Xcel Energy 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.86

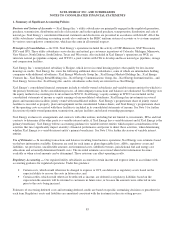

If restructuring or other changes in the regulatory environment occur, regulated utility subsidiaries may no longer be eligible to

apply this accounting treatment, and may be required to eliminate regulatory assets and liabilities from their balance sheets. Such

changes could have a material effect on Xcel Energy’s financial condition, results of operations and cash flows. See Note 15 for

further discussion of regulatory assets and liabilities.

Revenue Recognition — Revenues related to the sale of energy are generally recorded when service is rendered or energy is

delivered to customers. However, the determination of the energy sales to individual customers is based on the reading of their

meter, which occurs on a systematic basis throughout the month. At the end of each month, amounts of energy delivered to

customers since the date of the last meter reading are estimated and the corresponding unbilled revenue is recognized. Xcel

Energy presents its revenues net of any excise or other fiduciary-type taxes or fees.

NSP-Minnesota participates in MISO, and SPS participates in SPP. The revenues and charges from these RTOs related to serving

retail and wholesale electric customers comprising the native load of NSP-Minnesota and SPS are recorded on a net basis within

cost of sales. Revenues and charges for short term wholesale sales of excess energy transacted through RTOs are recorded on a

gross basis in electric revenues and cost of sales.

Xcel Energy Inc.’s utility subsidiaries have various rate-adjustment mechanisms in place that provide for the recovery of natural

gas, electric fuel and purchased energy costs. These cost-adjustment tariffs may increase or decrease the level of revenue collected

from customers and are revised periodically for differences between the total amount collected under the clauses and the costs

incurred. When applicable, under governing regulatory commission rate orders, fuel cost over-recoveries (the excess of fuel

revenue billed to customers over fuel costs incurred) are deferred as regulatory liabilities and under-recoveries (the excess of fuel

costs incurred over fuel revenues billed to customers) are deferred as regulatory assets.

Conservation Programs — Xcel Energy Inc.’s utility subsidiaries have implemented programs in many of their retail

jurisdictions to assist customers in conserving energy and reducing peak demand on the electric and natural gas systems. These

programs include, but are not limited to, efficiency and redesign programs, as well as rebates for the purchase of items such as

compact fluorescent bulbs, saver switches and energy-efficient heating and cooling appliances.

The costs incurred for DSM and CIP programs are deferred if it is probable future revenue will be provided to permit recovery of

the incurred cost. For incentive programs designed to allow adjustments of future rates for recovery of lost margins and/or

conservation performance incentives, recorded revenues are limited to those amounts expected to be collected within 24 months

following the end of the annual period in which they are earned.

For PSCo, SPS and NSP-Minnesota, DSM and CIP program costs are recovered through a combination of base rate revenue and

rider mechanisms. The revenue billed to customers recovers incurred costs for conservation programs and also incentive amounts

that are designed to encourage Xcel Energy’s achievement of energy conservation goals and compensate for related lost sales

margin. For these utility subsidiaries, regulatory assets are recognized to reflect the amount of costs or earned incentives that have

not yet been collected from customers. NSP-Wisconsin recovers approved conservation program costs in base rate revenue,

without the use of rider mechanisms.

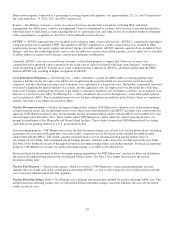

Property, Plant and Equipment and Depreciation — Property, plant and equipment is stated at original cost. The cost of plant

includes direct labor and materials, contracted work, overhead costs and AFUDC. The cost of plant retired is charged to

accumulated depreciation and amortization. Amounts recovered in rates for future removal costs are recorded as regulatory

liabilities. Significant additions or improvements extending asset lives are capitalized, while repairs and maintenance costs are

charged to expense as incurred. Maintenance and replacement of items determined to be less than a unit of property are charged to

operating expenses as incurred. Planned major maintenance activities are charged to operating expense unless the cost represents

the acquisition of an additional unit of property or the replacement of an existing unit of property. Property, plant and equipment

also includes costs associated with property held for future use. The depreciable lives of certain plant assets are reviewed annually

and revised, if appropriate. Property, plant and equipment that is to be early decommissioned is reclassified as plant to be retired.

Property, plant and equipment is tested for impairment when it is determined that the carrying value of the assets may not be

recoverable. Recently completed property, plant and equipment that is disallowed for cost recovery is expensed in the current

period. For investments in property, plant and equipment that are not expected to go into service, incurred costs and related

deferred tax amounts are compared to the discounted estimated future rate recovery, and a loss on abandonment is recognized, if

necessary.

Xcel Energy records depreciation expense related to its plant using the straight-line method over the plant’s useful life. Actuarial

and semi-actuarial life studies are performed on a periodic basis and submitted to the state and federal commissions for review.

Upon acceptance by the various commissions, the resulting lives and net salvage rates are used to calculate depreciation.