BP 2005 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

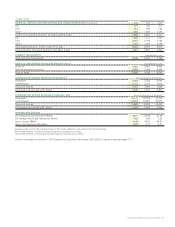

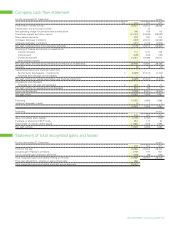

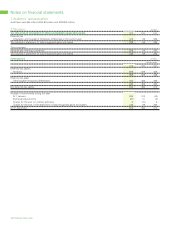

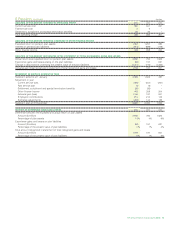

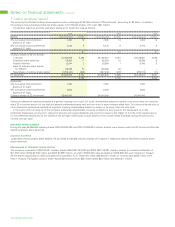

6 Pensions continued $ million

ANALYSIS OF THE AMOUNT CHARGED TO OPERATING PROFIT 2005 2004 2003

Current service cost 360 341 261

Past service cost 4 5 –

Settlement, curtailment and special termination benefits 36 36 –

Total operating charge 400 382 261

ANALYSIS OF THE AMOUNT CREDITED (CHARGED) TO OTHER FINANCE INCOME

Expected return on pension plan assets 1,357 1,257 983

Interest on pension plan liabilities (914) (899) (779)

Other finance income 443 358 204

ANALYSIS OF THE AMOUNT RECOGNIZED IN THE STATEMENT OF TOTAL RECOGNIZED GAINS AND LOSSES

Actual return less expected return on pension plan assets 2,946 750 1,526

Experience gains and losses arising on the plan liabilities (66) 157 621

Change in assumptions underlying the present value of the plan liabilities (1,721) (710) (1,306)

Actuarial gain (loss) recognized in statement of total recognized gains and losses 1,159 197 841

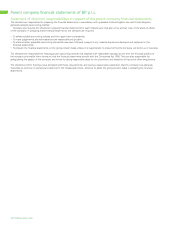

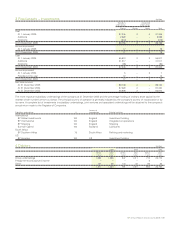

MOVEMENT IN SURPLUS DURING THE YEAR

Surplus in scheme at 1 January 2,093 1,562 497

Movement in year

Current service cost (360) (341) (261)

Past service cost (4) (5) –

Settlement, curtailment and special termination benefits (36) (36) –

Other finance income 443 358 204

Actuarial gain (loss) 1,159 197 841

Employers’ contributions 214 214 142

Exchange adjustments (283) 144 139

Surplus in plan at 31 December 3,226 2,093 1,562

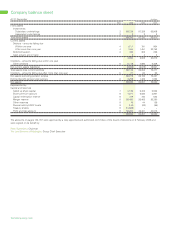

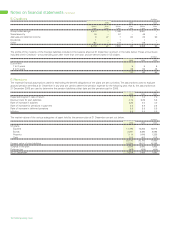

HISTORY OF EXPERIENCE GAINS AND LOSSES 2005 2004 2003

Difference between the expected and actual return on plan assets

Amount ($ million) 2,946 750 1,526

Percentage of plan assets 14%4%9%

Experience gains and losses on plan liabilities

Amount ($ million) (66) 157 621

Percentage of the present value of plan liabilities 0% 1% 4%

Total amount recognized in statement of total recognized gains and losses

Amount ($ million) 1,159 197 841

Percentage of the present value of plan liabilities 6% 1% 5%

BP Annual Report and Accounts 2005 151