Xcel Energy 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

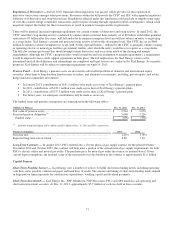

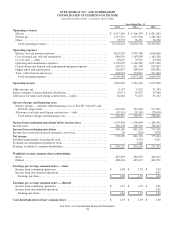

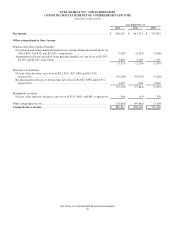

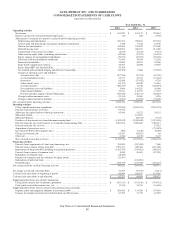

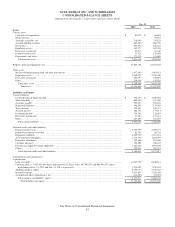

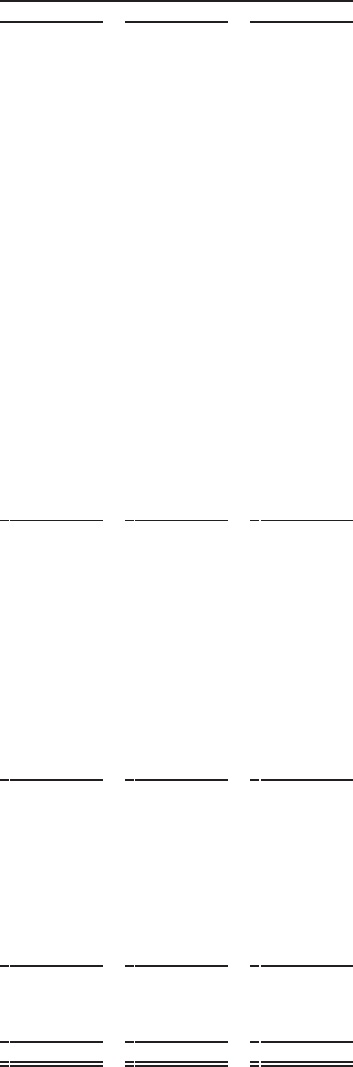

XCEL ENERGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in thousands)

See Notes to Consolidated Financial Statements

80

Year Ended Dec. 31

2012

2011

2010

Operating activities

Net income.................................................................. $

905,229

$

841,172

$

755,834

Remove (income) loss from discontinued operations ...................................

(30

)

202

(3,878)

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization .................................................

943,702

908,853

872,186

Conservation and demand side management program amortization .......................

7,258

9,816

21,700

Nuclear fuel amortization .....................................................

102,651

100,902

105,369

Deferred income taxes .......................................................

508,094

466,567

414,460

Amortization of investment tax credits ...........................................

(6,610

)

(6,194)

(6,353)

Allowance for equity funds used during construction .................................

(62,840

)

(51,223)

(56,152)

Equity earnings of unconsolidated subsidiaries .....................................

(29,971

)

(30,527)

(29,948)

Dividends from unconsolidated subsidiaries .......................................

33,470

34,034

32,538

Provision for bad debts .......................................................

33,808

44,521

44,068

Share-based compensation expense ..............................................

26,970

45,006

35,807

Prairie Island EPU and SmartGridCity............................................

20,766

-

-

Net realized and unrealized hedging and derivative transactions .........................

(85,308

)

9,966

(35,552)

Changes in operating assets and liabilities:

Accounts receivable .......................................................

(197,236

)

(79,701)

(29,749)

Accrued unbilled revenues ..................................................

25,377

19,951

(14,642)

Inventories..............................................................

82,658

(57,432)

9,239

Other current assets .......................................................

(30,707

)

62,458

10,461

Accounts payable.........................................................

(100,327

)

13,748

(188,855)

Net regulatory assets and liabilities ............................................

5,866

149,282

36,096

Other current liabilities.....................................................

42,914

112,353

13,192

Pension and other employee benefit obligations...................................

(183,922

)

(150,717)

(62,625)

Change in other noncurrent assets ...............................................

(33,151

)

24,069

5,936

Change in other noncurrent liabilities ............................................

(3,905

)

(61,584)

(35,190)

Net cash provided by operating activities ..............................................

2,004,756

2,405,522

1,893,942

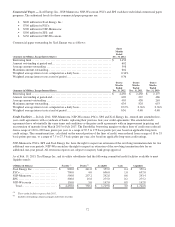

Investing activities

Utility capital/construction expenditures ............................................

(2,570,209

)

(2,205,567)

(2,216,193)

Proceeds from insurance recoveries ................................................

97,835

-

-

Allowance for equity funds used during construction ...................................

62,840

51,223

56,152

Merricourt refund .............................................................

-

101,261

-

Merricourt deposit ............................................................

-

(90,833)

(1,134)

Purchases of investments in external decommissioning fund..............................

(1,102,025

)

(2,098,642)

(3,781,438)

Proceeds from the sale of investments in external decommissioning fund ....................

1,087,076

2,098,642

3,786,373

Proceeds from the sale of assets ..................................................

-

-

87,823

Acquisition of generation assets ..................................................

-

-

(732,495)

Investment in WYCO Development LLC ...........................................

(980

)

(2,446)

(8,046)

Change in restricted cash .......................................................

95,287

(95,287)

89

Other, net...................................................................

(2,766

)

(6,152)

2,145

Net cash used in investing activities................................................

(2,332,942

)

(2,247,801)

(2,806,724)

Financing activities

Proceeds from (repayments of) short-term borrowings, net ...............................

383,000

(247,400)

7,400

Proceeds from issuance of long-term debt ...........................................

1,790,131

688,598

1,433,406

Repayments of long-term debt, including reacquisition premiums..........................

(1,302,763

)

(105,623)

(560,383)

Proceeds from issuance of common stock ...........................................

8,050

38,691

457,258

Repurchase of common stock ....................................................

(18,529

)

-

-

Purchase of common stock for settlement of equity awards...............................

(23,307

)

-

-

Redemption of preferred stock ...................................................

-

(104,980)

-

Dividends paid ...............................................................

(486,757

)

(474,760)

(432,110)

Net cash provided by (used in) financing activities .......................................

349,825

(205,474)

905,571

Net change in cash and cash equivalents ..............................................

21,639

(47,753)

(7,211)

Cash and cash equivalents at beginning of period ........................................

60,684

108,437

115,648

Cash and cash equivalents at end of period.............................................

$

82,323

$

60,684

$

108,437

Supplemental disclosure of cash flow information:

Cash paid for interest (net of amounts capitalized) .................................... $

(563,517

)

$

(531,148)

$

(530,072)

Cash (paid) received for income taxes, net...........................................

(9,570

)

55,764

(16,635)

Supplemental disclosure of non-cash investing and financing transactions:

Property, plant and equipment additions in accounts payable ............................. $

289,802

$

137,558

$

174,903

Issuance of common stock for reinvested dividends and 401(k) plans .......................

67,723

71,715

63,905