Xcel Energy 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

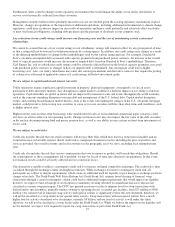

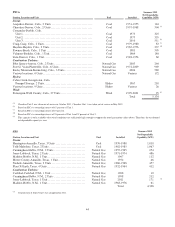

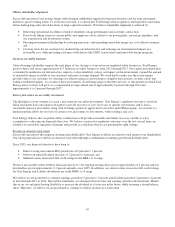

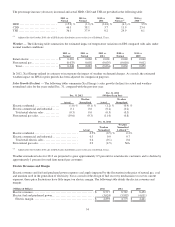

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table provides information about our purchases of equity securities that are registered by Xcel Energy Inc. pursuant

to Section 12 of the Exchange Act for the year ended Dec. 31, 2012:

Issuer Purchases of Equity Securities

Period

Total Number

of Shares

Purchased

Average Price

Paid per

Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans or

Programs

Maximum Number

(or Approximate

Dollar Value) of

Shares

That May Yet

Be Purchased Under

the Plans or

Programs

Jan. 1, 2012 — Jan. 31, 2012 (a) .........................

17,487

$

26.69

-

-

Feb. 1, 2012 — Feb. 29, 2012 ..........................

-

-

-

-

March 1, 2012 — March 31, 2012 (b) ....................

700,000

26.42

-

-

April 1, 2012 — Dec. 31, 2012 .........................

-

-

-

-

Total ...............................................

717,487

-

-

(a) Xcel Energy Inc. or one of its agents periodically purchases common shares in order to satisfy obligations under the Stock Equivalent Plan for Non-

Employee Directors.

(b) The Xcel Energy Inc. Board of Directors approved the repurchase of up to 700,000 shares of common stock for the issuance of shares in connection with the

vesting of awards under the Xcel Energy Inc. 2005 Long-Term Incentive Plan. Purchases were authorized to be made in the open market pursuant to Rule

10b-18.

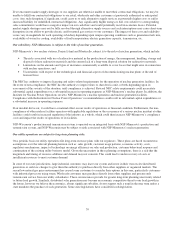

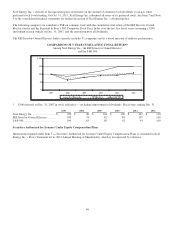

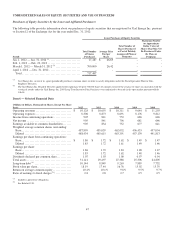

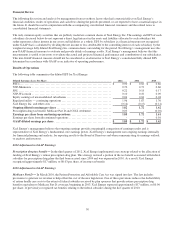

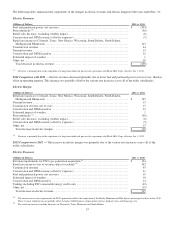

Item 6 — Selected Financial Data

(Millions of Dollars, Thousands of Shares, Except Per Share

Data)

2012

2011

2010

2009

2008

Operating revenues .............................

$

10,128

$

10,655 $

10,311

$

9,644

$

11,203

Operating expenses .............................

8,306

8,873

8,691

8,176

9,812

Income from continuing operations ..............

905

841

752

686

646

Net income ....................................

905

841

756

681

646

Earnings available to common shareholders.......

905

834

752

677

641

Weighted average common shares outstanding:

Basic ........................................

487,899

485,039

462,052

456,433

437,054

Diluted ......................................

488,434

485,615

463,391

457,139

441,813

Earnings per share from continuing operations:

Basic ........................................

$

1.86

$

1.72 $

1.62

$

1.49

$

1.47

Diluted ......................................

1.85

1.72

1.61

1.49

1.46

Earnings per share:

Basic ........................................

1.86

1.72

1.63

1.48

1.47

Diluted ......................................

1.85

1.72

1.62

1.48

1.46

Dividends declared per common share............

1.07

1.03

1.00

0.97

0.94

Total assets ....................................

31,141

29,497

27,388

25,306

24,805

Long-term debt (a) ..............................

10,144

8,849

9,263

7,889

7,732

Book value per share............................

18.19

17.44

16.76

15.92

15.35

Return on average common equity ...............

10.4

%

10.1

%

9.8

%

9.5

%

9.7

%

Ratio of earnings to fixed charges (b)..............

2.8

2.8

2.7

2.5

2.5

(a) Includes capital lease obligations.

(b) See Exhibit 12.01.