Xcel Energy 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

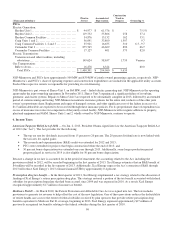

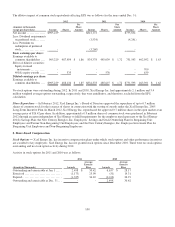

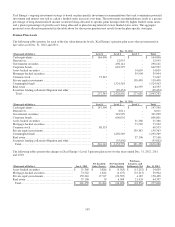

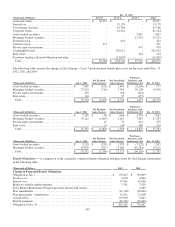

106

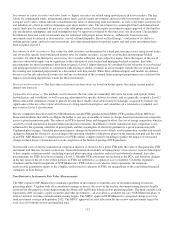

Purchases,

Net Realized

Net Unrealized

Issuances, and

(Thousands of Dollars)

Jan. 1, 2011

Gains (Losses)

Gains (Losses)

Settlements, Net

Dec. 31, 2011

Asset-backed securities

..........................

$ 26,986

$ 2,391

$

(2,504

)

$

4,495

$

31,368

Mortgage-backed securities

.......................

113,418

1,103

(5,926

)

(35,073

)

73,522

Private equity investments

........................

122,223

3,971

12,412

20,757

159,363

Real estate ................................

......

73,701

(629

)

20,271

(56,237

)

37,106

Total................................

..........

$ 336,328

$ 6,836

$

24,253

$

(66,058

)

$

301,359

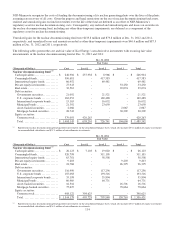

Purchases,

Net Realized

Net Unrealized

Issuances, and

(Thousands of Dollars)

Jan. 1, 2010

Gains (Losses)

Gains (Losses)

Settlements, Net

Dec. 31, 2010

Asset-backed securities

..........................

$ 47,825

$ 3,400

$

(7,078

)

$

(17,161

)

$

26,986

Mortgage-backed securities

.......................

144,006

13,719

(19,095

)

(25,212

)

113,418

Private equity investments

........................

82,098

(1,008

)

(24

)

41,157

122,223

Real estate ................................

......

66,704

(1,135

)

8,235

(103

)

73,701

Total................................

..........

$ 340,633

$ 14,976

$

(17,962

)

$

(1,319

)

$

336,328

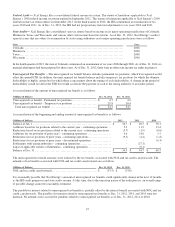

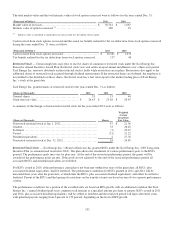

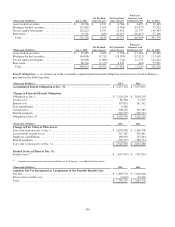

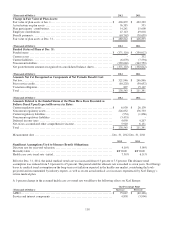

Benefit Obligations — A comparison of the actuarially computed pension benefit obligation and plan assets for Xcel Energy is

presented in the following table:

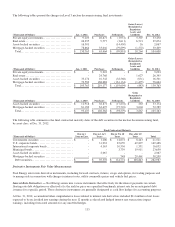

(Thousands of Dollars)

2012

2011

Accumulated Benefit Obligation at Dec. 31 ................................

......

$

3,475,154

$

3,073,637

Change in Projected Benefit Obligation:

Obligation at Jan. 1 ................................

..............................

$

3,226,219

$

3,030,292

Service cost ................................................................

.....

86,364

77,319

Interest cost ................................................................

.....

157,035

161,412

Plan amendments ................................

................................

6,240

-

Actuarial loss ................................................................

...

400,429

195,369

Benefit payments ................................

................................

(236,757)

(238,173

)

Obligation at Dec. 31 ................................

............................

$

3,639,530

$

3,226,219

(Thousands of Dollars)

2012

2011

Change in Fair Value of Plan Assets:

Fair value of plan assets at Jan. 1................................

..................

$

2,670,280

$

2,540,708

Actual return on plan assets ................................

......................

312,167

230,401

Employer contributions ................................

..........................

198,093

137,344

Benefit payments ................................

................................

(236,757)

(238,173

)

Fair value of plan assets at Dec. 31 ................................

................

$

2,943,783

$

2,670,280

Funded Status of Plans at Dec. 31:

Funded status (a) ................................................................

.

$

(695,747)

$

(555,939

)

(a) Amounts are recognized in noncurrent liabilities on Xcel Energy’s consolidated balance sheets.

(Thousands of Dollars)

2012

2011

Amounts Not Yet Recognized as Components of Net Periodic Benefit Cost:

Net loss................................................................

.........

$

1,800,770

$

1,610,946

Prior service (credit) cost................................

.........................

(2,633)

18,432

Total ................................................................

...........

$

1,798,137

$

1,629,378