Xcel Energy 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

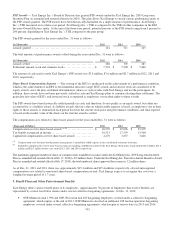

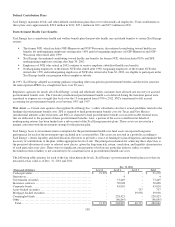

Cash Flows — The postretirement health care plans have no funding requirements under income tax and other retirement-related

regulations other than fulfilling benefit payment obligations, when claims are presented and approved under the plans. Additional

cash funding requirements are prescribed by certain state and federal rate regulatory authorities, as discussed previously. Xcel

Energy contributed $47.1 million during 2012 and $49.0 million during 2011 and expects to contribute approximately $21.8

million during 2013.

Plan Amendments — The 2011 decrease of the projected Xcel Energy postretirement health and welfare benefit obligation for

plan amendments is due to changes in the participant co-pay structure for certain retiree groups and the elimination of dental and

vision benefits for some nonbargaining retirees. The 2012 decrease of the projected Xcel Energy postretirement health and

welfare benefit obligation for plan amendments is due to the expected transition of certain participant groups to an external plan

administrator.

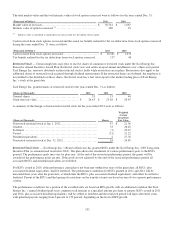

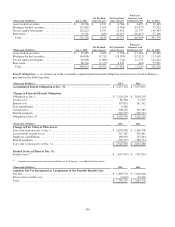

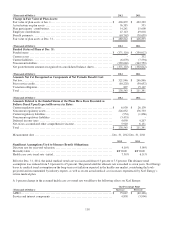

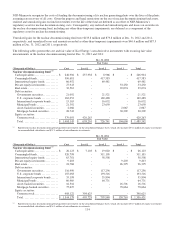

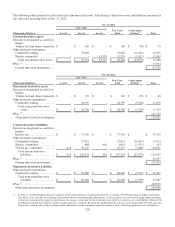

Benefit Costs — The components of Xcel Energy’s net periodic postretirement benefit costs were:

(Thousands of Dollars)

2012

2011

2010

Service cost ................................

......................

$

4,203

$

4,824

$

4,006

Interest cost ................................

......................

37,861

42,086

42,780

Expected return on plan assets ................................

.....

(28,409

)

(31,962

)

(28,529

)

Amortization of transition obligation

...............................

14,320

14,444

14,444

Amortization of prior service cost ................................

..

(7,552

)

(4,932

)

(4,932

)

Amortization of net loss................................

...........

16,906

13,294

11,643

Net periodic postretirement benefit cost

............................

37,329

37,754

39,412

Additional cost recognized due to effects of regulation

...............

3,891

3,891

3,891

Net benefit cost recognized for financial reporting

...................

$

41,220

$

41,645

$

43,303

2012

2011

2010

Significant Assumptions Used to Measure Costs:

Discount rate ................................

.....................

5.00

%

5.50

%

6.00

%

Expected average long-term rate of return on assets

..................

6.75

7.50

7.50

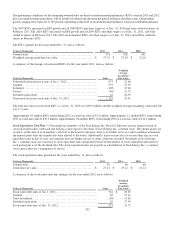

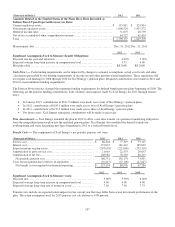

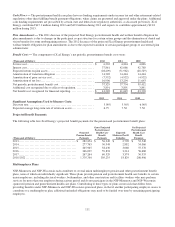

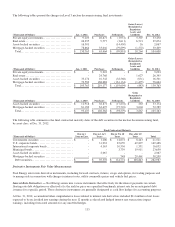

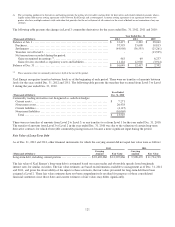

Projected Benefit Payments

The following table lists Xcel Energy’s projected benefit payments for the pension and postretirement benefit plans:

(Thousands of Dollars)

Projected

Pension Benefit

Payments

Gross Projected

Postretirement

Health Care

Benefit

Payments

Expected

Medicare Part D

Subsidies

Net Projected

Postretirement

Health Care

Benefit

Payments

2013................................

...............

$

282,854

$

56,249

$

2,709

$ 53,540

2014................................

...............

277,763

56,948

2,882

54,066

2015................................

...............

265,965

58,430

3,060

55,370

2016................................

...............

266,039

59,894

3,214

56,680

2017................................

...............

267,264

60,329

3,374

56,955

2018-2022 ................................

.........

1,335,384

305,235

18,829

286,406

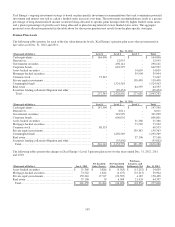

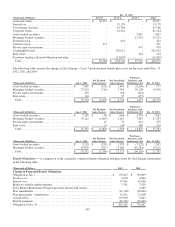

Multiemployer Plans

NSP-Minnesota and NSP-Wisconsin each contribute to several union multiemployer pension and other postretirement benefit

plans, none of which are individually significant. These plans provide pension and postretirement health care benefits to certain

union employees, including electrical workers, boilermakers, and other construction and facilities workers who may perform

services for more than one employer during a given period and do not participate in the NSP-Minnesota and NSP-Wisconsin

sponsored pension and postretirement health care plans. Contributing to these types of plans creates risk that differs from

providing benefits under NSP-Minnesota and NSP-Wisconsin sponsored plans, in that if another participating employer ceases to

contribute to a multiemployer plan, additional unfunded obligations may need to be funded over time by remaining participating

employers.