Xcel Energy 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

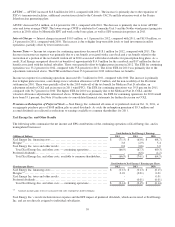

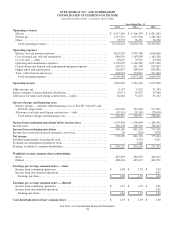

(Millions of Dollars)

2012

2011

2010

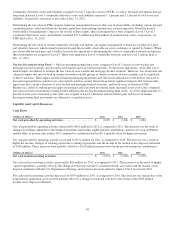

Net cash provided by (used in) financing activities ............... $

350

$

(205

)

$

906

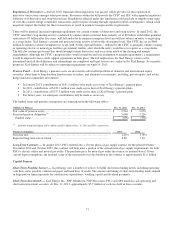

Net cash provided by financing activities increased by $555 million for 2012 as compared to 2011. The increase was primarily

due to higher proceeds from short-term borrowings and the issuance of long-term debt, partially offset by repayments of

previously existing long-term debt, repurchases of common stock and higher dividend payments.

Net cash used in financing activities increased by $1.1 billion during 2011 as compared to 2010. The increase was primarily due

to lower proceeds from the issuance of long-term debt and common stock in 2011 and the redemption of preferred stock during

2011.

See discussion of trends, commitments and uncertainties with the potential for future impact on cash flow and liquidity under

Capital Sources.

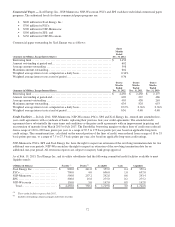

Capital Requirements

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt, common

stock, hybrid and other securities to maintain desired capitalization ratios.

