BP 2005 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166 Making energy more

directors as it best reflects the creation of long-term shareholder value.

Relative performance of the peer group is particularly key in order to

minimize the influence of sector-specific effects, including oil price.

The committee is mindful of the possibility that a simple ranking

system may in some circumstances give rise to distorted results in

view of the broad similarity of the oil majors’ underlying businesses,

the small size of the comparator group and inherent imperfections

in measurement. To counter this, the committee will have the ability

to exercise discretion in a reasonable and informed manner to adjust

(upwards or downwards) the vesting level derived from the ranking

if it considers that the ranking does not fairly reflect BP’s underlying

business performance relative to the comparator group.

The exercise of this discretion would be made after a broad analysis

of the underlying health of BP’s business relative to competitors, as

shown by a range of other measures including, but not limited to,

ROACE, earnings per share (EPS) growth, reserves replacement and

cash flow. This will enable a more comprehensive review of long-term

performance, with the aims of tempering anomalies created by relying

solely on a formula-based approach and ensuring that the objectives

of the plan are met.

It is anticipated that the need to use discretion is most likely to

arise where the TSR performance of some companies is clustered,

so that a relatively small difference in TSR performance would

produce a major difference in vesting levels. In these circumstances,

the committee will have power to adjust the vesting level, normally

by determining an average vesting level for the companies affected

by the clustering.

In line with its policy on transparency, the committee will explain

any adjustment to the relative TSR ranking in the next directors’

remuneration report following the vesting.

The committee may amend the performance conditions if events

occur that would make the amended condition a fairer measure of

performance and provided that any amended condition is no easier

to satisfy.

For 2006, all executive directors will receive performance share

awards on the above basis, over a maximum number of shares

set by reference to 5.5 x base salary. For awards under the share

element in future years, the committee may continue with the same

performance condition or may impose a different condition, which it

considers to be no less demanding.

As group chief executive, Lord Browne is eligible for performance

share awards of up to 7.5 x base salary. The committee has

determined that, while the largest part of this should relate to the

TSR measure described above, it continues to be appropriate that

a specific part (up to 2 x base salary) should be based on long-term

leadership measures. These will focus on sustaining BP’s financial,

strategic and organizational health and will include, but not be limited

to, maintenance of BP’s performance culture and the continued

development of BP’s business strategy, executive talent and internal

organization. As with the TSR part of his award, this part will be

measured over a three-year performance period.

Share element awards made in previous years Awards for the period

2005-2007 were made on the same basis as described above. For

outstanding awards of performance units made under the plans for

the periods 2003-2005 and 2004-2006, the previous performance

conditions will apply for the three-year performance periods in each

of the plans. The primary measure is BP’s shareholder return against

the market (SHRAM), which accounts for nearly two-thirds of the

potential total award, the remainder being assessed on BP’s relative

ROACE and EPS growth.

BP’s SHRAM is measured against the companies in the FTSE All

World Oil & Gas Index. Companies within the index are weighted

a share element, a share option element and a cash element. The

committee does not currently intend to use either the share option

or cash elements but, in exceptional circumstances, may do so.

Each executive director participates in the EDIP. The committee’s

policy, subject to unforeseen circumstances, is that this should

continue until the EDIP expires or is renewed in 2010.

The committee’s policy continues to be that each executive director

should hold shares equivalent in value to 5 x the director’s base salary

within five years of being appointed an executive director. This policy

is reflected in the terms of the EDIP, as shares awarded under the

share element will only be released at the end of the three-year

retention period (as described below) if the minimum shareholding

guidelines have been met.

1. Share element The committee may make conditional share awards

(performance shares) to executive directors, which will only vest to

the extent that a demanding performance condition imposed by the

committee is met at the end of a three-year performance period.

The maximum number of performance shares that may be

awarded to an executive director in any one year will be determined

at the discretion of the remuneration committee and will not normally

exceed 5.5 x base salary and, in the case of the group chief executive,

7.5 x base salary.

In addition to the performance condition described below,

the committee will have an overriding discretion, in exceptional

circumstances, to reduce the number of shares that vest (or to

provide that no shares vest).

The shares that vest will normally be subject to a compulsory

retention period determined by the committee, which will not

normally be less than three years. This gives executive directors

a six-year incentive structure and is designed to ensure that their

interests are aligned with those of shareholders. Where shares vest

under awards made in 2005 and future years, the executive director

will receive additional shares representing the value of reinvested

dividends on these shares.

For share element awards in 2006, the performance condition will

(as in 2005) relate to BP’s total shareholder return (TSR) performance

against the other oil majors (ExxonMobil, Shell, Total and Chevron)

over a three-year period. The committee will have the discretion to

amend this peer group in appropriate circumstances, for example,

in the case of any significant consolidations in the industry. TSR is

calculated by taking the share price performance of a company over

the period, assuming dividends to be reinvested in the company’s

shares. All share prices will be averaged over the three months

before the beginning and end of the performance period and will be

measured in US dollars. At the end of the performance period, the

TSR performance of each of the companies will be ranked to establish

the relative total return to shareholders over the period. Shares under

the award will vest as to 100%, 70% and 35% if BP achieves first,

second or third place respectively; no shares will vest if BP achieves

fourth or fifth place.

The committee considers that relative TSR is the most appropriate

measure of performance for BP’s long-term incentives for executive

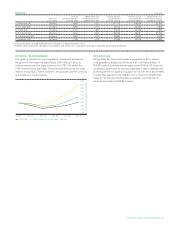

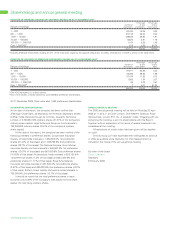

TIMELINE FOR 2006-2008 EDIP SHARE ELEMENT

Performance period Retention period

Award Vesting Release

2006 2007 2008 2009 2010 2011 2012