HSBC 2005 Annual Report Download - page 400

Download and view the complete annual report

Please find page 400 of the 2005 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424

|

|

HSBC HOLDINGS PLC

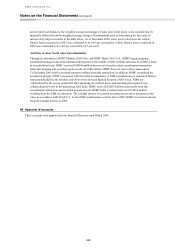

Notes on the Financial Statements (continued)

398

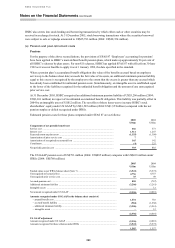

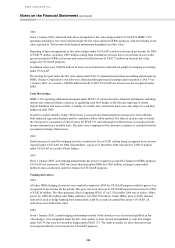

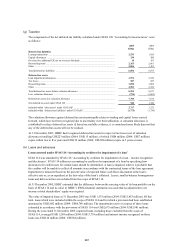

Loans outside the scope of SFAS 114

For smaller-balance homogeneous loans for which future cash flows from written-off balances can reasonably be

estimated on a portfolio basis, an asset equal to the present value of the cash flows is recognised under IFRSs as

it was previously under UK GAAP. This asset is not recognised for US GAAP purposes. This divergence

resulted in higher net income in 2005 of US$20 million under US GAAP compared with IFRSs, and a reduction

in the carrying value of loans and advances to customers and shareholders’ equity at 31 December 2005 of

US$327 million. There was no difference in reported net income or shareholders’ equity for 2004.

(i) Earnings per share

Basic earnings per share under US GAAP, SFAS 128 ‘Earnings per Share’, is calculated by dividing net income

of US$14,703 million (2004: US$12,506 million) by the weighted average number of ordinary shares in issue in

2005 of 11,042 million (2004: 10,916 million).

Diluted earnings per share under US GAAP is calculated by dividing net income, which requires no adjustment

for the effects of dilutive ordinary potential shares, by the weighted average number of shares outstanding plus

the weighted average number of ordinary shares that would be issued on conversion of all the dilutive potential

ordinary shares in 2005 of 11,334 million (2004: 11,063 million).

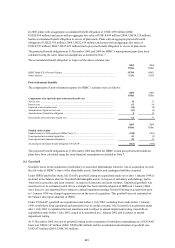

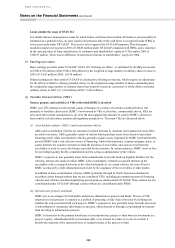

(j) Variable interest entities (‘VIEs’)

Nature, purpose and activities of VIEs with which HSBC is involved

HSBC uses VIE structures in the normal course of business in a variety of activities (outlined below), but

primarily to facilitate client needs. HSBC’s involvement in VIEs is, therefore, commercially driven. VIEs are

only used after careful consideration is given to the most appropriate structure to achieve HSBC’s objectives

from control, risk allocation, taxation and regulatory perspectives. The main VIEs are discussed below.

(i) Asset-backed conduits (‘ABCs’) and securitisation vehicles

ABCs and securitisation vehicles are structures in which interests in consumer and commercial receivables

are sold to investors. ABCs generally consist of entities which purchase assets from clients to meet their

financing needs, while securitisation vehicles generally acquire assets originated by HSBC itself and thereby

provide HSBC with a cost-effective source of financing. Under both structures, commercial paper, notes, or

equity interests are issued to investors to fund the purchase of receivables, and cash received from the

receivables is used to service the finance provided by the investors. In certain instances, HSBC receives fees

for providing liquidity facility commitments and for acting as administrator of the vehicle.

HSBC’s exposure to loss generally arises from commitments to provide back-up liquidity facilities for the

vehicles; interest-rate swaps in which HSBC is the counterparty; retained or acquired interests in the

receivables sold; or acquired interests in the vehicles themselves. In certain vehicles, the risk of loss to

HSBC is reduced by credit enhancements provided by the originator of the receivables or other parties.

In addition to these securitisation vehicles, HSBC (primarily through its North American subsidiaries)

securitises assets through entities that are not considered VIEs, including government-sponsored financing

vehicles and vehicles considered qualifying special-purpose entities under US GAAP. These entities are not

consolidated under US GAAP although certain of them are consolidated under IFRSs.

(ii) Infrastructure projects and funds

HSBC acts as an arranger for both public and private infrastructure projects and funds. The use of VIE

structures in such projects is common as a method of attracting a wider class of investor by dividing into

tranches the risk associated with such projects. HSBC’s exposure to loss generally arises from the provision

of subordinated or mezzanine debt finance to projects, either directly or through a consolidated investment

fund investing in infrastructure projects.

HSBC is deemed to be the primary beneficiary of an infrastructure project or fund when its investment in a

project’s equity, subordinated debt or mezzanine debt, or its interest in a fund, is at a level at which it

absorbs the majority of the expected losses or residual returns of the project or fund.