HSBC 2005 Annual Report Download - page 262

Download and view the complete annual report

Please find page 262 of the 2005 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424

|

|

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

260

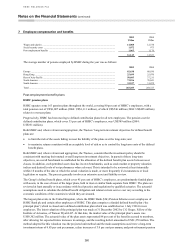

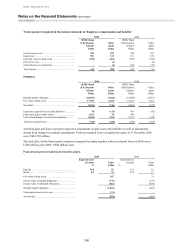

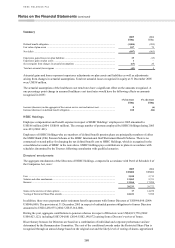

7 Employee compensation and benefits

2005 2004

US$m US$m

Wages and salaries ......................................................................................................................... 14,008 12,374

Social security costs ....................................................................................................................... 1,072 973

Post-employment benefits .............................................................................................................. 1,065 1,176

16,145 14,523

The average number of persons employed by HSBC during the year was as follows:

2005 2004

Europe ............................................................................................................................................ 82,638 80,930

Hong Kong ..................................................................................................................................... 25,699 25,070

Rest of Asia-Pacific ........................................................................................................................ 50,605 37,211

North America ................................................................................................................................ 73,816 70,041

South America ................................................................................................................................ 32,527 31,475

Total ............................................................................................................................................... 265,285 244,727

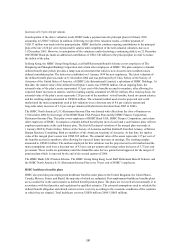

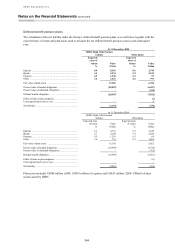

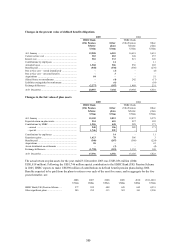

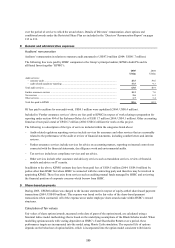

Post-employment benefit plans

HSBC pension plans

HSBC operates some 163 pension plans throughout the world, covering 80 per cent of HSBC’s employees, with a

total pension cost of US$1,007 million (2004: US$1,111 million), of which US$546 million (2004: US$485 million)

relates to overseas plans.

Progressively, HSBC has been moving to defined contribution plans for all new employees. The pension cost for

defined contribution plans, which cover 35 per cent of HSBC’s employees, was US$389 million (2004:

US$351 million).

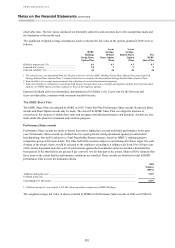

Both HSBC and, where relevant and appropriate, the Trustees’ long-term investment objectives for defined benefit

plans are:

• to limit the risk of the assets failing to meet the liability of the plans over the long-term; and

• to maximise returns consistent with an acceptable level of risk so as to control the long-term costs of the defined

benefit plans.

Both HSBC and, where relevant and appropriate, the Trustees, consider that the investment policy should be

consistent with meeting their mutual overall long-term investment objectives. In pursuit of these long-term

objectives, an overall benchmark is established for the allocation of the defined benefit plan assets between asset

classes. In addition, each permitted asset class has its own benchmarks, such as stock market or property valuation

indices and desired levels of out performance where relevant. This is intended to be reviewed at least triennially

within 18 months of the date at which the actual valuation is made, or more frequently if circumstances or local

legislation so require. The process generally involves an extensive asset and liability review.

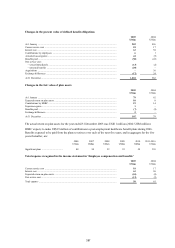

The Group’s defined benefit plans, which cover 45 per cent of HSBC’s employees, are predominantly funded plans

with assets, in the case of most of the larger plans, held in trust or similar funds separate from HSBC. The plans are

reviewed at least annually or in accordance with local practice and regulations by qualified actuaries. The actuarial

assumptions used to calculate the defined benefit obligation and related current service cost vary according to the

economic conditions of the countries in which they are situated.

The largest plan exists in the United Kingdom, where the HSBC Bank (UK) Pension Scheme covers employees of

HSBC Bank plc and certain other employees of HSBC. This plan comprises a funded defined benefit plan (‘the

principal plan’) which is closed and a defined contribution plan which was established on 1 July 1996 for new

employees. The latest valuation of the principal plan was made at 31 December 2002 by C G Singer, Fellow of the

Institute of Actuaries, of Watson Wyatt LLP. At that date, the market value of the principal plan’s assets was

US$9,302 million. The actuarial value of the plan assets represented 88 per cent of the benefits accrued to members,

after allowing for expected future increases in earnings, and the resulting deficit amounted to US$1,270 million. The

method adopted for this valuation was the projected unit method and the main assumptions used were a long-term

investment return of 6.85 per cent per annum, salary increases of 3.0 per cent per annum, and post-retirement pension