Xcel Energy 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

Prairie Island Units 1 and 2 received their initial operating license and began commercial operations in 1973 and 1974. In 2011,

the NRC approved Prairie Island’s license renewal application for its nuclear reactors, allowing operations for an additional 20

years until 2033 and 2034, respectively. In 2011, the MPUC approved a depreciation life extension for Prairie Island bringing the

depreciation remaining life in line with the NRC approved operating license. The Prairie Island dry-cask storage facility currently

stores 29 casks, with MPUC approval for the use of 35 additional casks to support operations until the end of the renewed

operating licenses in 2033 and 2034.

NSP-Minnesota previously recorded annual decommissioning accruals based on periodic site-specific cost studies and a presumed

level of dedicated funding consistent with cost-recovery in utility customer rates. Cost studies quantify decommissioning costs in

current dollars. This study presumed that costs will escalate in the future at a rate of 3.63 percent per year during operations and

radiological portion of decommissioning and 2.63 percent during the independent spent fuel storage installation and site

restoration portion of decommissioning. The total estimated decommissioning costs that will ultimately be paid, net of income

earned by the external decommissioning trust fund, is currently being accrued using an annuity approach over the approved plant-

recovery period. This annuity approach uses an assumed rate of return on funding, which is an after-tax return between 4.57

percent and 5.53 percent, depending on production unit and time frame for external funding. The net unrealized gain or loss on

nuclear decommissioning investments is deferred as a regulatory asset or liability.

The total obligation for decommissioning currently is expected to be funded 100 percent by the external decommissioning trust

fund, as approved by the MPUC, when decommissioning commences. In November 2012, the MPUC approved NSP-Minnesota’s

most recent nuclear decommissioning study which used 2011 cost data. The MPUC approved the use of a 60-year

decommissioning scenario. This resulted in an approved annual accrual for 2013 of $14.2 million for Minnesota retail customers

to be offset by funds received in October 2012 of $15.3 million from the DOE settlement.

The external funds are held in trust and in escrow. The portion in escrow is subject to refund if approved by the various

commissions. In 2009, the MPUC authorized the return of funds associated with the Monticello plant for the Minnesota retail

jurisdictions with refunds made on customers’ bills in 2010. In March 2010, approximately $5.9 million was also withdrawn from

the Monticello plant portion of the escrow fund for a refund to Wisconsin and Michigan retail customers through general rates in

2011 and 2012.

As of Dec. 31, 2012, NSP-Minnesota has recorded and recovered in rates cumulative decommissioning expense of $1.5 billion.

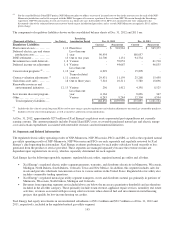

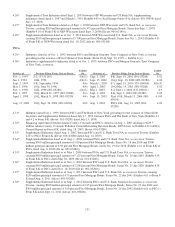

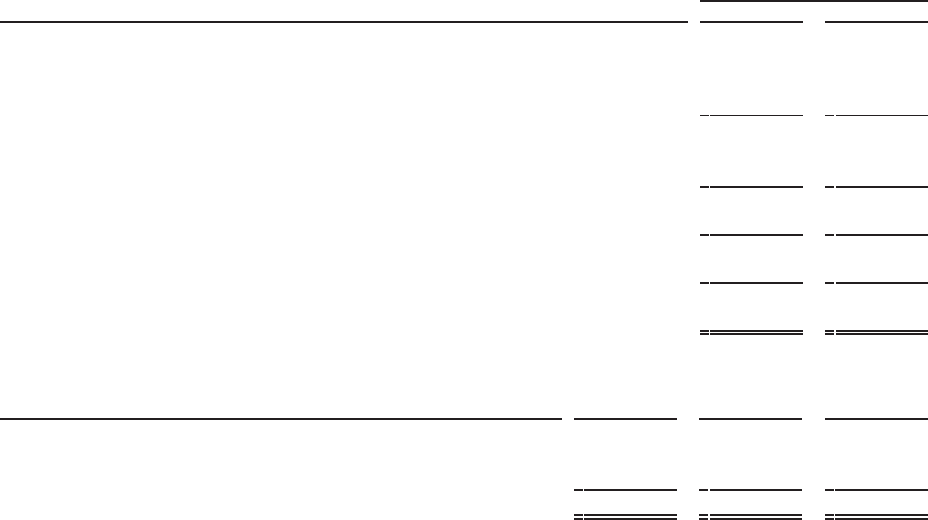

The following table summarizes the funded status of NSP-Minnesota’s decommissioning obligation based on approved regulatory

recovery parameters from the most recently approved decommissioning study. Xcel Energy believes future decommissioning cost

expense, if necessary, will continue to be recovered in customer rates. These amounts are not those recorded in the financial

statements for the ARO.

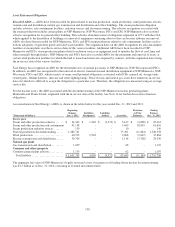

Regulatory Basis

(Thousands of Dollars)

2012

2011

Estimated decommissioning cost obligation from most recently approved study (2011

dollars for 2012 and 2008 dollars for 2011) ..................................... $

2,694,079

$

2,308,196

Effect of escalating costs (to 2012 and 2011 dollars, respectively, at 3.63/2.63 percent

for 2012 and 2.89 percent for 2011) ............................................

93,327

205,960

Estimated decommissioning cost obligation (in current dollars) .....................

2,787,406

2,514,156

Effect of escalating costs to payment date (3.63/2.63 percent for 2012 and 2.89

percent for 2011) .............................................................

5,793,882

2,602,207

Estimated future decommissioning costs (undiscounted) ...........................

8,581,288

5,116,363

Effect of discounting obligation (using risk-free interest rate).......................

(6,243,332

)

(3,187,914

)

Discounted decommissioning cost obligation .....................................

2,337,956

1,928,449

Assets held in external decommissioning trust.....................................

1,489,542

1,336,431

Underfunding of external decommissioning fund compared to the discounted

decommissioning obligation ...................................................

$

848,414

$

592,018

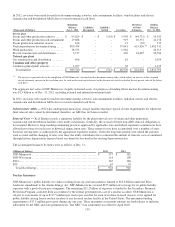

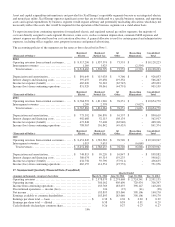

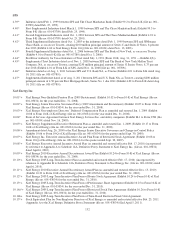

Decommissioning expenses recognized as a result of regulation include the following components:

(Thousands of Dollars)

2012

2011

2010

Annual decommissioning recorded as depreciation expense: (a)

Externally funded ................................

..............

$

-

$

-

$

934

Internally funded (including interest costs)

........................

(1,251

)

(456

)

(777

)

Net decommissioning expense recorded

............................

$

(1,251

)

$

(456

)

$

157

(a) Decommissioning expense does not include depreciation of the capitalized nuclear asset retirement costs.