Xcel Energy 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

(e) For the cancelled Prairie Island EPU project, NSP-Minnesota plans to address recovery of incurred costs to date in the next rate case for each of the NSP-

Minnesota jurisdictions and to file a request with the FERC for approval to recover a portion of the costs from NSP-Wisconsin through the Interchange

Agreement. NSP-Wisconsin plans to seek cost recovery in a future rate case. In December 2012, EPU costs incurred to date were compared to the

discounted value of the estimated future rate recovery based on past jurisdictional precedent, and as a result, NSP-Minnesota recognized a $10.1 million

pretax charge.

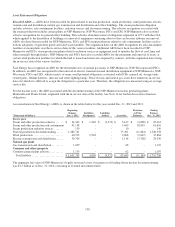

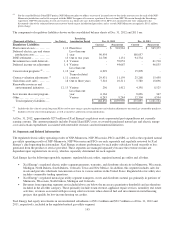

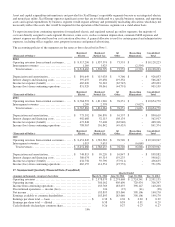

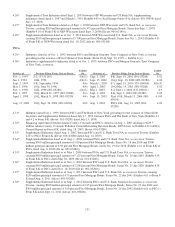

The components of regulatory liabilities shown on the consolidated balance sheets at Dec. 31, 2012 and 2011 are:

(Thousands of Dollars)

See Note(s)

Remaining

Amortization Period

Dec. 31, 2012

Dec. 31, 2011

Regulatory Liabilities

Current

Noncurrent

Current

Noncurrent

Plant removal costs ............

1, 13

Plant lives

$

-

$

922,963

$

-

$

945,377

Deferred electric, gas and steam

production costs .............

1

Less than one

year

90,454

-

108,057

-

DOE settlement ...............

13

One to two years

22,700

1,131

94,734

-

Investment tax credit deferrals . .

1, 6

Various

-

59,052

-

61,710

Deferred income tax adjustment

1, 6

Various

-

44,667

-

46,835

Conservation programs (b) ......

1, 12

Less than one

year

6,292

-

15,898

-

Contract valuation adjustments (a)

1, 11

Term of related

contract

29,431

11,159

25,268

15,450

Gain from asset sales ..........

18

One to three years

7,318

10,311

5,780

18,696

Renewable resources and

environmental initiatives .....

12, 13

Various

256

1,412

4,358

8,525

Low income discount program..

Less than one

year

6,164

-

8,696

347

Other .........................

Various

6,243

9,244

12,304

4,594

Total regulatory liabilities ....

$

168,858

$

1,059,939

$

275,095

$

1,101,534

(a) Includes the fair value of certain long-term PPAs used to meet energy capacity requirements and valuation adjustments on natural gas commodity purchases.

(b) Includes costs for conservation programs, as well as incentives allowed in certain jurisdictions.

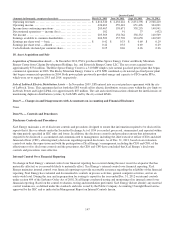

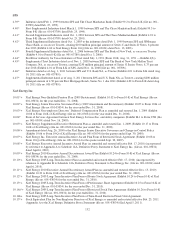

At Dec. 31, 2012, approximately $275 million of Xcel Energy's regulatory assets represented past expenditures not currently

earning a return. This amount primarily includes Prairie Island EPU costs, recoverable purchased natural gas and electric energy

costs and certain expenditures associated with renewable resources and environmental initiatives.

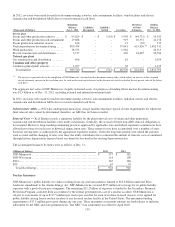

16. Segments and Related Information

The regulated electric utility operating results of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS, as well as the regulated natural

gas utility operating results of NSP-Minnesota, NSP-Wisconsin and PSCo are each separately and regularly reviewed by Xcel

Energy’s chief operating decision maker. Xcel Energy evaluates performance by each utility subsidiary based on profit or loss

generated from the product or service provided. These segments are managed separately because the revenue streams are

dependent upon regulated rate recovery, which is separately determined for each segment.

Xcel Energy has the following reportable segments: regulated electric utility, regulated natural gas utility and all other.

• Xcel Energy’s regulated electric utility segment generates, transmits, and distributes electricity in Minnesota, Wisconsin,

Michigan, North Dakota, South Dakota, Colorado, Texas and New Mexico. In addition, this segment includes sales for

resale and provides wholesale transmission service to various entities in the United States. Regulated electric utility also

includes commodity trading operations.

• Xcel Energy’s regulated natural gas utility segment transports, stores and distributes natural gas primarily in portions of

Minnesota, Wisconsin, North Dakota, Michigan and Colorado.

• Revenues from operating segments not included above are below the necessary quantitative thresholds and are therefore

included in the all other category. Those primarily include steam revenue, appliance repair services, nonutility real estate

activities, revenues associated with processing solid waste into refuse-derived fuel and investments in rental housing

projects that qualify for low-income housing tax credits.

Xcel Energy had equity investments in unconsolidated subsidiaries of $91.2 million and $92.7 million as of Dec. 31, 2012 and

2011, respectively, included in the regulated natural gas utility segment.