BP 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

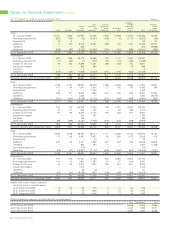

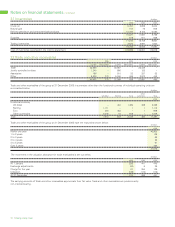

20 Finance costs $ million

2005 2004 2003

Bank loans and overdrafts 44 34 38

Other loans 828 573 600

Finance leases 38 37 34

Interest payable 910 644 672

Capitalized at 4.25% (2004 3% and 2003 3%)a(351) (204) (190)

Early redemption of borrowings and finance leases 57 – 31

Continuing operations 616 440 513

aTax relief on capitalized interest is $123 million (2004 $73 million and 2003 $68 million).

21 Other finance expense $ million

2005 2004 2003

Interest on pension and other post-retirement benefit plan liabilities 2,022 2,012 1,840

Expected return on pension and other post-retirement benefit plan assets (2,138) (1,983) (1,500)

Interest net of expected return on plan assets (116) 29 340

Unwinding of discount on provisions 201 196 173

Unwinding of discount on deferred consideration for acquisition of investment in TNK-BP 57 91 34

Change in discount rate for provisionsa– 41 –

142 357 547

Innovene operations 3 (17) (15)

Continuing operations 145 340 532

aRevaluation of environmental and litigation and other provisions at a different discount rate.

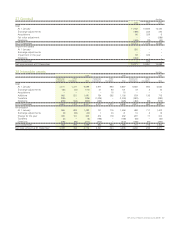

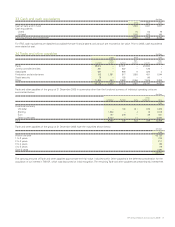

22 Taxation $ million

TAX ON PROFIT 2005 2004 2003

Current tax

Charge for the year 10,511 7,217 5,061

Adjustment in respect of prior years (977) (308) (392)

9,534 6,909 4,669

Innovene operations (910) (48) 54

Continuing operations 8,624 6,861 4,723

Deferred tax

Origination and reversal of temporary differences in the current year 349 138 448

Adjustment in respect of prior years (450) (74) (67)

(101) 64 381

Innovene operations 950 157 (54)

Continuing operations 849 221 327

Tax on profit from continuing operations 9,473 7,082 5,050

Tax on profit from continuing operations may be analysed as follows:

Current tax charge

UK 880 1,839 1,142

Overseas 7,744 5,022 3,581

8,624 6,861 4,723

Deferred tax charge

UK (489) (218) 289

Overseas 1,338 439 38

849 221 327

To t al

UK 391 1,621 1,431

Overseas 9,082 5,461 3,619

9,473 7,082 5,050

BP Annual Report and Accounts 2005 61