Xcel Energy 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.127

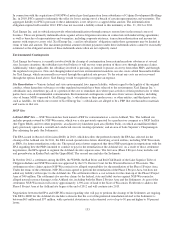

The procedural schedule is as follows:

• Intervenor Direct Testimony – March 22, 2013

• Staff Direct Testimony – April 2, 2013

• SPS Rebuttal Testimony – April 12, 2013

• Hearing Starts – April 23, 2013

• The procedural order also establishes July 1, 2013 as the latest date rates from this case will become effective.

In an effort to pursue settlement, the parties have asked the ALJ for a four week extension for filing Intervenor Direct Testimony,

but that in the event the ultimate decision is delayed beyond July 1, 2013, that SPS could implement a surcharge for any approved

increase for the period from July 1 to final rate implementation.

Pending Regulatory Proceedings — NMPRC

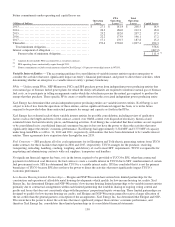

SPS - New Mexico 2012 Electric Rate Case — In December 2012, SPS filed an electric rate case in New Mexico with the

NMPRC for an increase in annual revenue of approximately $45.9 million. The rate filing is based on a 2014 forecast test year, a

requested ROE of 10.65 percent, a jurisdictional electric rate base of $479.8 million and an equity ratio of 53.89 percent. A

NMPRC decision is expected in the fourth quarter of 2013 with the implementation of final rates anticipated in the first quarter of

2014.

The procedural schedule is as follows:

Intervenor and Staff Direct Testimony - May 6, 2013

Intervenor and Staff Direct Testimony - May 6, 2013

Rebuttal Testimony - May 20, 2013

Rebuttal Testimony - May 20, 2013

Hearing Starts - June 3, 2013

Hearing Starts - June 3, 2013

Pending Regulatory Proceedings — FERC

SPS Wholesale Rate Complaint — In April 2012, Golden Spread Electric Cooperative, Inc. (Golden Spread) filed a rate

complaint with the FERC alleging that SPS’ rates for wholesale service were excessive. Golden Spread alleges that the base ROE

currently charged to them through the SPS production formula rate, of 10.25 percent, and the SPS transmission base formula rate,

ROE of 10.77 percent, is unjust and unreasonable. Golden Spread alleges that the appropriate base ROE is 9.15 percent, or an

annual difference of approximately $3.3 million. An additional 50 basis point incentive is added to the base ROE for the

transmission formula rate for SPS’ participation in the SPP RTO. Golden Spread is not contesting this transmission incentive. The

FERC has taken no action on this complaint.

13. Commitments and Contingencies

Commitments

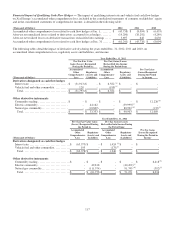

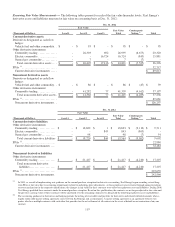

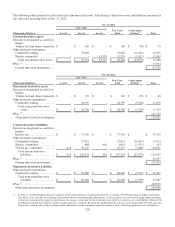

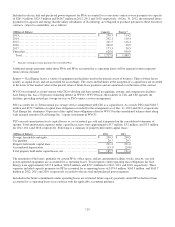

Capital Commitments — Xcel Energy has made commitments in connection with a portion of its projected capital expenditures.

Xcel Energy’s capital commitments primarily relate to the following major projects:

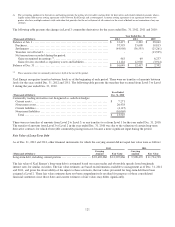

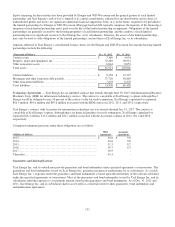

Nuclear Lifecycle Management and EPU — NSP-Minnesota is pursuing capital improvements to enhance plant safety through the

extended licensed life of the Monticello facility. Planned improvements are expected to result in capacity increases at the Monticello

generating plant of up to approximately 71 MW. The MPUC approved the CON for the EPU for Monticello in 2008. The license

amendment application was filed with the NRC in November 2008. NSP-Minnesota expects to receive approval of the EPU project

by the NRC in the second half of 2013. Pending approval by the NRC, NSP-Minnesota plans to implement the equipment changes

needed to support the Monticello life extension and EPU projects during the planned spring 2013 refueling outage. In addition to the

Monticello projects, NSP-Minnesota is also implementing life cycle management improvements at the Prairie Island facilities to help

ensure their safe and reliable operation through 2034. The major capital investments for these activities at the Monticello and Prairie

Island nuclear generating plants are expected to be completed in the years 2013 through 2017.