BP 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 Making energy more

DEAR SHAREHOLDER We start from the view that the purpose

of business is to satisfy human needs and, in doing so, to

generate profits for investors. For BP, that means providing

energy to fuel human progress and economic growth. It also

means satisfying the need for a sustainable environment.

On many fronts, our performance in 2005 was very strong

but the year was overshadowed by the industrial accident at

our Texas City refinery in March, which caused 15 deaths and

many more injuries. That incident has been the subject of

rigorous and thorough investigation both by our own team and

by external authorities and lessons have been learned. We are

determined to do everything possible to ensure that no such

accident recurs.

In addition to safety, the primary challenge for BP during

2005 was the maintenance of the flow of secure supplies of

energy to our customers in the face of volatile markets and

the instability caused by continued conflict in the Middle East,

terrorism and extreme weather conditions in the US and

elsewhere. Our success in meeting this fundamental element

of our purpose was due to the talent and dedication of our

staff, often working under conditions of severe difficulty.

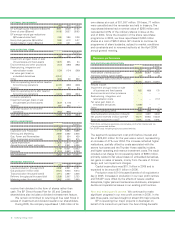

FINANCIAL PERFORMANCE In terms of financial performance,

2005 was an exceptional year for BP, with profits of

$19.3 billion, representing a return on average capital

employed of 20%. High oil prices, which averaged $54.48

during 2005 against $38.27 in 2004 (dated Brent), contributed

to the result but the underlying performance of the company

is strong. These results reflect not just a positive operating

environment but were the consequence of the long-run

strategic position of the company and improvements in each

part of our business. That performance is described in the

following pages.

BP now produces more than 4 million barrels of oil

equivalent per day of oil and gas for customers across the

world. To sustain supplies and meet the growing levels of

demand that population growth and prosperity are generating,

we continue to invest for the future. Our profits fund not only

the dividends, which we are delighted to have been able to

increase once again during 2005, and the buybacks of shares,

which totalled $11.6 billion during the year, but also the

investment in new developments that will form the basis

of the group’s business for years to come.

Capital expenditure in the exploration and production

segment totalled $10.1 billion in 2005, bringing the total

so far since the turn of the century to more than $50 billion.

That investment is aimed at providing sustainable supplies of

oil and gas and enabling us to develop the extensive base of

proved reserves and identified resources that we have built up

in recent years. In 2005, we added 662 million barrels of oil

and 4.6 trillion cubic feet of natural gas to our booked reserves

for subsidiaries and equity-accounted entities. That success

made 2005 the 13th consecutive year in which we have

replaced, in accordance with UK generally accepted

accounting practice Statement of Recommended Practice

(SORP), 100% or more of the oil and gas we produced.

Exploration success continues to augment this base. Major

new discoveries were made in the deepwater Gulf of Mexico

and Angola.

We have a strong and successful trading business and

a growing presence as a producer and supplier of natural gas,

with a daily output averaging 8.4 billion cubic feet during 2005

from fields in Trinidad and North Africa, as well as the US and

the North Sea.

We are also investing in the refining and marketing

businesses, developing new and strong positions in those

Group chief executive’s review