BP 2005 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The committee continued the engagement of Towers Perrin as its

principal external adviser during 2005. Towers Perrin also provided

limited ad hoc remuneration and benefits advice to parts of the group,

mainly comprising pensions advice in Canada, as well as providing

some market information on pay structures. The committee also

continued the engagement of Kepler Associates to advise on

performance measurement. Kepler Associates also provided

performance data and limited ad hoc advice on performance

measurement to the group.

Freshfields Bruckhaus Deringer provided legal advice on specific

matters to the committee as well as providing some legal advice

to the group.

Ernst & Young reviewed the calculations in respect of financial-

based targets that form the basis of the performance-related pay

for the executive directors. They also provided audit, audit-related

and taxation services to the group.

Lord Browne (group chief executive) was consulted on matters

relating to the other executive directors who report to him and on

matters relating to the performance of the company. He was not

present when matters affecting his own remuneration were considered.

POLICY ON EXECUTIVE DIRECTORS’ REMUNERATION

During 2004, the committee carried out a comprehensive and

independent review of all elements of remuneration policy for executive

directors, culminating in a shareholder resolution at the 2005 AGM

approving the renewal of the Executive Directors’ Incentive Plan (EDIP).

The committee seeks to ensure that, in determining remuneration policy,

there is a clear link between the company’s purpose, the business

plans and executive reward. The following key principles guide its policy:

••• Policy for the remuneration of executive directors will be

determined and regularly reviewed independently of executive

management and will set the tone for the remuneration of other

senior executives.

••• The remuneration structure will support and reflect BP’s stated

purpose to maximize long-term shareholder value.

••• The remuneration structure will reflect a just system of rewards

for the participants.

••• The overall quantum of all potential remuneration components

will be determined by the exercise of informed judgement of

the independent remuneration committee, taking into account

the success of BP and the competitive global market.

••• The majority of the remuneration will be linked to the achievement of

demanding performance targets that are independently set and

reflect the creation of long-term shareholder value.

••• A significant personal shareholding will be developed in order to

align executive and shareholder interests.

••• Assessment of performance will be quantitative and qualitative and

will include exercise of informed judgement by the remuneration

committee within a framework that takes account of sector

characteristics and is approved by shareholders.

••• The committee will be proactive in obtaining an understanding

of shareholder preferences.

••• Remuneration policy and practices will be as transparent as

possible, both for participants and shareholders.

••• The wider scene, including pay and employment conditions

elsewhere in the group, will be taken into account, especially

when determining annual salary increases.

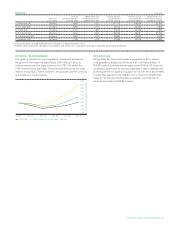

Elements of remuneration The executive directors’ total remuneration

will consist of salary, annual bonus, long-term incentives, pensions

and other benefits. This reward structure will be regularly reviewed

by the committee to ensure that it is achieving its objectives.

In 2006, over three-quarters of executive directors’ potential direct

remuneration will again be performance-related (see illustrative

chart below).

This chart reflects on-target values for annual bonus and share element.

ON-TARGET REMUNERATION ELEMENTS

Base salary

Performance-related annual bonus

Performance-related share element

Salary The committee expects to review salaries in 2006. In doing

so, the committee considers both top Europe-based global companies

and the US oil and gas sector; each of these groups is defined and

analysed by the committee’s independent external remuneration

advisers. The committee then assesses the market information and

advice and applies its judgement in setting the salary levels.

Annual bonus Each executive director is eligible to participate in an

annual performance-based bonus scheme. The committee reviews

and sets bonus targets and levels of eligibility annually.

For 2006, the target level is 120% of base salary (except for

Lord Browne, for whom, as group chief executive, it is considered

appropriate to have a target of 130%). In normal circumstances, the

maximum payment level for substantially exceeding targets will continue

to be 150% (165% for the group chief executive) of base salary. In

exceptional circumstances, outstanding performance may be recognized

by bonus payments moderately above the 150% (and 165%) levels at

the discretion of the remuneration committee. Similarly, bonuses may

be reduced where the committee considers that this is warranted

and, in exceptional circumstances, bonuses can be reduced to zero.

The committee recognizes that it is responsible to shareholders

to use its discretion in a reasonable and informed manner in the best

interests of the company and that it has a corresponding duty to be

accountable and transparent as to the manner in which it exercises

its discretion. The committee will explain any significant exercise of

discretion in the subsequent directors’ remuneration report.

Executive directors’ annual bonus awards for 2006 will be based

on a mix of demanding financial targets, based on the company’s

annual plan and leadership objectives established at the beginning

of the year, in accordance with the following weightings:

••• 50% financial and operational metrics from the annual plan, principally

earnings before interest, tax, depreciation and amortization

(EBITDA) and return on average capital employed (ROACE).

••• 30% annual strategic milestones taken from the five-year group

business plan, including those relating to technology, operational

actions and business development.

••• 20% individual performance against leadership objectives and living

the values of the group, which incorporates BP’s code of conduct.

In assessing the final outcome of the individual bonuses each year,

the committee will also carefully review the underlying performance

of the group in the context of the five-year group business plan, as

well as looking at competitor results, analysts’ reports and the views

from the chairmen of other BP board committees. All the calculations

are reviewed by Ernst & Young.

Long-term incentives Long-term incentives will continue to be

provided under the EDIP. It has three elements within its framework:

BP Annual Report and Accounts 2005 165