BP 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

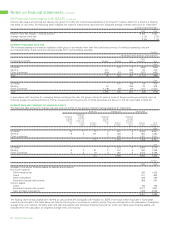

39 Finance debt continued

Interest rates on borrowings repayable wholly or partly more than five years from 31 December 2005 range from 2% to 12%, with a weighted

average of 5%. The weighted average interest rate on finance debt is 5%.

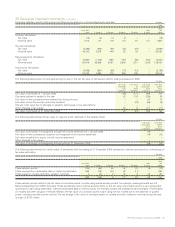

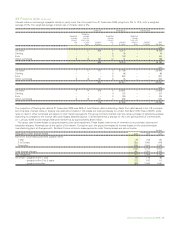

Fixed rate Floating rate Interest free

Weighted

Weighted average Weighted Weighted

average time for average average

interest which rate interest time until

rate is fixed Amount rate Amount maturity Amount Total

% Years $ million % $ million Years $ million $ million

2005

US dollar 7 11 665 5 18,073 – – 18,738

Sterling – – – 6 76 – – 76

Euro – – – 3 150 – – 150

Other currencies 9 14 157 12 41 – – 198

822 18,340 – 19,162

2004

US dollar 7 11 707 3 21,789 – – 22,496

Sterling – – – 5 96 – – 96

Euro – – – 3 297 – – 297

Other currencies 9 15 167 8 35 – – 202

874 22,217 – 23,091

2003

US dollar 8 14 578 2 20,991 – – 21,569

Sterling – – – 4 107 – – 107

Euro – – – 3 125 – – 125

Other currencies 9 15 141 3 383 – – 524

719 21,606 – 22,325

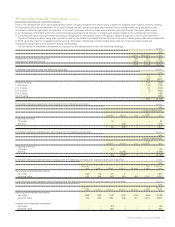

The proportion of floating rate debt at 31 December 2005 was 96% of total finance debt outstanding. Aside from debt issued in the US municipal

bond markets, interest rates on floating rate debt denominated in US dollars are linked principally to London Inter-Bank Offer Rate (LIBOR), while

rates on debt in other currencies are based on local market equivalents. The group monitors interest rate risk using a process of sensitivity analysis.

Assuming no changes to the finance debt and hedges described above, it is estimated that a change of 1% in the general level of interest rates

on 1 January 2006 would change 2006 profit before tax by approximately $180 million.

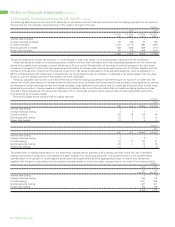

The group uses finance leases to acquire property, plant and equipment. These leases have terms of renewal but no purchase options and

escalation clauses. Renewals are at the option of the lessee. During the year, the group terminated its finance leases on the petrochemicals

manufacturing plant at Grangemouth, Scotland. Future minimum lease payments under finance leases are set out below.

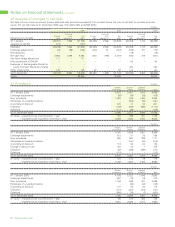

$ million

Obligations under finance leases 2005 2004 2003

Minimum future lease payments payable within

1 year 78 152 127

2 to 5 years 320 1,060 979

Thereafter 838 3,540 3,528

1,236 4,752 4,634

Less finance charges 455 2,354 2,452

Net obligations 781 2,398 2,182

Of which – payable within 1 year 60 115 90

– payable within 2 to 5 years 133 187 111

– payable thereafter 588 2,096 1,981

BP Annual Report and Accounts 2005 85