Xcel Energy 2012 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

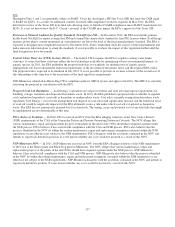

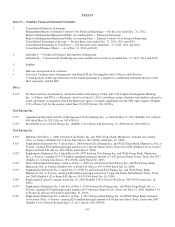

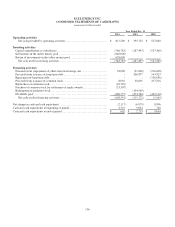

147

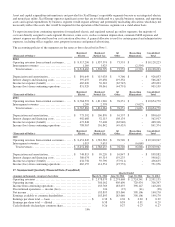

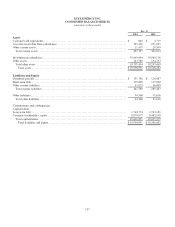

Quarter Ended

(Amounts in thousands, except per share data)

March 31, 2011

June 30, 2011

Sept. 30, 2011

Dec. 31, 2011

Operating revenues ................................

.............

$

2,816,540

$

2,438,222

$

2,831,598

$

2,568,410

Operating income................................

...............

426,663

359,442

651,496

344,001

Income from continuing operations

..............................

203,467

158,671

338,295

140,941

Discontinued operations — income (loss)

.........................

102

91

37

(432)

Net income ................................

....................

203,569

158,762

338,332

140,509

Earnings available to common shareholders

.......................

202,509

157,702

333,658

140,509

Earnings per share total — basic ................................

.

$

0.42

$

0.33

$

0.69

$

0.29

Earnings per share total — diluted

...............................

0.42

0.33

0.69

0.29

Cash dividends declared per common share

.......................

0.25

0.26

0.26

0.26

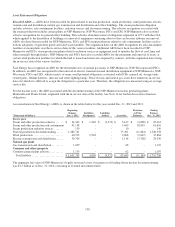

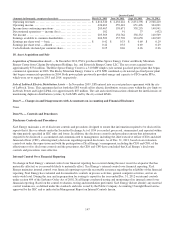

18. Asset Acquisition and Sale

Acquisition of Generation Assets — In December 2010, PSCo purchased Blue Spruce Energy Center and Rocky Mountain

Energy Center from Calpine Development Holdings, Inc. and Riverside Energy Center LLC. The net assets acquired were

approximately $732 million. The Blue Spruce Energy Center is a 310 MW simple cycle natural gas-fired power plant that began

commercial operations in 2003. The Rocky Mountain Energy Center is a 652 MW combined-cycle natural gas-fired power plant

that began commercial operations in 2004. Both power plants previously provided energy and capacity to PSCo under PPAs,

which were set to expire in 2013 and 2014, respectively.

Sale of Lubbock Electric Distribution Assets — In November 2009, SPS entered into an asset purchase agreement with the city

of Lubbock, Texas. This agreement had set forth that SPS would sell its electric distribution system assets within the city limits to

Lubbock Power and Light (LP&L) for approximately $87 million. The sale and related transactions eliminate the inefficiencies of

maintaining duplicate distribution systems, by both SPS and by the city-owned LP&L.

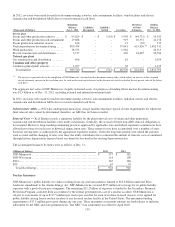

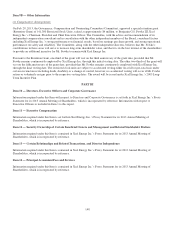

Item 9 — Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A — Controls and Procedures

Disclosure Controls and Procedures

Xcel Energy maintains a set of disclosure controls and procedures designed to ensure that information required to be disclosed in

reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized, and reported within

the time periods specified in SEC rules and forms. In addition, the disclosure controls and procedures ensure that information

required to be disclosed is accumulated and communicated to management, including the chief executive officer (CEO) and chief

financial officer (CFO), allowing timely decisions regarding required disclosure. As of Dec. 31, 2012, based on an evaluation

carried out under the supervision and with the participation of Xcel Energy’s management, including the CEO and CFO, of the

effectiveness of its disclosure controls and the procedures, the CEO and CFO have concluded that Xcel Energy’s disclosure

controls and procedures were effective.

Internal Control Over Financial Reporting

No change in Xcel Energy’s internal control over financial reporting has occurred during the most recent fiscal quarter that has

materially affected, or is reasonably likely to materially affect, Xcel Energy’s internal control over financial reporting. Xcel

Energy maintains internal control over financial reporting to provide reasonable assurance regarding the reliability of the financial

reporting. Xcel Energy has evaluated and documented its controls in process activities, general computer activities, and on an

entity-wide level. During the year and in preparation for issuing its report for the year ended Dec. 31, 2012 on internal controls

under section 404 of the Sarbanes-Oxley Act of 2002, Xcel Energy conducted testing and monitoring of its internal control over

financial reporting. Based on the control evaluation, testing and remediation performed, Xcel Energy did not identify any material

control weaknesses, as defined under the standards and rules issued by the Public Company Accounting Oversight Board and as

approved by the SEC and as indicated in Management Report on Internal Controls herein.