BP 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 Making energy more

Notes on financial statements continued

35 Derivative financial instruments continued

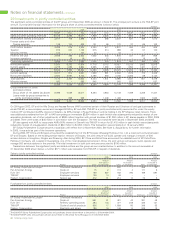

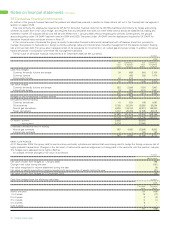

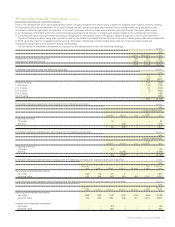

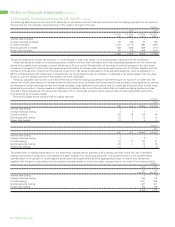

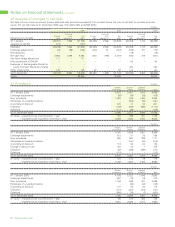

The following table shows the changes during the year in the net fair value of embedded derivatives held for trading purposes for 2005.

$ million

Fair value Fair value

interest natural gas

rate price

contracts contracts

Fair value of contracts at 1 January 2005 (17) (659)

Contracts realized or settled in the year – 138

Fair value of new contracts when entered into during the year – –

Change in fair value due to changes in valuation techniques or key assumptions – –

Other changes in fair values (13) (1,990)

Fair value of contracts at 31 December 2005 (30) (2,511)

There are no fair value amounts for embedded derivatives held for trading that are deferred on the balance sheet.

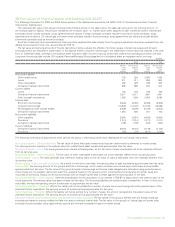

The following table shows the net fair value of embedded derivatives held for trading purposes at 31 December 2005 analysed by maturity period

and by methodology of fair value estimation.

$ million

2005

Total

Less than Over fair

1 year 1-2 years 2-3 years 3-4 years 4-5 years 5 years value

Prices actively quoted – – – – – – –

Prices sourced from observable data or market corroboration 51 28 – – – – 79

Prices based on models and other valuation methods (674) (542) (426) (231) (182) (565) (2,620)

(623) (514) (426) (231) (182) (565) (2,541)

The net change in fair value of contracts based on models and other valuation methods during the year is a loss of $1,773 million.

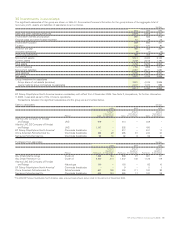

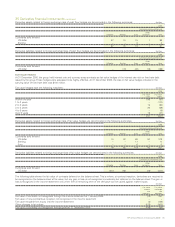

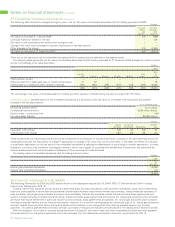

Sensitivity analysis Detailed below for the embedded derivatives is a sensitivity of the fair value to immediate 10% favourable and adverse

changes in the key assumptions.

At 31 December 2005

Remaining contract terms 3 to 13 years

Contractual/notional amount 8,220 million therms

Discount rate – nominal risk free 4.5%

Fair value asset (liability) $(2,590) million

$ million

Natural Gas oil and Discount

gas price fuel oil price Power price rate

Favourable 10% change 408 30 (63) 34

Unfavourable 10% change (427) (45) 58 (34)

These sensitivities are hypothetical and should not be considered to be predictive of future performance. Changes in fair value generally cannot be

extrapolated because the relationship of change in assumption to change in fair value may not be linear. Also, in this table, the effect of a variation

in a particular assumption on the fair value of the embedded derivatives is calculated independently of any change in another assumption. In reality,

changes in one factor may contribute to changes in another, which may magnify or counteract the sensitivities. Furthermore, the estimated fair

values as disclosed should not be considered indicative of future earnings on these contracts.

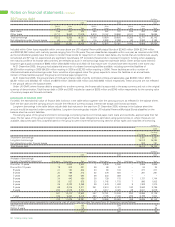

The trading result of embedded derivatives held for trading is shown below.

$ million

2005

Net

gain (loss)

Natural gas embedded derivatives (2,034)

Interest rate embedded derivatives (13)

(2,047)

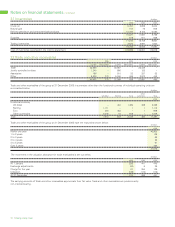

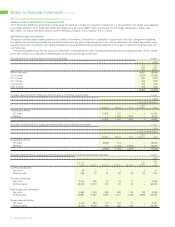

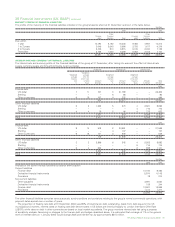

36 Financial instruments (UK GAAP)

The following information for 2004 and 2003 shows certain of the disclosures required by UK GAAP (FRS 13 ‘Derivatives and Other Financial

Instruments: Disclosures’) (FRS 13).

Financial instruments comprise primary financial instruments (cash and cash equivalents, trade and other receivables, loans, other investments,

trade and other payables, finance debt and provisions) and derivative financial instruments (interest rate contracts, foreign exchange contracts, oil

price contracts, natural gas price contracts and power price contracts). Interest rate contracts include futures contracts, swap agreements and

options. Foreign exchange contracts include forwards, futures contracts, swap agreements and options. Oil, natural gas and power price contracts

are those that require settlement in cash and include futures contracts, swap agreements and options. Oil, natural gas and power price contracts

that require physical delivery are not financial instruments. However, if it is normal market practice for a particular type of oil, natural gas and power

contract, despite having contract terms that require settlement by delivery, to be extinguished other than by physical delivery (e.g. by cash

payment), it is called a cash-settled commodity contract. Contracts of this type are included with derivatives in the disclosures in Notes 37 and 38.

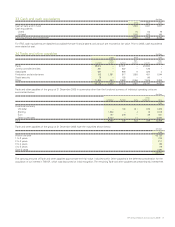

With the exception of the table of currency exposures shown on page 80, short-term trade and other receivables and trade and other payables

that arise directly from the group’s operations have been excluded from the disclosures contained in this note, as permitted by FRS 13.