HSBC 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

30

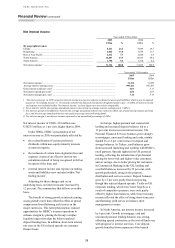

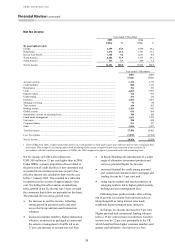

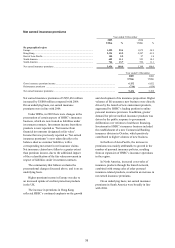

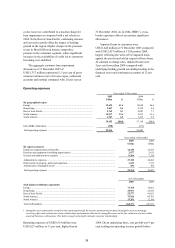

Net fee income

Year ended 31 December

2005 2004

US$m % US$m %

By geographical region

Europe ....................................................................................................... 6,299 43.6 5,980 46.2

Hong Kong ................................................................................................ 1,674 11.6 1,703 13.2

Rest of Asia-Pacific ................................................................................... 1,340 9.2 1,041 8.0

North America ........................................................................................... 4,606 31.9 3,765 29.1

South America ........................................................................................... 537 3.7 459 3.5

Net fee income .......................................................................................... 14,456 100.0 12,948 100.0

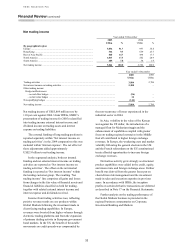

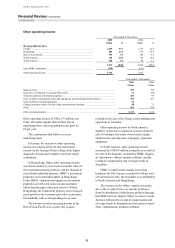

Year ended 31 December

2005

US$m

2004

US$m

Account services ............................................................................................................................. 3,132 2,779

Credit facilities1 .............................................................................................................................. 880 1,179

Remittances .................................................................................................................................... 396 353

Cards .............................................................................................................................................. 4,699 3,987

Imports/exports ............................................................................................................................... 722 692

Underwriting .................................................................................................................................. 274 234

Insurance ........................................................................................................................................ 1,082 1,001

Mortgage servicing ......................................................................................................................... 76 80

Trust income ................................................................................................................................... 199 203

Broking income .............................................................................................................................. 1,104 943

Global custody ................................................................................................................................ 656 564

Maintenance income on operating leases ........................................................................................ 180 190

Funds under management ............................................................................................................... 1,831 1,479

Unit trusts ....................................................................................................................................... 388 498

Corporate finance ........................................................................................................................... 211 193

Other .............................................................................................................................................. 1,656 1,527

Total fee income ............................................................................................................................. 17,486 15,902

Less: fee expense ............................................................................................................................ (3,030) (2,954)

Net fee income ............................................................................................................................... 14,456 12,948

1Under IFRSs from 2005, a higher proportion of fees on credit facilities is dealt with as part of an effective interest rate calculation than

previously. This change in accounting affects both the timing of fee income recognition and its presentation in the accounts. In

accordance with the transition arrangements to IFRSs, the 2004 comparative figure is presented on the old accounting basis.

Net fee income of US$14,456 million was

US$1,508 million or 12 per cent higher than in 2004.

Under IFRSs, a greater proportion of fees related to

the provision of credit facilities is now amortised and

accounted for in net interest income as part of an

effective interest rate calculation than was the case

before 1 January 2005. This resulted in a reduction

in reported net fee income of approximately 4 per

cent. Excluding this effect and on an underlying

basis, growth in net fee income was 14 per cent and

the comments that follow are presented on this basis.

The principal drivers of this growth were:

• the increase in card fee income, reflecting

strong growth in personal credit card sales

across the Group and increased transaction

volumes;

• increased customer numbers, higher transaction

volumes, an increase in packaged accounts and

the selective management of tariffs led to an

11 per cent increase in account services fees;

• in Private Banking, the introduction of a wider

range of alternative investment products and

services generated higher fee income;

• increased demand for credit among personal

and commercial customers drove mortgage and

lending fees up by 11 per cent; and

• rising equity markets and renewed interest in

emerging markets led to higher global custody,

broking and asset management fees.

Offsetting these positive trends, after a strong

run of growth, fee income from unit trust sales in

Hong Kong fell as rising interest rates made

traditional deposit products more attractive.

In Europe, fee income increased by 9 per cent.

Higher personal and commercial lending volumes

led to a 19 per cent increase in credit fees. Card fee

income rose by 22 per cent, principally in the UK

which benefited from higher customer numbers and

greater card utilisation. Account service fees