Xcel Energy 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

PSP Awards — Xcel Energy Inc.’s Board of Directors has granted PSP awards under the Xcel Energy Inc. 2005 Long-term

Incentive Plan (as amended and restated effective in 2010). The plan allows Xcel Energy to attach various performance goals to

the PSP awards granted. The PSP awards have been historically dependent on a single measure of performance, Xcel Energy

Inc.’s TSR measured over a three-year period. Xcel Energy Inc.’s TSR is compared to the TSR of other companies in the EEI

Investor-Owned Electrics index. At the end of the three-year period, potential payouts of the PSP awards range from 0 percent to

200 percent, depending on Xcel Energy Inc.’s TSR compared to the peer group.

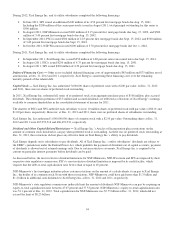

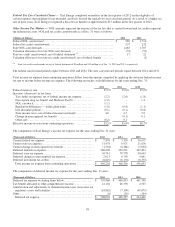

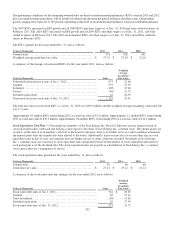

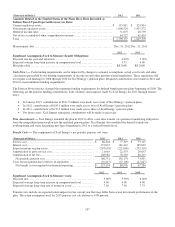

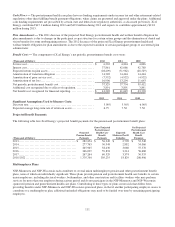

The PSP awards granted for the years ended Dec. 31 were as follows:

(In Thousands)

2012

2011

2010

Awards granted ................................

..................

161

311

225

The total amounts of performance awards settled during the years ended Dec. 31 were as follows:

(In Thousands)

2012

2011

2010

Awards settled ................................

...................

286

305

267

Settlement amount (cash and common stock)

.......................

$

7,554

$

7,200

$

5,460

The amount of cash used to settle Xcel Energy’s PSP awards was $3.8 million, $3.6 million and $2.7 million in 2012, 2011 and

2010, respectively.

Share-Based Compensation Expense — The vesting of the RSUs is predicated on the achievement of a performance condition,

which is the achievement of an EPS or environmental measures target. RSU awards and restricted stock are considered to be

equity awards, since the plan settlement determination (shares or cash) resides with Xcel Energy and not the participants. In

addition, these awards have not been previously settled in cash and Xcel Energy plans to continue electing share settlement. The

grant date fair value of RSUs and restricted stock is expensed as employees vest in their rights to those awards.

The PSP awards have been historically settled partially in cash, and therefore, do not qualify as an equity award, but rather are

accounted for as a liability award. As liability awards, the fair value on which ratable expense is based, as employees vest in their

rights to those awards, is remeasured each period based on the current stock price and performance conditions, and final expense

is based on the market value of the shares on the date the award is settled.

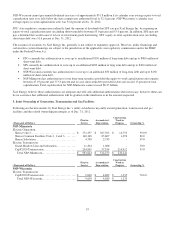

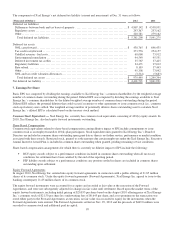

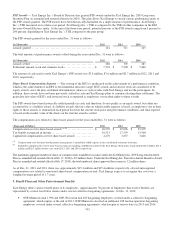

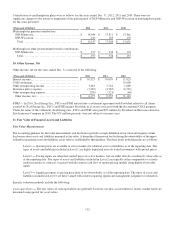

The compensation costs related to share-based awards for the years ended Dec. 31 were as follows:

(Thousands of Dollars)

2012

2011

2010

Compensation cost for share-based awards (a) (b)

.....................

$

26,970

$

45,006

$

35,807

Tax benefit recognized in income ................................

..

10,513

17,559

13,964

Capitalized compensation cost for share-based awards

...............

4,270

3,857

3,646

(a) Compensation costs for share-based payment arrangements is included in O&M expense in the consolidated statements of income.

(b) Included in compensation cost for share-based awards are matching contributions related to the Xcel Energy 401(k) plan, which totaled $22.2 million, $21.6

million and $20.7 million for the years ended 2012, 2011 and 2010, respectively.

The maximum aggregate number of shares of common stock available for issuance under the Xcel Energy Inc. 2005 Long-term Incentive

Plan (as amended and restated effective Feb. 17, 2010) is 8.3 million shares. Under the Xcel Energy Inc. Executive Annual Incentive Award

Plan (as amended and restated effective Feb. 17, 2010), the total number of shares approved for issuance is 1.2 million shares.

As of Dec. 31, 2012 and 2011, there was approximately $15.3 million and $15.4 million, respectively, of total unrecognized

compensation cost related to nonvested share-based compensation awards. Xcel Energy expects to recognize that cost over a

weighted average period of 1.7 years.

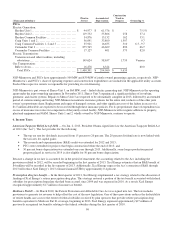

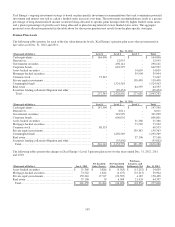

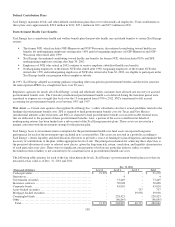

9. Benefit Plans and Other Postretirement Benefits

Xcel Energy offers various benefit plans to its employees. Approximately 50 percent of employees that receive benefits are

represented by several local labor unions under several collective-bargaining agreements. At Dec. 31, 2012:

• NSP-Minnesota had 1,996 and NSP-Wisconsin had 405 bargaining employees covered under a collective-bargaining

agreement, which expires at the end of 2013. NSP-Minnesota also had an additional 228 nuclear operation bargaining

employees covered under several collective-bargaining agreements, which expire at various dates in 2013 and 2014.