of that class) and 644,450 9% 2nd

preference shares (11.77% of that class); Royal & SunAlliance

Insurance plc holds interests in 287,500 8% 1st preference shares

(3.97% of that class) and 250,000 9% 2nd preference shares (4.57%

of that class); Ruffer Limited Liability Partnership holds interests in

750,000 9% 2nd preference shares (13.7% of that class).

It should be noted that the total preference shares in issue

comprise only 0.39% of the company’s total issued nominal share

capital, the rest being ordinary shares.

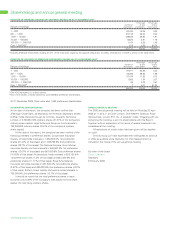

Shareholdings and annual general meeting

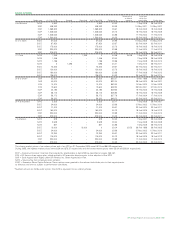

REGISTER OF MEMBERS HOLDING BP ORDINARY SHARES AS AT 31 DECEMBER 2005

Percentage Percentage

Number of of total of total

Range of holdings shareholders shareholders share capital

1 – 200 60,420 18.25 0.02

201 – 1,000 127,158 38.40 0.30

1,001 – 10,000 128,949 38.94 1.81

10,001 – 100,000 12,622 3.81 1.19

100,001 – 1,000,000 1,164 0.35 1.92

Over 1,000,000a818 0.25 94.76

331,131 100.00 100.00

aIncludes JPMorgan Chase Bank, holding 31.07% of the total share capital as the approved depositary for ADSs, a breakdown of which is shown in the table below.

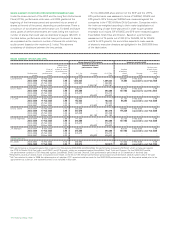

REGISTER OF HOLDERS OF AMERICAN DEPOSITARY SHARES AS AT 31 DECEMBER 2005a

Percentage Percentage

Number of of total of total

Range of holdings ADS holders ADS holders ADSs

1 – 200 81,911 52.25 0.44

201 – 1,000 45,386 28.95 1.95

1,001 – 10,000 27,478 17.53 6.73

10,001 – 100,000 1,955 1.24 3.07

100,001 – 1,000,000 29 0.02 0.57

Over 1,000,000b1 0.01 87.24

156,760 100.00 100.00

aOne ADS represents six ordinary shares.

bOne of the holders of ADSs represents some 839,800 preference shareholders.

At 31 December 2005, there were also 1,588 preference shareholders.