Xcel Energy 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

In April 2012, the CPUC approved a comprehensive multi-year settlement agreement, which covers 2012 through 2014. Key

terms of the agreement include the following:

• PSCo would implement an annual electric rate increase of $73 million in 2012. The rate increase was effective on May 1,

2012. In addition, PSCo will implement incremental electric rate increases of $16 million on Jan. 1, 2013 and $25

million on Jan. 1, 2014. These rate increases are net of the shift of the costs from the PCCA and the TCA clauses to base

rates.

• The settlement reflects an authorized ROE of 10 percent and an equity ratio of 56 percent.

• For 2012 through 2014, incremental property taxes in excess of $76.7 million (2010-2011 historic test year property

taxes) will be deferred over a three-year period with the amortization effective the first year after the deferral. To the

extent that PSCo is successful in the manufacturer’s sales tax refund lawsuit, PSCo will credit such refunds first against

legal fees incurred to obtain the refund and then against the deferred property tax balances outstanding at the end of the

2014. Regarding the manufacturer’s sales tax refund case, PSCo was successful in the District Court and Court of

Appeals, but in January 2013 the Colorado Supreme Court agreed to review this matter following an appeal by the

Colorado Department of Revenue. Briefing will be completed by both parties in the next few months. It is uncertain

when the Colorado Supreme Court will issue its decision.

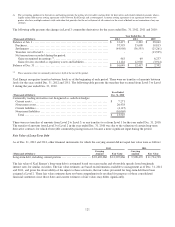

• The signing parties agreed to implement an earnings test, in which customers and shareholders will share weather

normalized earnings above an ROE of 10 percent. The sharing mechanism is as follows:

ROE

Shareholders

Customers

> 10.0% < 10.2%..........................................

40

%

60

%

> 10.2% < 10.5%..........................................

50

50

> 10.5% ..................................................

-

100

• PSCo agreed that it will not file for an electric rate increase that would take effect prior to Jan. 1, 2015, provided that net

revenue requirements increase or decrease in excess of $10 million caused by changes in tax law, government mandates,

or natural disasters may be deferred or recovered through a modified rate adjustment. In the event normalized base

revenues in either 2012 or 2013 are 2.0 percent below 2011 actual levels adjusted to reflect the rate increases allowed for

2012 and 2013, PSCo has the right to an additional rate adjustment in the next year for 50 percent of the shortfall. The

parties acknowledged that PSCo may file an electric rate increase as early as May 1, 2014, so long as no rate increase

takes effect on either an interim or permanent basis prior to Jan. 1, 2015.

SmartGridCity (SGC) Cost Recovery — PSCo requested recovery of the revenue requirements associated with $45 million of

capital and $4 million of annual O&M costs incurred to develop and operate SGC as part of its 2010 electric rate case. In

February 2011, the CPUC allowed recovery of approximately $28 million of the capital cost and all of the O&M costs. In

December 2011, PSCo requested CPUC approval for the recovery of the remaining capital investment in SGC and also provided

the additional information requested. On Jan. 17, 2013, the ALJ recommended denial of PSCo’s request for recovery of the

remaining portion of the SGC investment. On Feb. 6, 2013, PSCo filed exceptions to the ALJ recommendation requesting that the

CPUC grant recovery of its investment. However, as a result of the ALJ’s recommended decision denying recovery, PSCo

recognized a $10.7 million pre-tax charge in 2012, representing the net book value of the disallowed investment, which is

included in O&M expense.

Electric, Purchased Gas and Resource Adjustment Clauses

DSM and the DSMCA — The CPUC approved higher savings goals and a slightly higher financial incentive mechanism for

PSCo’s electric DSM energy efficiency programs starting in 2012. Savings goals are 330 GWh in 2012 and 356 GWh in 2013

with incentives awarded as one installment in the year following plan achievements. PSCo is able to earn an incentive on 11

percent of net economic benefits at an achievement level of 130 percent and a maximum annual incentive of $30 million.

The CPUC approved the PSCo electric and gas DSM budget of $115.5 million and $13.3 million, respectively, effective Jan. 1,

2013. Energy efficiency and demand response related DSM costs are recovered through a combination of the DSMCA riders and

base rates. Electric DSMCA rates are designed to collect $26.8 million in 2013 with the remainder of the electric DSM

expenditures collected through base rates. DSMCA riders are adjusted biannually to capture program costs, performance

incentives, and any over- or under-recoveries are trued-up in the following year.