BP 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

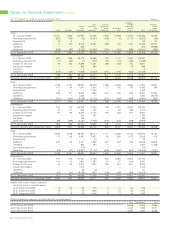

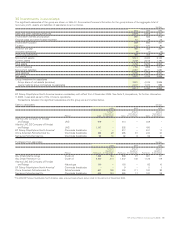

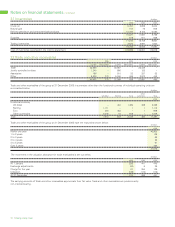

22 Taxation continued $ million

DEFERRED TAX Income statement Balance sheet

2005 2004 2003 2005 2004 2003

Deferred tax liability

Depreciation (778) 492 (716) 18,529 19,873 18,783

Pension plan surplus 170 10 199 957 520 468

Other taxable temporary differences 887 (113) 132 3,864 2,979 2,956

279 389 (385) 23,350 23,372 22,207

Deferred tax asset

Petroleum revenue tax 121 77 26 (407) (581) (613)

Pension plan and other post-retirement benefit plan deficits 220 92 501 (1,822) (2,068) (2,530)

Decommissioning, environmental and other provisions (144) 106 76 (2,033) (2,015) (2,015)

Derivative financial instruments (629) – – (807) – –

Tax credit and loss carry forward (245) 6 231 (253) (5) (12)

Other deductible temporary differences 297 (606) (68) (1,585) (2,002) (986)

(380) (325) 766 (6,907) (6,671) (6,156)

Net deferred tax liability (101) 64 381 16,443 16,701 16,051

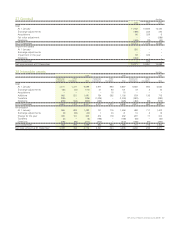

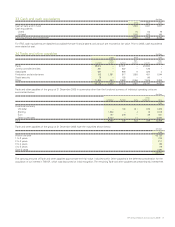

$ million

2005 2004 2003

Analysis of movements during the year

At 1 January 16,701 16,051 15,045

Adoption of IAS 32 and IAS 39 (112) – –

Restated 16,589 16,051 15,045

Exchange adjustments (178) 358 566

Charge for the year on ordinary activities (101) 64 381

Charge for the year in the statement of recognized income and expense 214 50 59

Other movements (81) 178 –

At 31 December 16,443 16,701 16,051

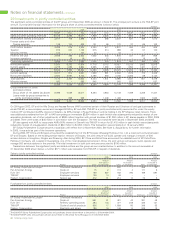

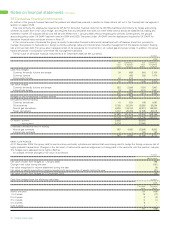

FACTORS THAT MAY AFFECT FUTURE TAX CHARGES

The group earns income in many different countries and, on average, pays taxes at rates higher than the UK statutory rate. The overall impact of

these higher taxes, which include the supplementary charge of 10% on UK North Sea profits, is subject to changes in enacted tax rates and the

country mix of the group’s income. The UK government has announced that the supplementary charge will be increased to 20% with effect from

1 January 2006. If this change is enacted, it will increase the group’s ongoing effective tax rate by 1-2%, and will also require a deferred tax

adjustment resulting in a further 2% increase in the tax rate for 2006. The impact of this increase, together with the other factors outlined below,

is likely to increase the effective tax rate by around 4-5% in future years.

Under International Financial Reporting Standards, the results of equity-accounted entities are reported within the group’s profit before taxation

on a post-tax basis. The impact of this treatment is to reduce the reported effective tax rate by around 3%. This effect is expected to continue for

the foreseeable future.

In 2005, the group released around $1 billion of income tax provisions that had been set up in previous years, reflecting a revised assessment of

risks. It is unlikely that a similar release of provisions will occur in future years.

At 31 December 2005, deferred tax liabilities were recognized for all taxable temporary differences:

••• Except where the deferred tax liability arises on goodwill that is not tax deductible or the initial recognition of an asset or liability in a transaction

that is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss; and

••• In respect of taxable temporary differences associated with investments in subsidiaries, associates and jointly controlled entities, except where

the timing of the reversal of the temporary differences can be controlled by the group and it is probable that the temporary differences will not

reverse in the foreseeable future.

At 31 December 2005, deferred tax assets were recognized for all deductible temporary differences, carry forward of unused tax assets and

unused tax losses, to the extent that it is probable that taxable profit will be available against which the deductible temporary differences and

the carry forward of unused tax assets and unused tax losses can be utilized:

••• Except where the deferred income tax asset relating to the deductible temporary difference arises from the initial recognition of an asset or

liability in a transaction that is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable

profit or loss; and

••• In respect of deductible temporary differences associated with investments in subsidiaries, associates and jointly controlled entities, deferred tax

assets are only recognized to the extent that it is probable that the temporary differences will reverse in the foreseeable future and taxable profit

will be available against which the temporary differences can be utilized.

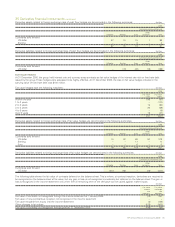

The group has around $5.1 billion (2004 $7.7 billion and 2003 $4.5 billion) of carry-forward tax losses in the UK and Germany, which would be

available to offset against future taxable income. At the end of 2005, $176 million of deferred tax assets were recognized on these losses (2004

no tax asset and 2003 $86 million of assets were recognized). Tax assets are recognized only to the extent that it is considered more likely than not

that suitable taxable income will arise. Carry-forward losses in other taxing jurisdictions have not been recognized as deferred tax assets and are

unlikely to have a significant effect on the group’s tax rate in future years.

The major component of temporary differences in the current year are tax depreciation, US inventory holding gains (classified under other

taxable temporary differences) and derivative financial instruments. Based on current capital investment plans, the group expects that temporary

differences arising in future years from differences between tax allowances and depreciation will be at levels similar to the current year.

BP Annual Report and Accounts 2005 63