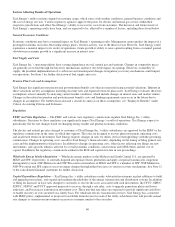

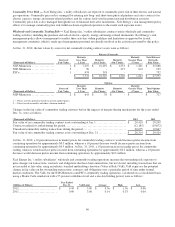

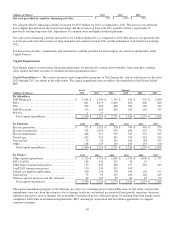

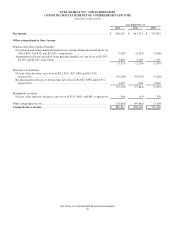

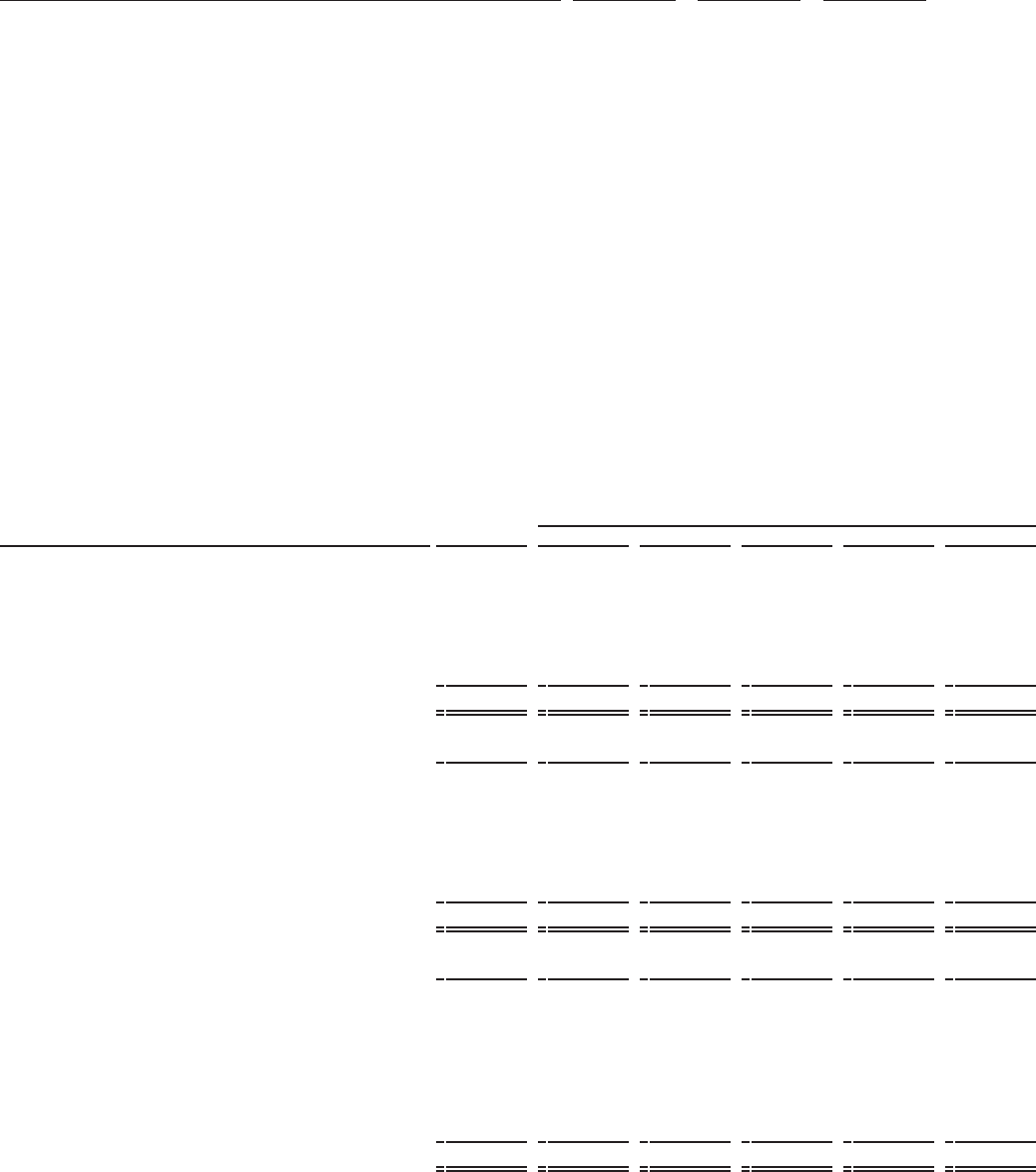

Capital Expenditures — The current estimated capital expenditure programs of Xcel Energy Inc. and its subsidiaries for the years

2013 through 2017 are shown in the table below. The capital expenditure forecast reflects the termination of the Prairie Island

EPU.

Actual

Forecast

(Millions of Dollars)

2012

2013

2014

2015

2016

2017

By Subsidiary

NSP-Minnesota .................................. $ 1,018

$ 1,395

$ 1,135

$ 910

$ 925

$ 1,080

PSCo ............................................

887

1,075

1,000

850

800

840

SPS .............................................

389

490

400

305

300

345

NSP-Wisconsin ..................................

155

180

240

245

230

235

WYCO ..........................................

1

15

-

-

-

-

Total capital expenditures ....................... $ 2,450

$ 3,155

$ 2,775

$ 2,310

$ 2,255

$ 2,500

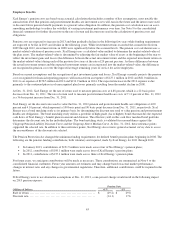

By Function

2012

2013

2014

2015

2016

2017

Electric generation................................ $ 772

$ 1,025

$ 710

$ 550

$ 465

$ 570

Electric transmission..............................

734

1,010

870

650

635

770

Electric distribution ...............................

486

515

525

525

535

545

Natural gas.......................................

247

355

365

335

325

320

Nuclear fuel......................................

53

95

155

100

140

145

Other ............................................

158

155

150

150

155

150

Total capital expenditures ....................... $ 2,450

$ 3,155

$ 2,775

$ 2,310

$ 2,255

$ 2,500

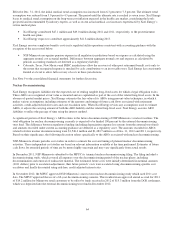

By Project

2012

2013

2014

2015

2016

2017

Other capital expenditures......................... $ 1,720

$ 1,710

$ 1,610

$ 1,555

$ 1,600

$ 1,755

PSCo CACJA ....................................

189

345

235

90

15

-

Other major transmission projects ..................

179

245

260

175

320

415

CapX2020 transmission project ....................

170

350

295

140

-

-

Natural gas pipeline replacement...................

100

140

170

190

130

135

Nuclear fuel......................................

53

95

155

100

140

145

Nuclear capacity increases and life extension .......

39

270

50

60

50

50

Total capital expenditures ....................... $ 2,450

$ 3,155

$ 2,775

$ 2,310

$ 2,255

$ 2,500

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth, regulatory decisions,

legislative initiatives, reserve margins, the availability of purchased power, alternative plans for meeting long-term energy needs,

compliance with future environmental requirements, RPS, and merger, acquisition and divestiture opportunities to support

corporate strategies.