BP 2005 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 Making energy more

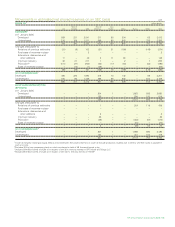

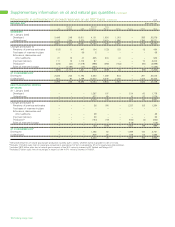

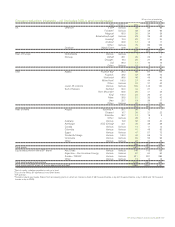

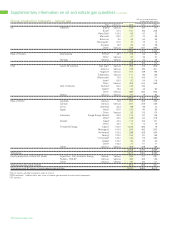

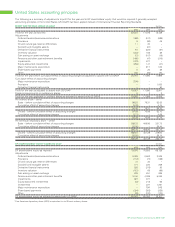

Supplementary information on oil and natural gas quantities continued

At 31 December 2005, the marker price for Brent crude was $58.21

per barrel and for Henry Hub gas it was $9.52 per mmBtu.

Applying higher year-end prices to reserve estimates and assuming

they apply to the end-of-field life have the effect of increasing proved

reserves associated with concessions (tax and royalty arrangements)

for which additional development opportunities become economic at

higher prices or where higher prices make it more economic to extend

the life of a field. On the other hand, applying higher year-end prices to

reserves in fields subject to PSAs has the effect of decreasing proved

reserves from those fields because higher prices result in lower

volume entitlements.

The company’s proved reserves estimates on an SEC basis for

the year ended 31 December 2005 reflect year-end prices and some

adjustments that have been made vis-à-vis individual asset reserve

estimates based on different applications of certain SEC

interpretations of SEC regulations relating to the use of technology

(mainly seismic) to estimate reserves in the reservoir away from

wellbores and the reporting of fuel gas (i.e. gas used for fuel in

operations on the lease) within proved reserves. On an aggregate

basis, the net impact of these changes, comprising some reductions

and some additions, is a decrease of 378mmboe compared with

our reserves under UK SORP, resulting in total proved reserves of

17,893mmboe (including equity-accounted entities). Excluding

equity-accounted entities, our proved reserves on an SEC basis were

14,023mmboe.

The total net movement in subsidiaries and equity-accounted

entities comprises a decrease of 397mmboe as a result of using the

year-end price, offset by a net increase of 19mmboe in respect of fuel

gas and technology interpretations.

Following SEC rules for reserves, our total proved reserves for

subsidiaries and equity-accounted entities at the end of 2005 were

17,893mmboe, representing a proved reserve replacement ratio (RRR)

before acquisitions and divestments of 95% versus 89% in 2004. For

subsidiaries only, the RRR is 68% and, for equity-accounted entities

only, the RRR is 151%.

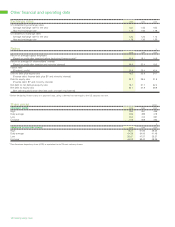

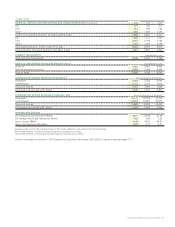

The estimated proved oil and natural gas reserves prepared on an

SEC basis are shown on pages 135-136.