BP 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 Making energy more

Notes on financial statements continued

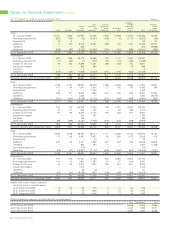

13 Impairment of goodwill continued

The key assumptions required for the value in use estimation are the oil and natural gas prices, production volumes and the discount rate. To test

the sensitivity of the excess of the recoverable amount over the carrying amount of goodwill and other non-current assets shown above (the

headroom) to changes in production volumes and oil and natural gas prices, management has developed ‘rules of thumb’ for these two key

assumptions. Applying these gives an indication of the impact on the headroom of possible changes in the key assumptions.

On the basis of the rules of thumb using estimated 2006 production profiles extrapolated over an average 15-year production life, it is estimated

that a long-term decrease of $1 per barrel in the price of Brent crude or $0.1 per mmBtu of Henry Hub gas with corresponding adjustments to

other prices would cause the above excess of recoverable amount over carrying amount to be reduced by $3.3 billion in respect of oil production

and $0.6 billion for gas production. Consequently, it is estimated that the long-term price of Brent crude that would cause the total recoverable

amount to be equal to the total carrying amount of the goodwill and related non-current assets for individual cash-generating units would be of the

order of $25 per barrel for the UK and $26 per barrel for the US. No reasonably possible change in oil or gas prices would cause the headroom in

Rest of World to be reduced to zero.

Estimated production volumes are based on detailed data for the fields and take into account development plans for the fields agreed by

management as part of the long-term planning process. It is estimated that, if all our production were to be reduced by 10% for the whole of the

next 15 years, this would not be sufficient to reduce the excess of recoverable amount over the carrying amounts of the individual cash-generating

units to zero. Consequently, management believes no reasonably possible change in the production assumption would cause the carrying amount

of goodwill and other non-current assets to exceed their recoverable amount.

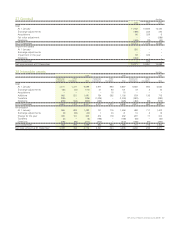

REFINING AND MARKETING

For all cash-generating units, the cash flows for the next five years are derived from the five-year group plan. The cost inflation rate is assumed to

be 2.5% (2004 2.5% and 2003 2.5%) throughout the period. For determining the value in use for each of the SPUs, cash flows for a period of

10 years have been discounted and aggregated with its terminal value.

Refining Cash flows beyond the five-year period are extrapolated using a 2% growth rate (2004 4% and 2003 2%).

The key assumptions to which the calculation of value in use for the Refining unit is most sensitive are gross margins, production volumes and

the terminal value. The value assigned to the gross margin is based on $5.25 per barrel global indicator margin (GIM), which is then adjusted for

specific refinery configurations (2004 $2.70 per barrel and 2003 $2.70 per barrel), except in the first year of the plan period when a GIM of $7.25 is

used, reflecting market conditions expected in the near term. The value assigned to the production volume is 900mmbbl a year (2004 900mmbbl

and 2003 1,100mmbbl) and remains constant over the plan period. The value assigned to the terminal value assumption is 5 times earnings (2004 5

times and 2003 5 times), which is indicative of similar assets in the current market. These key assumptions reflect past experience and are

consistent with external sources.

The Refining unit’s recoverable amount exceeds its carrying amount by $13.6 billion. Based on sensitivity analysis, it is estimated that if the GIM

changes by $1 per barrel, the Refining unit’s value in use changes by $7.7 billion and, if there is an adverse change in the GIM of $1.75 per barrel,

the recoverable amount of the Refining unit would equal its carrying amount. If the volume assumption changes by 5% the Refining unit’s value in

use changes by $3.1 billion and if there is an adverse change in Refining volumes of 200mmbbl a year, the recoverable amount of the Refining unit

would equal its carrying amount. If the multiple of earnings used in the terminal value changes by 1 then the Refining unit’s value in use changes

by $1.7 billion. Management believes no reasonably possible change in the multiple of earnings used in the terminal value would lead to the

Refining value in use being equal to its carrying amount.

Retail The cash flows beyond the five-year period assume no growth in fuel margins (2004 1% decline and 2003 no growth), reflecting a

competitive marketplace.

The key assumptions to which the calculation of value in use for the Retail unit is most sensitive are unit gross margins, branded marketing

volumes, the terminal value and discount rate. The value assigned to the unit gross margin varies between markets. For the purpose of planning,

each market develops a gross margin based on a market-specific reference price adjusted for the different income streams within the market and

other market specific factors. The weighted average Retail reference margin used in the plan was 5.4 cents per litre (2004 4.6 cents per litre and

2003 4.3 cents per litre). The value assigned to the branded marketing volume assumption is 101 billion litres a year (2004 106 billion litres a year

and 2003 107 billion litres a year). The unit gross margin assumptions decline on average by 0.8% a year over the plan period and marketing volume

assumptions grow by an average of 2% a year over the plan period. The value assigned to the terminal value assumption is 6.5 times earnings

(2004 6.5 times and 2003 6.5 times), which is indicative of similar assets in the current market. These key assumptions reflect past experience and

are consistent with external sources.

The Retail unit’s recoverable amount exceeds its carrying amount by $1.5 billion. It is estimated that, if there is an adverse change in the unit

gross margin of 7.5%, the recoverable amount of the Retail unit would equal its carrying amount. It is estimated that, if the volume assumption

changes by 5%, the Retail unit’s value in use changes by $1 billion and, if there is an adverse change in Retail volumes of 8 billion litres a year, the

recoverable amount of the Retail unit would equal its carrying amount. If the multiple of earnings used in the terminal value changes by 1 then the

Retail unit’s value in use changes by $0.5 billion and, if the multiple of earnings falls to 3 times, then the Retail value in use would equal its carrying

amount. A change of 1% in the discount rate would change the Retail value in use by $0.7 billion and, if the discount rate increases to 12%, the

value in use of the Retail unit would equal its carrying amount.

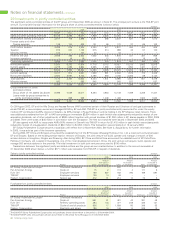

Lubricants Cash flows beyond the five-year period are extrapolated using a 3% sales volume growth rate (2004 3% and 2003 3%), which is lower

than the long-term average growth rate for the first five years. The terminal value for the Lubricants unit represents cash flows discounted to

perpetuity. For the Lubricants unit, the key assumptions to which the calculation of value in use is most sensitive are operating margin, sales

volumes and the discount rate. The values assigned to the operating margin and sales volumes are 49 cents per litre (2004 51 cents per litre and

2003 55 cents per litre) and 3.3 billion litres a year (2004 3.3 billion litres and 2003 3.4 billion litres). These key assumptions reflect past experience.

The Lubricants unit’s recoverable amount exceeds its carrying amount by $4.0 billion. If there is an adverse change in the operating gross margin

of 10 cents per litre, the recoverable amount of the Lubricants unit would equal its carrying amount. If the sales volume assumption changes by

5%, the Lubricants unit’s value in use changes by $1.1 billion and, if there is an adverse change in Lubricants sales volumes of 600 million litres,

the recoverable amount of the Lubricants unit would equal its carrying amount. A change of 1% in the discount rate would change the Lubricants

unit’s value in use by $0.7 billion and, if the discount rate increases to 17%, the value in use of the Lubricants unit would equal its carrying amount.